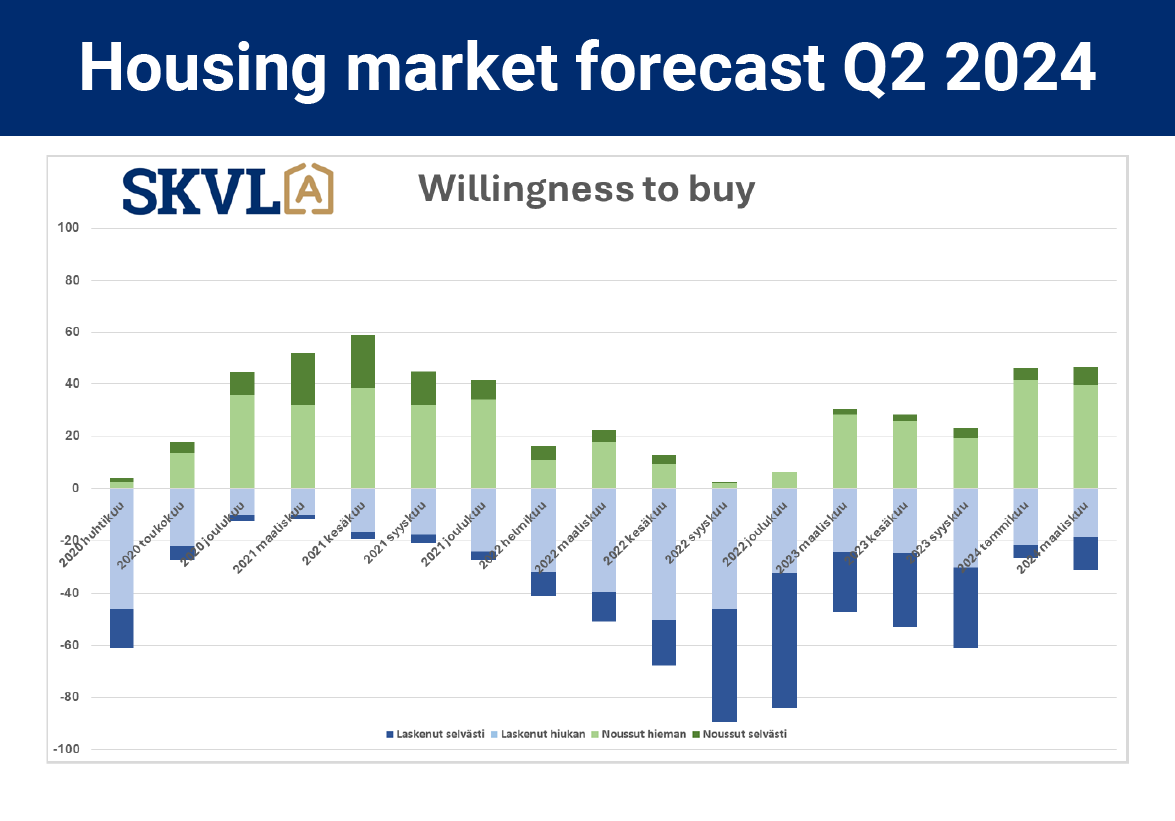

SKVL’s more than 1700 housing market experts estimate the market situation cautiously, but positive for the spring. External factors strongly influence the opinions of people changing homes at the moment.

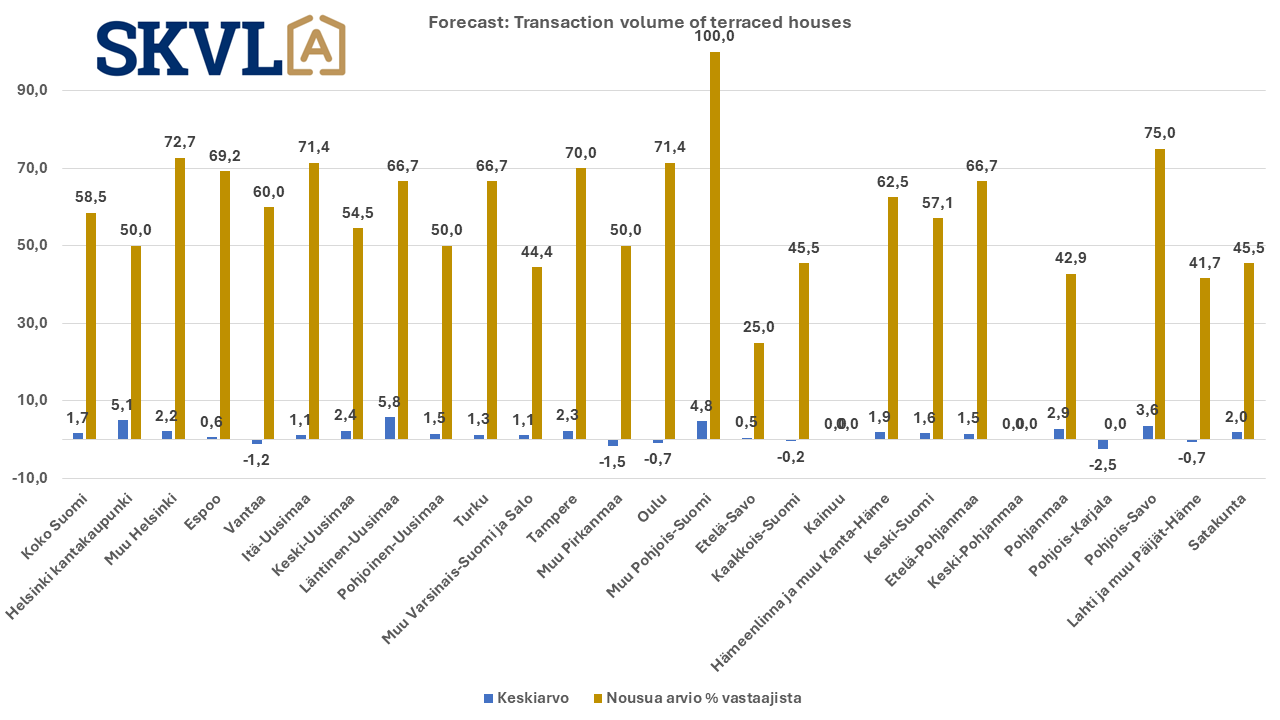

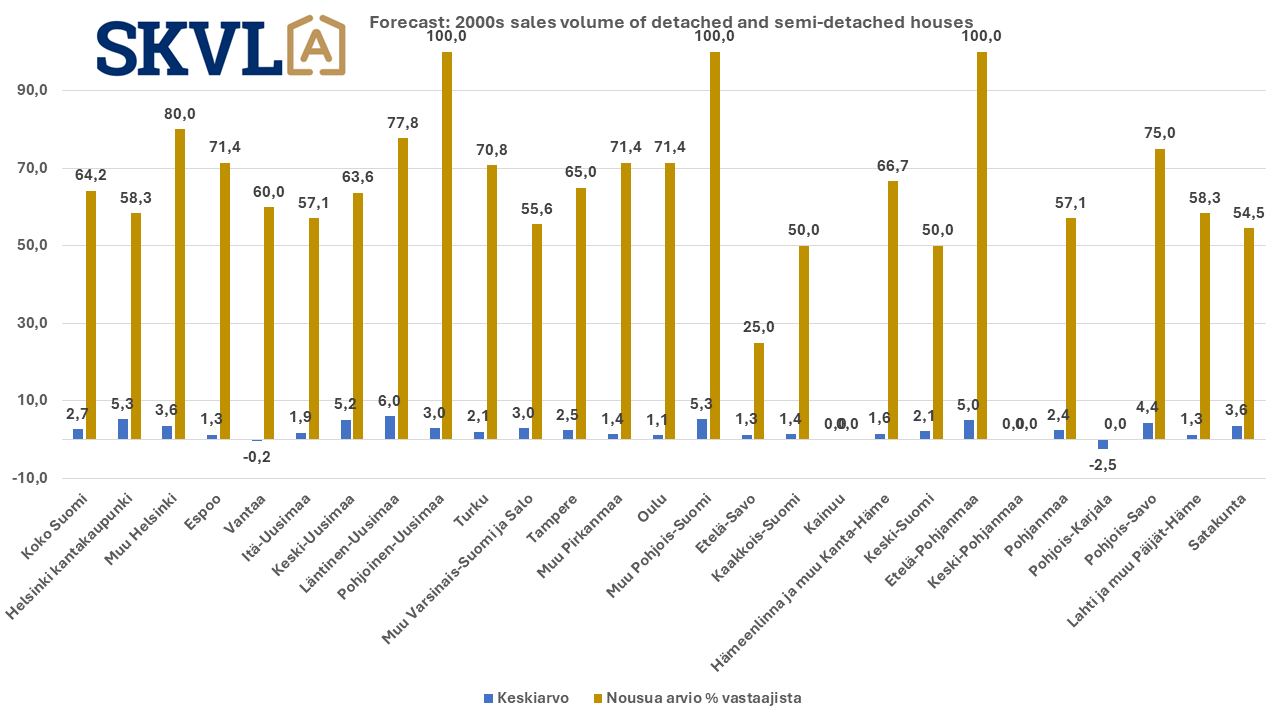

“Rapidly increasing unemployment figures and layoffs are holding back many housing dreams this spring,” comments Jussi Mannerberg, CEO of Finnish real estate brokers association SKVL. “In addition, the postponement of the decline in benchmark rates to June at the earliest has contributed to postponing the implementation schedule for many home swappers to later this year,” he continues. However, with the advent of the spring sun, there are already clear signs that trade will be better than at the beginning of the year. March was already clearly the best month of this year, and terraced houses, detached houses and three-room apartments in particular have sold better, despite the fact that Easter ate into sales figures from March this year,” Mannerberg points out.

The exceptional situation will gradually unravel this spring if there are no new unexpected factors

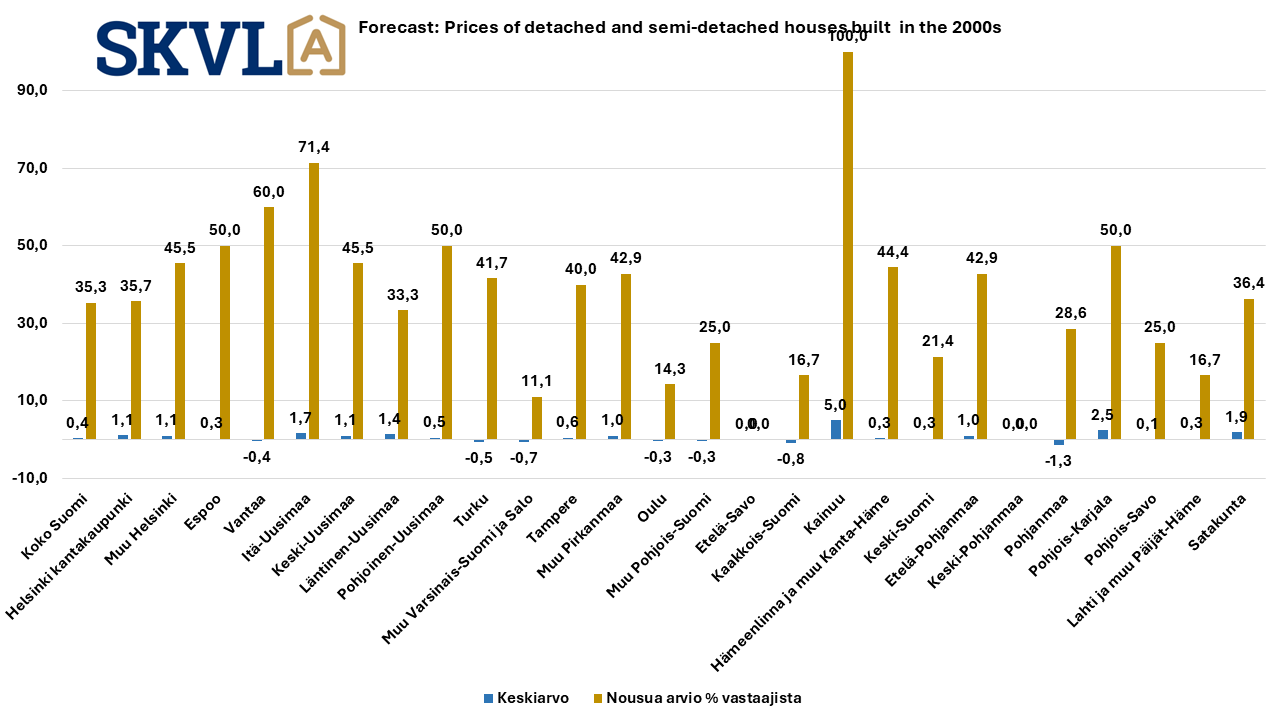

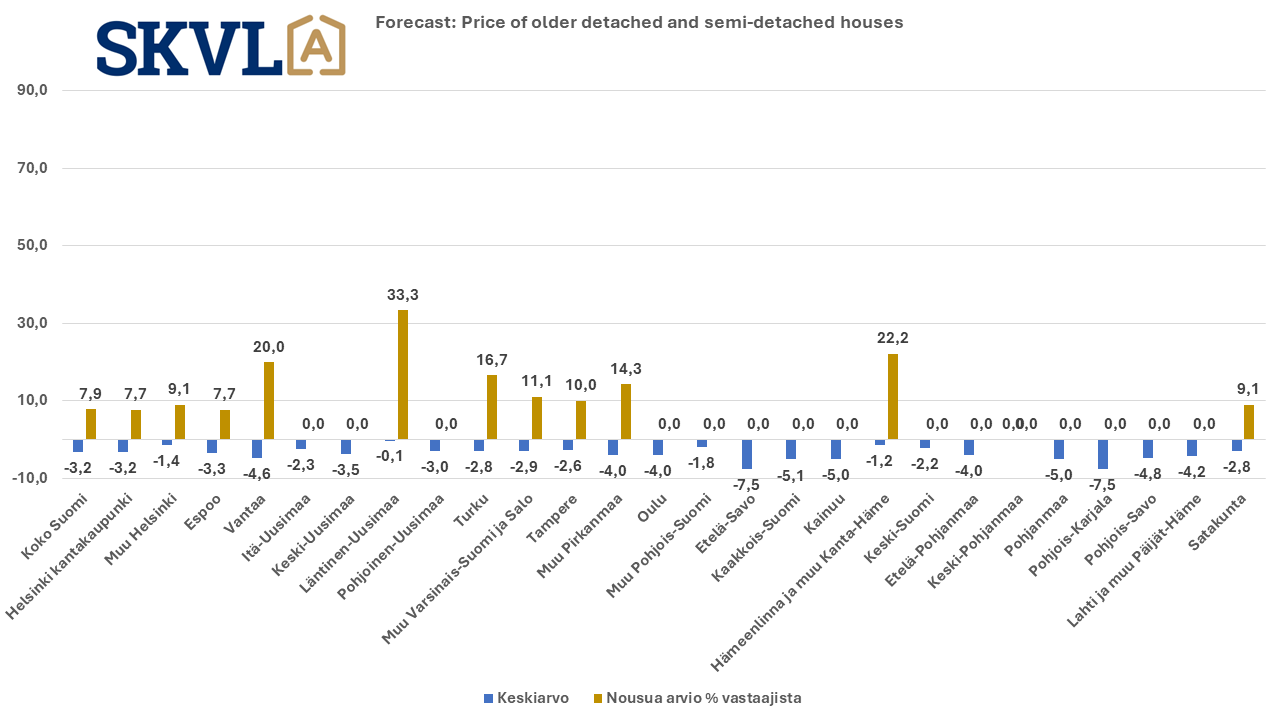

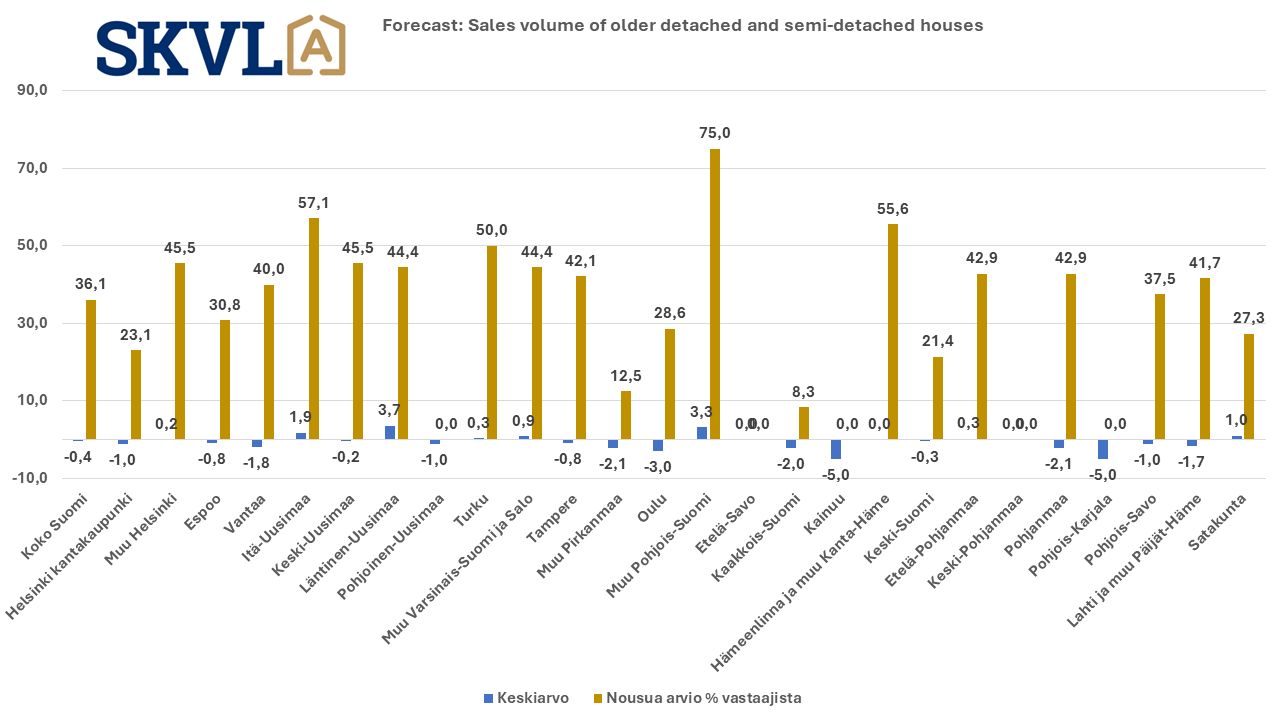

Lower interest rates and improved employment are decisive factors for a clear pick-up in housing sales. Newer detached houses and terraced houses are most in demand. The demand for apartments in apartment buildings in need of renovation is lower. “The market situation in Finland is exceptional even on the European level,” comments Mannerberg. “We have a lot of houses that are about 40–50 years old and that need to be repaired extensively. In housing sales, demand is very limited due to the selective behaviour of the financial markets. Many families would like to buy homes to be renovated, but a mortgage is not available for renovation costs. Banks are still reluctant to grant loans for houses or apartments in need of renovation in general, unless they are located in the centres of growth centres,” he continues.

“Energy efficiency will continue to be a loan component in the coming years, as the EU’s Energy Efficiency Directive enters Finnish legislation and requires higher energy efficiency. Receiving EU subsidies for renovations will play a crucial role for Finland’s housing stock in the coming years,” Mannerberg points out.

Interest tax deduction must be refunded temporarily

In SKVL’s view, the deduction for mortgage interest should be immediately reinstated temporarily. At the moment, huge sums of taxes remain unpaid on housing sales and construction, and the stimulus effect of the interest deduction on trade and employment would also be positive for the state in terms of net benefits.

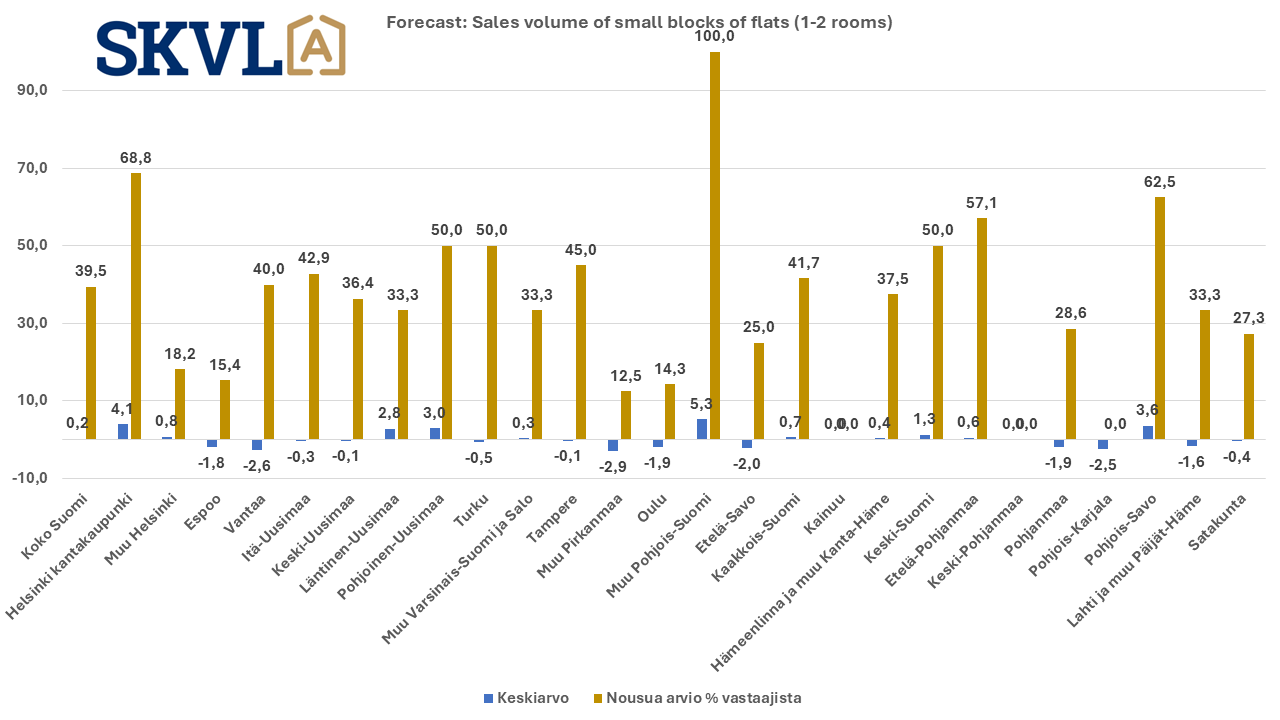

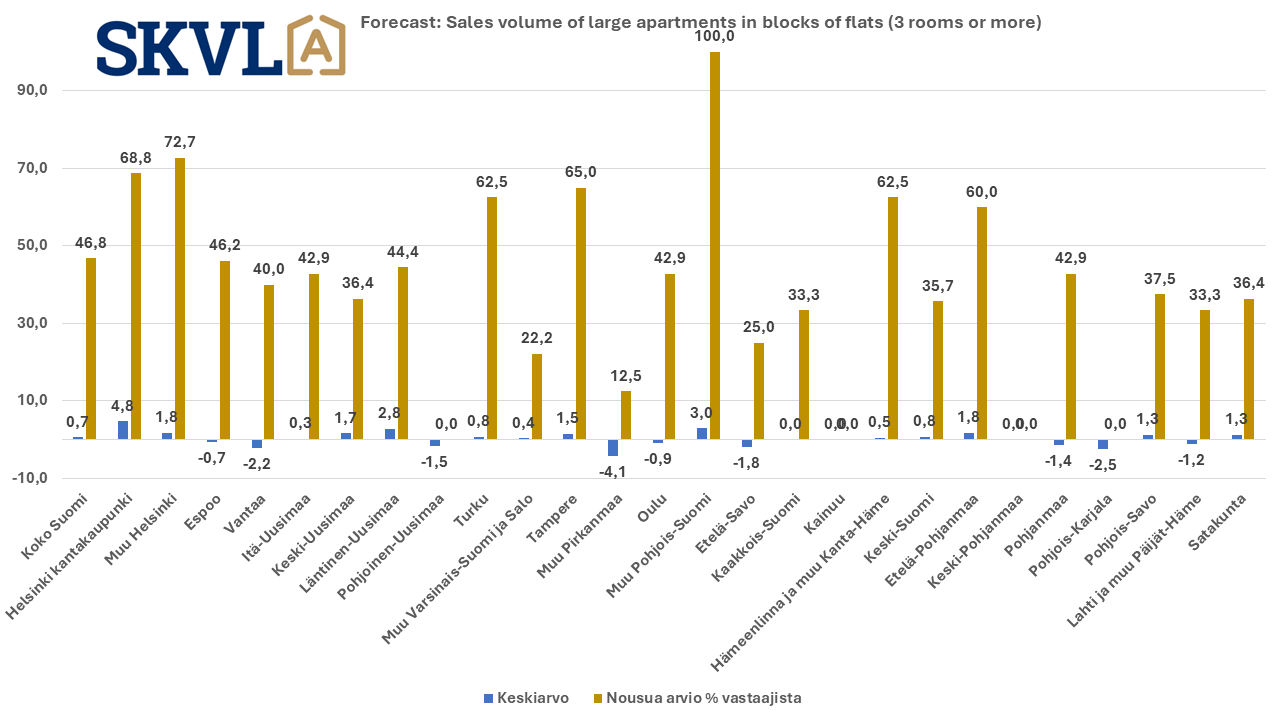

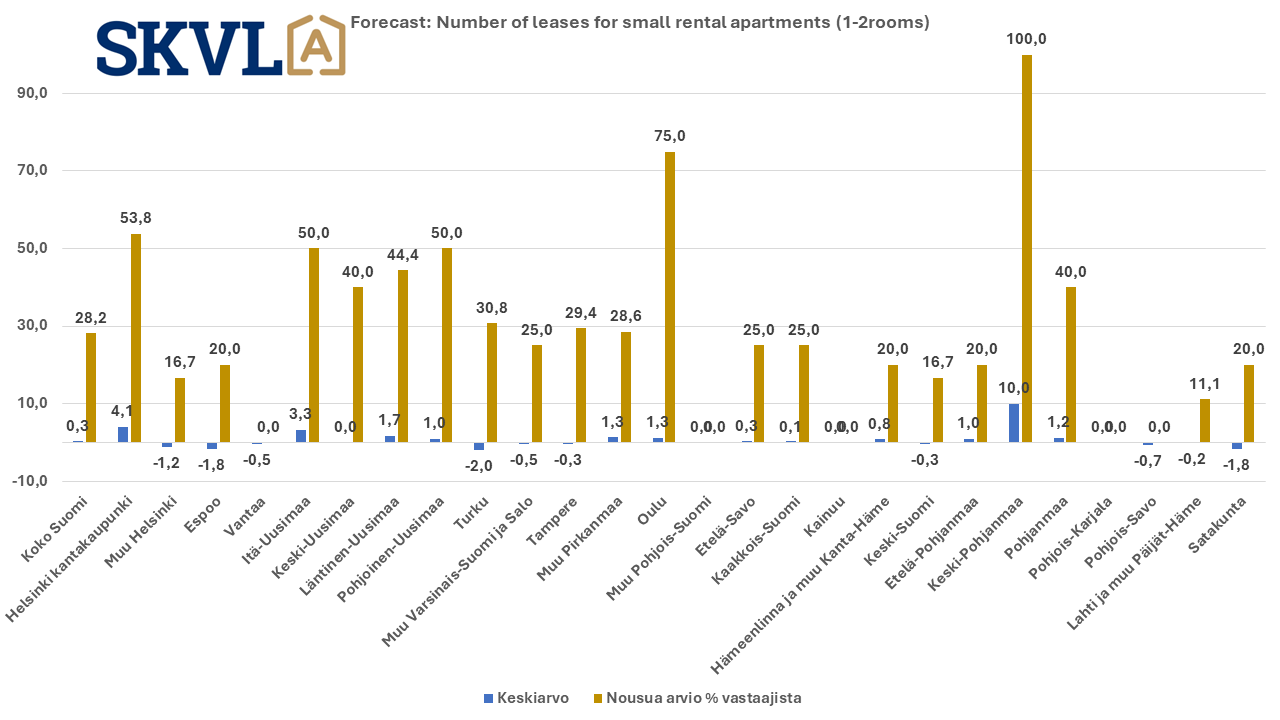

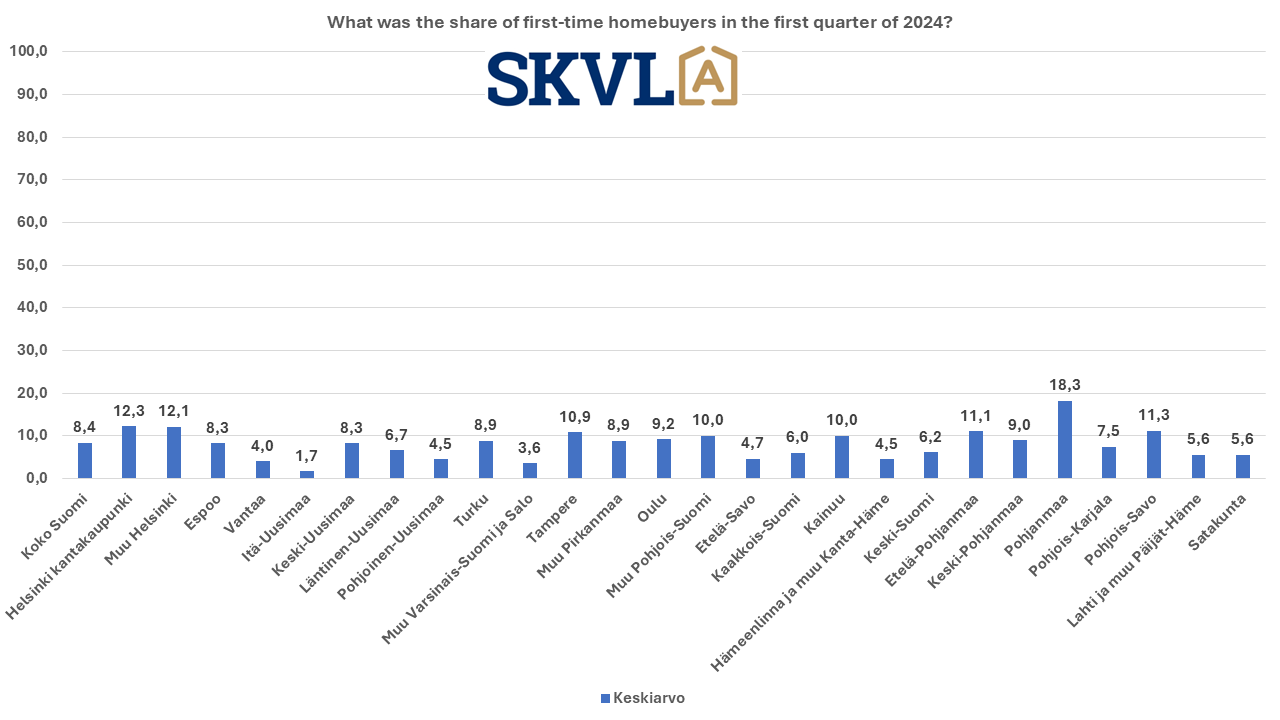

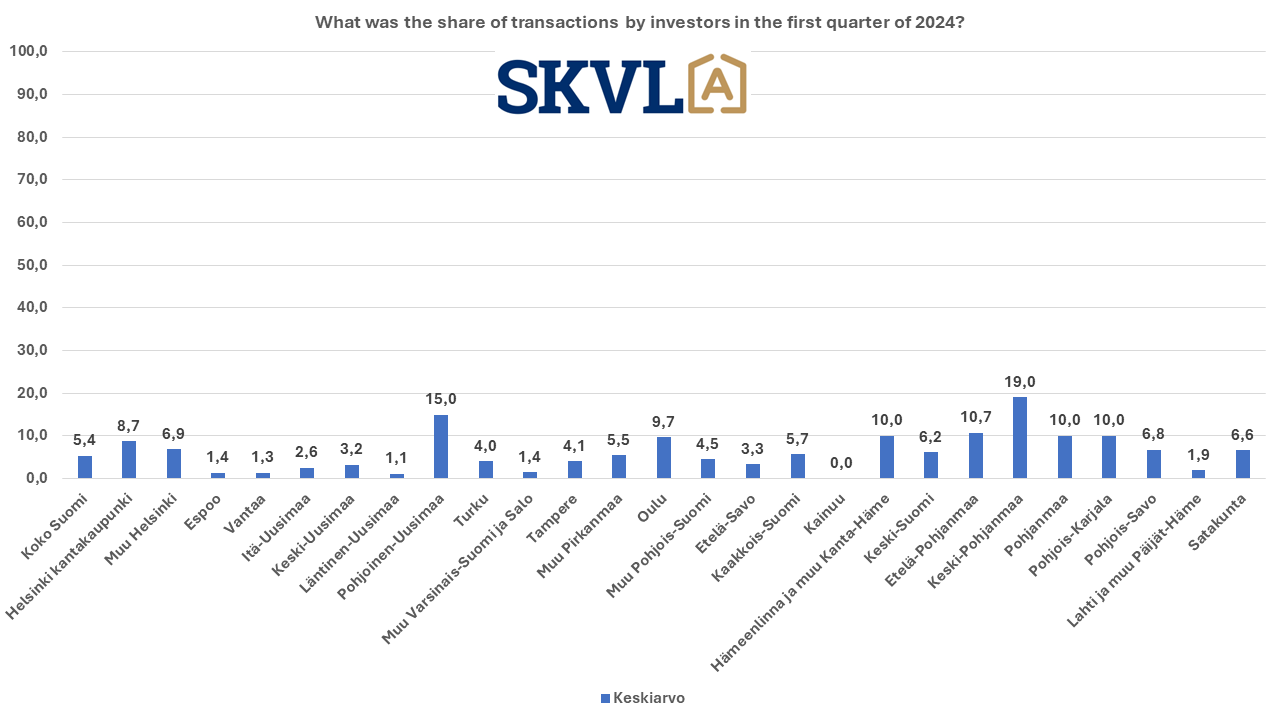

Share of first-time homebuyers fell to normal level in the early part of the year – investors on the move

The rush to housing sales seen at the end of last year was reflected in a strong cooling of sales in the early part of the year. However, first-time homebuyers have still bought about 8–12% of homes. This indicates that if there is no pressure on the buyer to sell their own home, a lower price level is still tempting to buy their first home. Investors have also already been on the move to a greater extent, and investment apartments have been traded especially in Central and Northern Finland, as well as in Ostrobothnia and Helsinki.

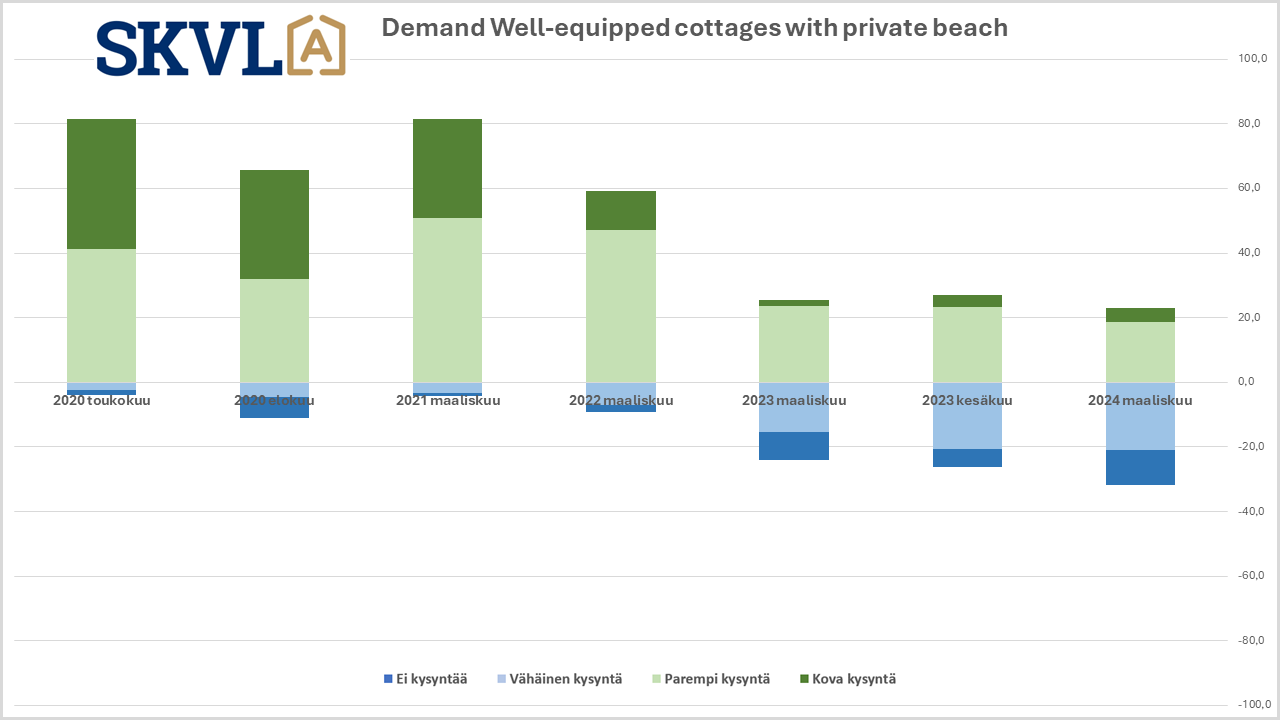

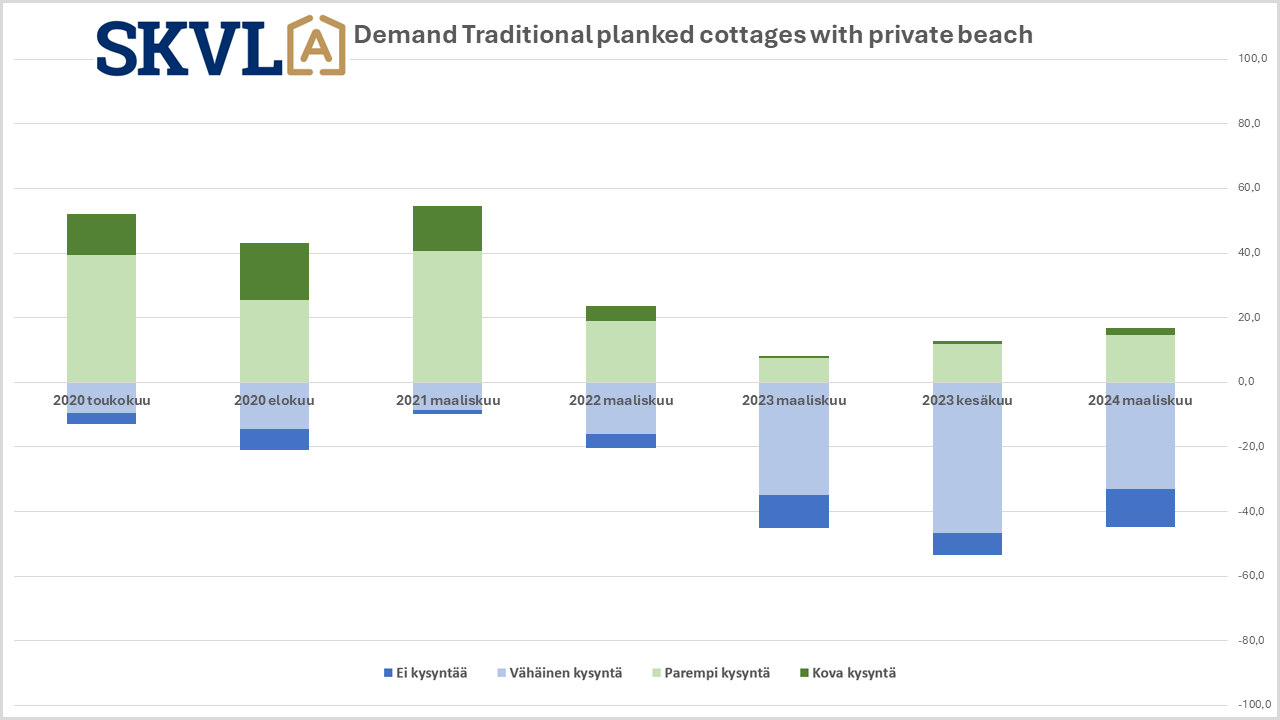

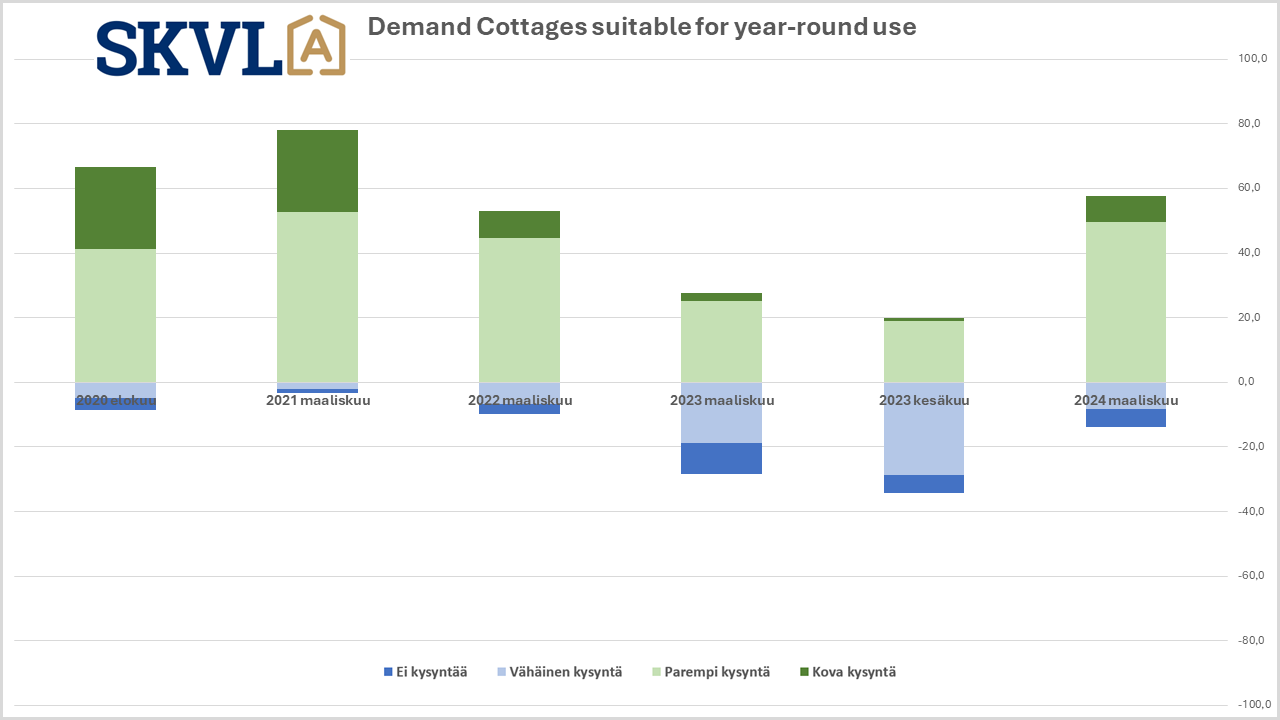

Demand for cottages at pre-corona level

Interest in holiday homes suitable for year-round use is clearly highest in cottage sales. Cottages in good condition and well-equipped on the shores of large bodies of water are still the most popular types of cottages. However, cottage sales are seeing the impact of the general economic situation and have clearly returned to the pre-corona market situation, where cottages in good condition and in the right location are selling as before and sales start to take place when the summer season starts.

Rental housing market

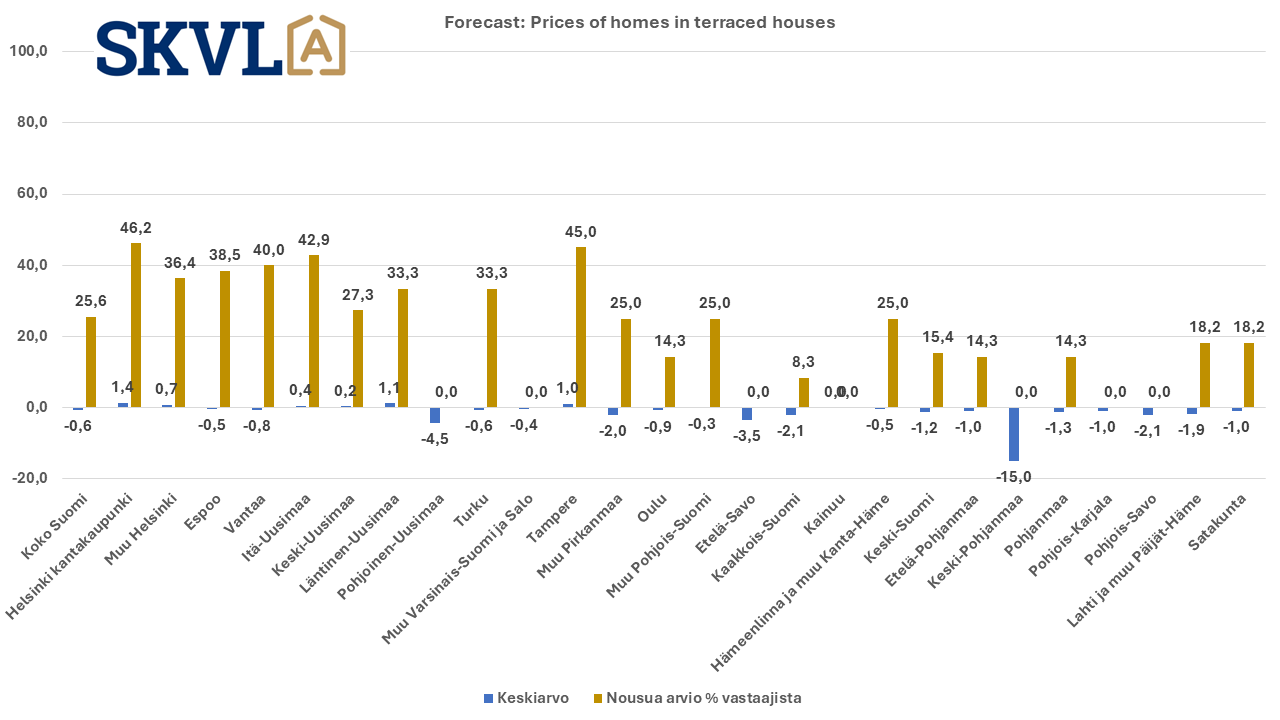

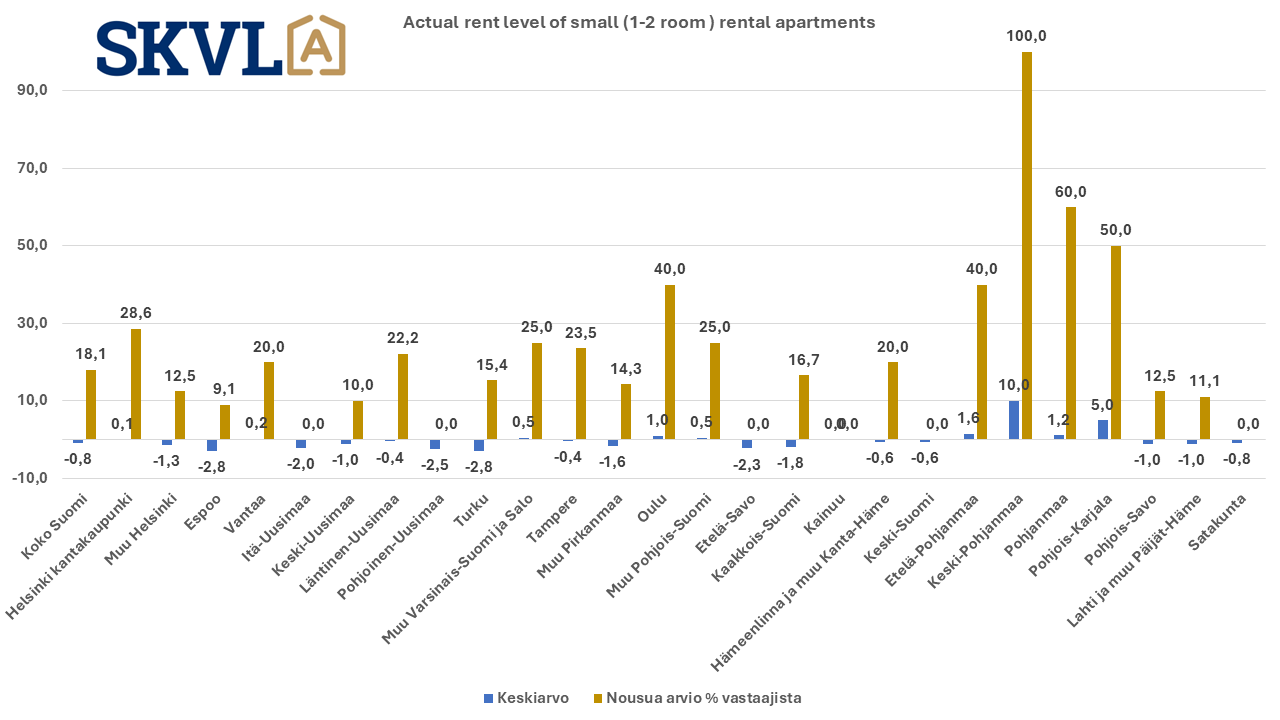

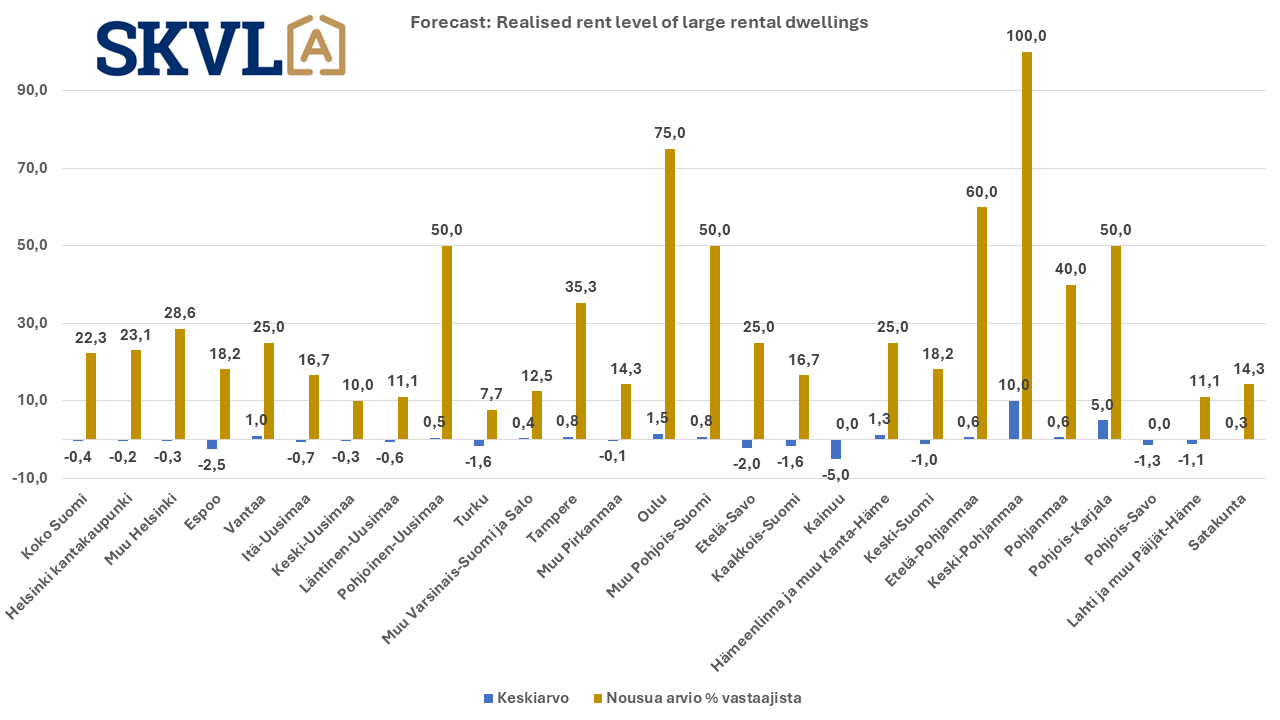

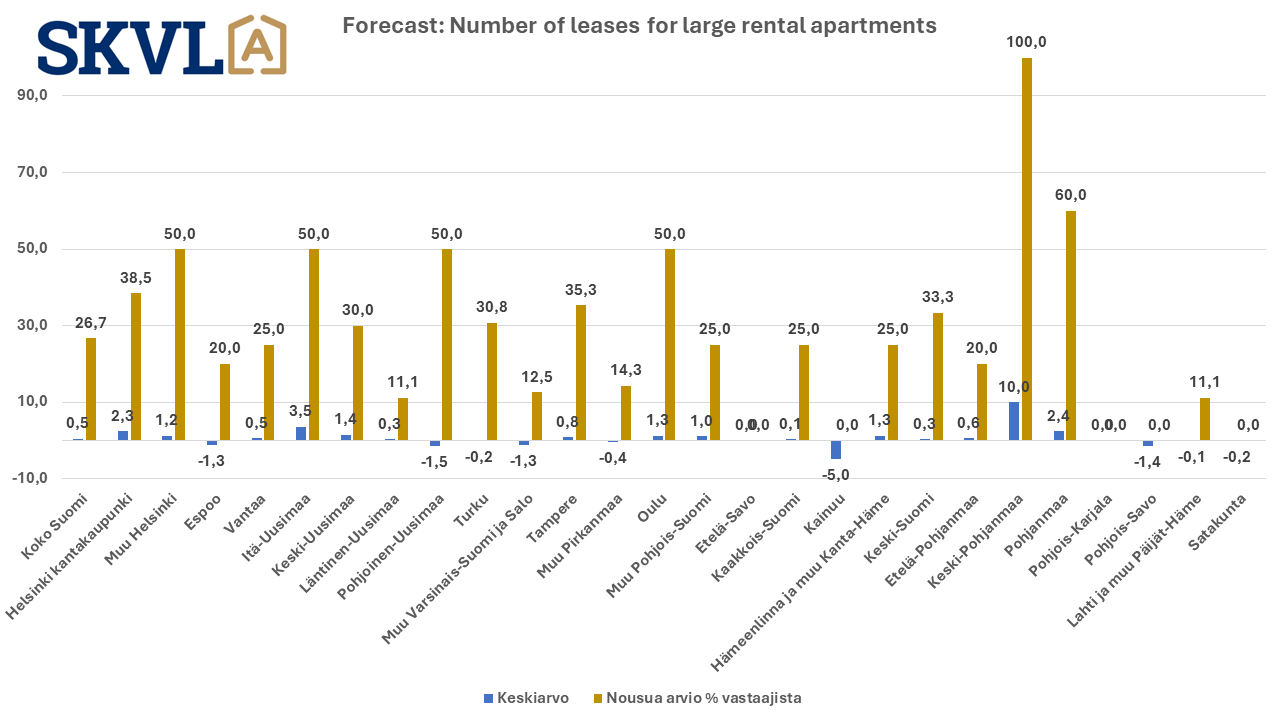

The survey investigated how changes in housing allowance and the general market situation affect the rental housing market. There is now a clear trend that tenants are switching to more affordable rental apartments, either in a more affordable area or smaller apartments. According to the forecast, there will be no significant increase in rents, with the exception of Northern Finland and parts of Ostrobothnia and North Karelia. The demand for rental housing in the smallest apartments is still not as high as the supply, so rents will not increase especially in them. This contributes to slowing down investors’ enthusiasm for small apartments. However, higher charges and higher interest rates in most housing companies are constantly putting pressure on rent increases.

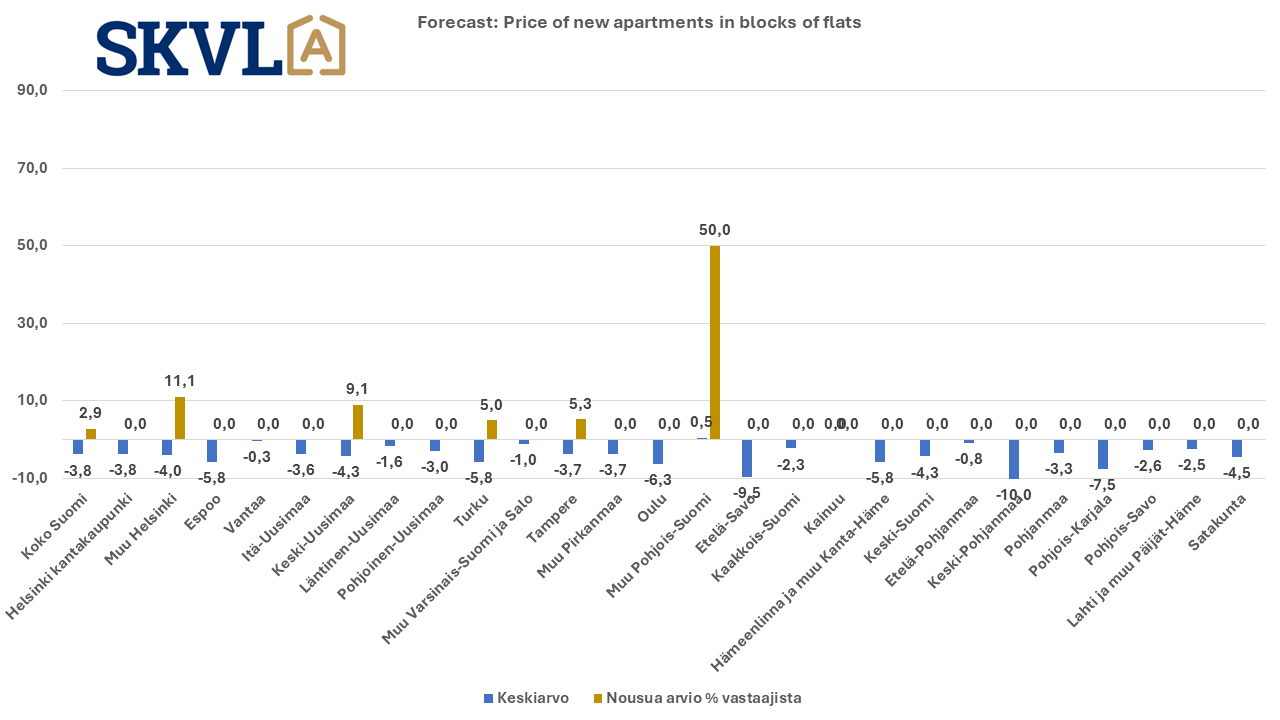

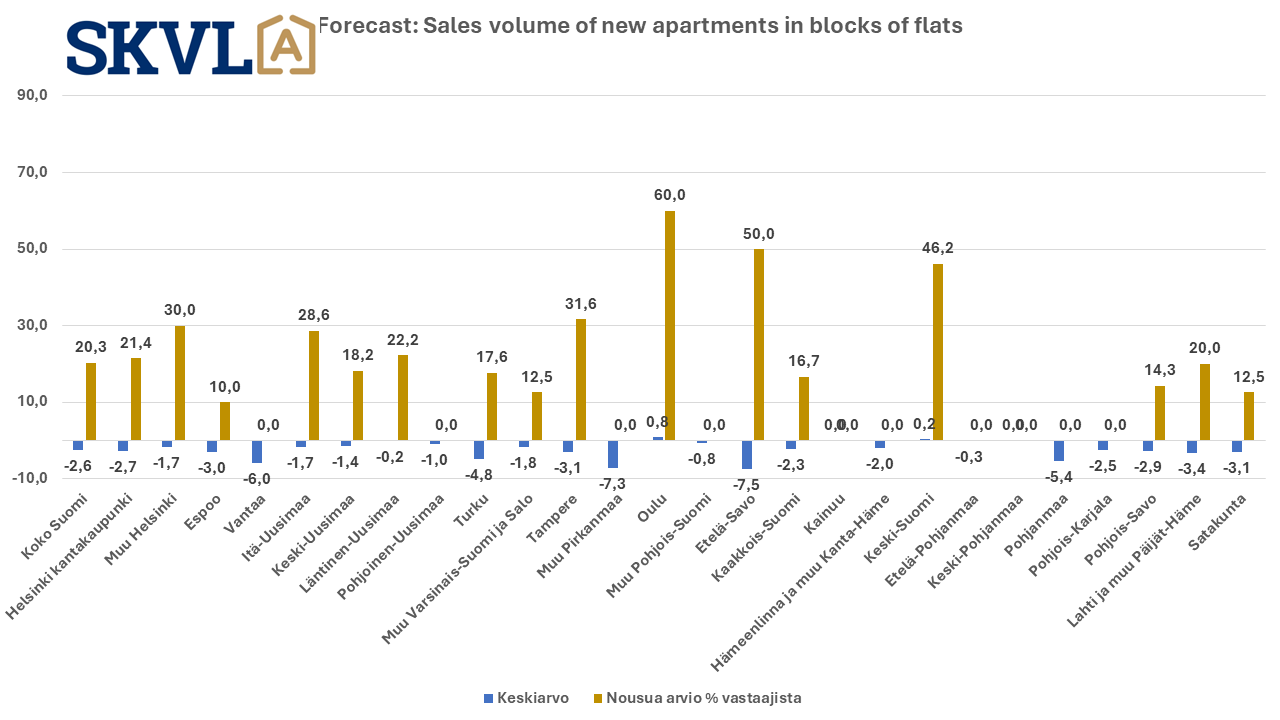

No rapid change is expected in new home sales

Prices of unsold new homes are expected to decline somewhat due to low interest. The demand for small apartments has recovered slightly, but there is still an oversupply in areas close to growth centres, where small apartments were built heavily in recent years. During 2025, however, a turnaround in new production and a recovery in demand are expected, as well as a clear decrease in supply.

Regional comments SKVL housing market forecast 2/2024

Helsinki, inner city

- In the South Helsinki area, the volume of housing sales has increased clearly during and after February, indicating a unwinding of pent-up demand.

- The demand for new housing remains low, which is related to the situation of construction companies.

- During the first quarter compared to 2023, the situation in the southern inner city area was good, and it is believed that the situation will remain at least as good until the summer.

- In the inner city of Helsinki, there are more active apartment changers than before.

- Large and more valuable apartments move better in the inner city and Lauttasaari.

- Töölö has a lot of supply in relation to demand.

- Family apartments with three rooms or more are slightly more in demand than a year ago (Helsinki city centre).

Rest of Helsinki

- Buyers hesitate and not much deal is made, which raises concerns.

- In Helsinki, demand is concentrated on buildings from the 2000s, while prejudices related to older apartments and the risks mentioned in condition inspections have a negative impact.

- Condition inspection records of future repair needs are often seen as negative.

- The repair backlog of houses built in the 70s and 90s is growing. Buyers are looking for apartments that offer a good combination of affordability, location, well-maintained housing association, own plot and minimal renovation needs.

- Housing sales are chained and risk aversion is common. The market is expected to pick up when interest rates fall below 3%.

- There is interest in old apartments in Laajasalo due to the wait for the completion of the Crown Bridges, but the sale of new properties is blocked.

- Buyers wait for an interest rate cut before actively buying a home.

- There are plenty of apartments available and pent-up needs in the Helsinki metropolitan area. In Vantaa, Helsinki and Espoo, offers for new properties are made quickly, but often the prices offered are too low to make a sale. A pick-up in the market can be observed at the end of March.

Espoo

- In Espoo and Western Helsinki, the housing market situation is challenging, as sellers’ and buyers’ views on prices are far apart.

- In Espoo, buyers are cautious and wait for market developments. First-time homebuyers are particularly interested in two-room and three-room apartments, while studio apartments do not arouse the same interest. Many expect lower interest rates and an improvement in the market.

- The uncertainty of working life and the change negotiations started in companies affect people’s plans to change apartments in Espoo.

- The demand for ready-to-move family apartments completed in the 2000s is high, especially in apartments of more than 100 square metres. The willingness to carry out renovations is low, as renovation costs are perceived as high and financing is expensive and difficult to obtain.

- In Espoo, there is a growing willingness of sellers to sell, which indicates the existence of a willingness to buy, but chaining of stores is difficult.

- Selling new apartment buildings is difficult, and customers are cautious when making purchasing decisions. The western centre of Helsinki and Espoo’s waterfront areas. Small apartments hardly raise any questions. Similarly, there is demand for larger terraced and semi-detached houses in Espoo’s waterfront areas and along Länsiväylä. The price just has to be right. The largest customer base is in the budget between 500,000 and 800,000 euros.

- Banks are becoming more cautious in housing transactions and often require condition inspections of housing companies as well, which makes it more difficult to make a sale.

Vantaa

- Picking up a bit. There will be more to sell.

- There are a lot of conditional offers.

- Very peculiar situation and uncertain.

- Great tension and caution noticeable

- Sellers don’t want to sell their own nice homes when they don’t have a nice new home for sale.

- A few congested districts in terms of new buildings, such as Kivistö and Tikkurila. Gradually erupts when there is no new one. At the end of the year, you can no longer buy what you want when you are not for sale. In March 2025, a real housing shortage will begin, as there will be no new ones in the migration growth centres.

Eastern Uusimaa

- Trade in Loviisa has been fairly good despite the economic cycle. The beginning of the year was quiet, but the market has now picked up both in terms of demand and sales.

- The market situation in Porvoo is approximately at the same level as in 2019. In the inner city of Porvoo, the market has become livelier. An increase in purchase enquiries, sales orders, demonstrations and quotes can be observed. Clients have increased their understanding of the changed price level, but they are often reluctant to accept the offers received at the last stage. The cottage sales season has not yet started and its start will be postponed to April due to weather conditions.

- In Porvoo, housing and single-family house sales are expected to pick up in the spring. The number of contacts has already increased, and the pick-up in the market in the spring can be observed. The spring trade volume is expected to be significantly better than in the previous quarter.

- The new properties in Söderkulla in South Sipoo have many waiting customers. Buyers monitor the situation of housing companies and the number of unsold apartments, and properties on rental plots are particularly difficult to sell. Buyers pledge their purchase decision.

- The market situation for holiday homes in Porvoo is expectant, and buyers only make decisions in exceptionally advantageous cases.

- In the surrounding municipality of Askola, the market is still relatively stagnant, and demand is focused on new, well-maintained and affordable properties.

Western Uusimaa

- Espoo-Ekenäs area, clearly more requests for valuations and are putting their houses up for sale during the spring.

- Hanko: The spring season has got off to a fast start. Buyers are ready to make quick decisions and the offered transaction prices are closer to the asking price than last year. Buyers have clearly been following price trends and waiting for the right time to buy – and it seems to be now. There will also be a lot more properties for sale and most of the sellers have understood the right price level. Some buyers don’t have time to react quickly enough and popular destinations are already passing by.

- Vihti: Sales are very lively and there will soon be a shortage of the most popular apartment types.

- In Kirkkonummi, trade is active. Terraced, semi-detached, detached houses and detached houses with yards from the 2000s are sought-after and now they have started to go even from the first presentation and at full price. From one-bedroom apartments, delicacies go, others wait.

Northern and Central Uusimaa

- Central Uusimaa: There are very few buyers on the move, but surprisingly, properties that have been for sale for a long time can be sold at reasonable prices. Banks’ decisions block trade. A more hopeful situation than last spring. Signs of an increase in item views, which is reflected in demos and therefore deals.

- In Mäntsälä, a clear difference in the increased interest of buyers began to be visible in mid-March, when sellers also woke up to offer their own homes. A lot of valuation visits were made during the first half of the year, and when good properties were put up for sale, they sold very quickly. Buyers’ interest in properties completed after the 2010s, especially detached houses, has clearly increased.

- In Nurmijärvi, older apartments in blocks of flats and terraced houses and detached houses in need of renovation are not selling, nor are newer 1–2-hour apartment buildings, i.e. no demand for them.

Turku and the rest of Southwest Finland

- The housing market in Turku as a whole has improved slightly, even though the beginning of the year was even better. The effects of Finland’s general economic situation, such as strikes, will also be felt in the Turku region. However, trading has shown signs of picking up as the weather warms up and the sun shines more.

- Banks are slow to operate, which delays deals. This applies to a large number of banks.

- There is a shortage of all types of housing in family apartments. It is expected that the fall in interest rates in spring and summer will stimulate the markets.

- In Kakola and Telakkaranta in Turku, housing sales are quiet, and prices in Kakola have fallen. Buyers are waiting and there is a lot of supply.

- First-time homebuyers are on the move, who make a purchase decision quickly if a suitable apartment is found. Trade in the suburbs has almost stopped, and investors are not moving into the smaller apartments in the city center.

- Turku and nearby municipalities have had more visitors to the screenings than last year, and decisions are made better.

- Elsewhere in Southwest Finland and Salo, the market situation has picked up slightly, but is still subdued.

- In Kaarina, single-level terraced houses are selling, while sales of larger apartments in housing companies are slow. Thoughtful and hopelessly low offers can also be observed in the region.

Satakunta

- Old apartments in blocks of flats are the most difficult in the Pori area, and there should be no repair backlog in the apartment or company. Even newer ones are sold at a lower price and being in good condition is a big plus. All the peripheral villages in the area are older and full of renovation sites that have long existed. The sellers have not wanted to lower the price and are waiting for an increase. Banks do not lend easily to old houses, it is easier with correctly priced ones in good condition.

- In the economic area of Pori, the number of buyers and displays has clearly decreased as a result of the strike.

- Rauma: Sellers are actively on the move, and at a healthy and reasonable price level. Buyers have cautiously woken up and requests for displays and viewers are coming in nicely. Making a purchase decision seems to be easier than, say, 12 or 6 months ago. The well-maintained and spacious family homes north of Rauma sell comfortably and there is more demand than supply. In other areas, sales of detached houses and dwellings in renovation condition are most quiet.

- Cottage sales picking up in Satakunta.

Tampere and the rest of Tampere Region

- In Tampere and Pirkanmaa, the housing market is unusual. Sellers expect last year’s prices, while buyers want prices half as low. Strikes have caused job losses, affecting people’s desire to avoid major economic decisions.

- It now takes more time to make purchasing decisions, and many buyers are making bold underbids. Investors are cautious and hardly buy homes.

- Tampere is a good market for buyers, as there is plenty of supply. Setting the right price is especially important now, as people are more price-conscious than before.

- In February, the market was very difficult, but since then there has been a pick-up.

- There is a small glimmer of light in the Tampere region and surrounding municipalities, and there have been more requests for presentations since the turn of the year.

- Elsewhere in Pirkanmaa, the situation varies: in Kangasala, the market has almost stopped, in Lempäälä there is a pick-up, in Sastamala trade is more sluggish, and in Nokia the situation is healthy, but the mood among buyers is more expectant. The continuation of the strikes creates uncertainty.

- The development of transaction volumes and prices of new blocks of flats is currently uncertain, and new blocks of flats are not being built as much as before.

Oulu

- In Oulu, contacts and visits to presentations have increased. There are also clearly more private presentations.

- There is immediate interest in apartments built in the 2000s when the property is released for sale, but purchase decisions are tight. The offers also fall short of the sellers’ wishes.

- Buyers are already starting to get used to the level of interest rates, but the threat of escalation of the war, as well as strikes and the consequent fear for one’s own job, have become a bigger threat than interest rates and thus a brake on purchasing decisions.

Rest of Northern Finland

- The sentiment expecting a reduction in interest rates continues, but there is a clear pick-up in terms of both sellers and buyers compared to the beginning of the year.

- In the Rovaniemi area, more sales have started to flow into sales, which indicates an improvement in the direction of the market, although this is not yet reflected in sales volumes. Demand for new housing remains very subdued, almost non-existent.

- However, the forecast for new properties remains unchanged for the whole year: If or when sales start to open, there will be a shortage of new properties. At this stage, construction companies should already set the projects in motion, and since the deal has not taken place, the projects will not start either. This will lead to a situation where, due to the increase in demand, only the fastest will now receive completed or completed apartments for themselves, and new apartments will not be available until 2025 at the earliest, rather in 2026.

- Second-hand housing sales are still not going on normally, but light can be seen at the other end of the tunnel little by little.

North Karelia

- The biggest problem in Joensuu and the surrounding municipalities is the lack of supply in the market. Sellers do not dare to put their apartments up for sale when there is no information about the next apartment, i.e. the whole does not work.

- In other words, those who move to a smaller one do not put their large apartments or houses up for sale and also do not put the smaller apartments of those buyers of larger apartments up for sale when there is nothing bigger to buy.

- It is difficult to sell renovation properties, as banks do not start lending for renovation costs, even if the collateral value of the object purchased through renovation increases significantly. Thus, old renovated properties are not available for many people to buy, which then directly affects their price level.

- Strikes also have a clear impact on people’s purchasing behaviour. When the strikes began, the market slowed down. But now the market seems to be picking up again.

South Ostrobothnia

- It is difficult to sell new apartments in the centre of Seinäjoki. Families with children want to move a little further away from the city centre to residential areas.

- Single-family houses from the early 2000s are most in demand, but interest in the transaction takes 1–2 months, i.e. it takes a long time to consider.

- There is demand in the Seinäjoki-Lapua-Kauhava area, the lack of sales is mainly due to the fact that buyers do not receive financing.

- Housing sales are good in Seinäjoki’s Shelf Rock, Kertunlaakso, Karhuvuori, Tanelinranta and Nurmo city centre.

Ostrobothnia

- Vaasa: there are few old properties for sale in Vaasa and Korsholm. There would be a little more buyers in traffic now.

- Vaasa: sales of new properties very quiet.

Central Finland

- In Central Finland, especially in Jyväskylä, customers visit apartment displays, but no decisions are made and there is hesitation in the market.

- There has been no major change during the early part of the year and last autumn, apart from the activity of first-time homebuyers.

- Cuts in housing allowances are expected to have an impact on the rental growth potential of rental properties in Jyväskylä, which may drive investors out of the market.

- There is some demand in Jyväskylä for larger, newer or new homes, such as terraced, semi-detached and detached houses. February was quieter, but there has been a slight pick-up in March.

- In Muurame, there is a slight revival in the terraced house market, and residents are considering selling detached houses or exchanging them for a new terraced house.

- In general, the market in Jyväskylä has declined from a cheerful Christmas and January. The willingness to buy has decreased, and caution has increased when buying a home.

- The single-family house market in Jyväskylä seems to be picking up as spring approaches, and there is demand especially for houses built in the 2000s. However, once a suitable house has been found, few are ready to make a direct offer.

South Savonia

- More single-family houses from the 2000s would be sold if they existed. Good, renovated apartments stand out well in the market, and their purchase price is good and the selling time is short.

- Prices of dwellings in blocks of flats in the 70s and 80s have fallen.

- The summer cottage season is about to start and there is even a shortage of things to sell.

Southeast Finland

- In Imatra, we are right on the eastern border, where there is uncertainty about jobs and the situation at the border.

- In the City of Kouvola area, the volume of trade has held surprisingly well. There has been more trade in the first two months of this year than last year. But what characterizes today’s market is that people trade in very cheap assets.

- Lappeenranta: There are difficulties in making a sale, but there is already some light. The city centre and western area are functional and there are fairly new detached houses. Old houses are of no interest and the farther from the center, the harder it is to sell, excluding single-family houses

- Lappeenranta: The proximity of the eastern border frightens the markets, and strikes and large forest giants have paralysed trade. After the strikes end, an increase is expected when spring comes.

Hämeenlinna and the rest of Kanta-Häme

- Kanta-Häme, City of Hämeenlinna, Renko: Trade volume has clearly increased compared to the last quarter of last year.

- Cheer up.

- In Riihimäki, the number of sales orders is growing rapidly. There are now considerably more buyers on the move than in the previous 6 months. However, decision-making is still slow for them. At first, big bargains before rising to a realistic level. Most demand for good family apartments, i.e. terraced houses and detached houses. There is an oversupply of two-room apartments.

Lahti and the rest of Päijät-Häme

- The Päijät-Häme region, especially Lahti, continues to face challenging times in the housing market. Supply and demand do not meet. Strikes and general uncertainty affect willingness to buy, and the fear of making an erroneous purchase decision or criticizing others is present.

- In Lahti, the market is waiting, and buyers are hesitant about making a decision. Finding suitable properties for customers is difficult and buyers’ perceptions of haggling funds are unreal.

- In Eastern Häme, on the shores of Lake Päijänne and other lakes, there is still demand especially for good evening sun plots and high-quality villas. Demand exceeds supply for these items.

- In the Lahti-Hollola area, the number of assessment visits has increased and sales volumes are slightly increasing. However, sellers’ price expectations remain high.

- In Nastola, the market situation is quiet.

- The Päijät-Häme region has an atmosphere of restraint and consideration.

- There is good demand for single-family houses built in the 2000s in the price range below EUR 350,000, but few of them are on sale.

- Houses from the 1980s and 1990s have risen in popularity. There is also demand for properties over 350,000 euros, but the buyer base is smaller.

- For old houses in the price range of about 100,000 euros, buyers have been found during 1–3 month trading periods, especially in Lahti and Hollola, but also in other nearby municipalities.