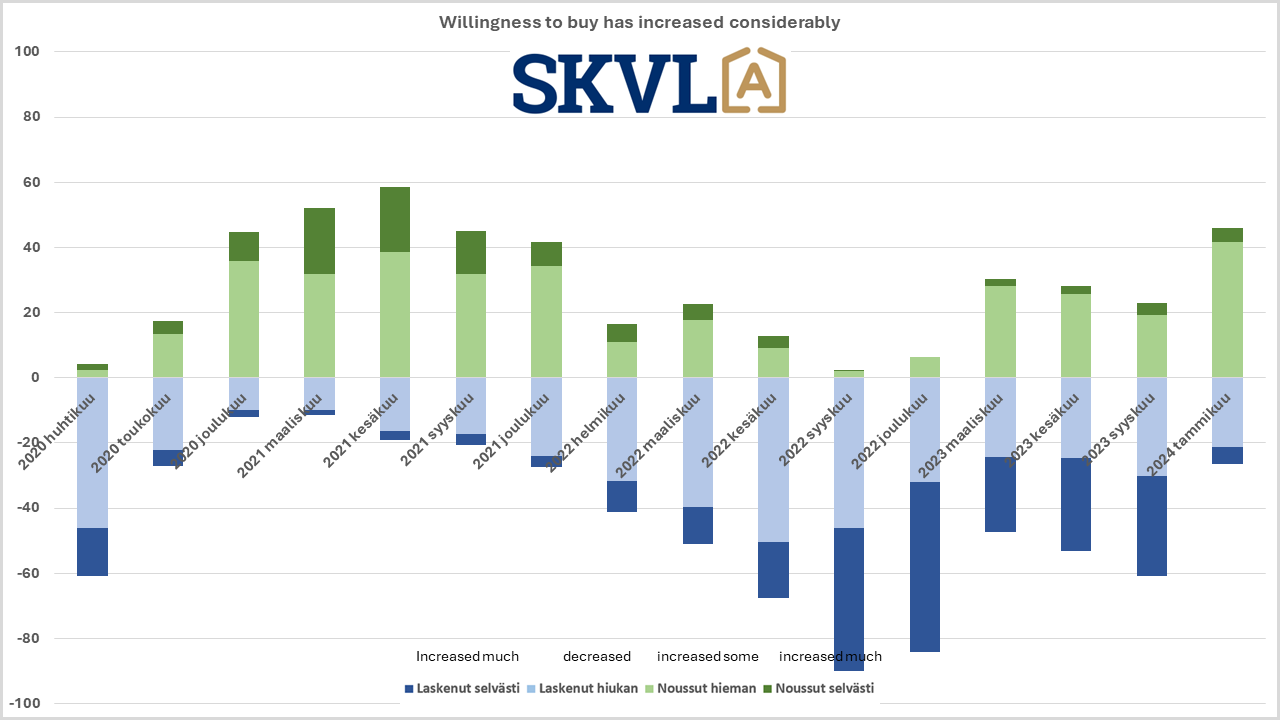

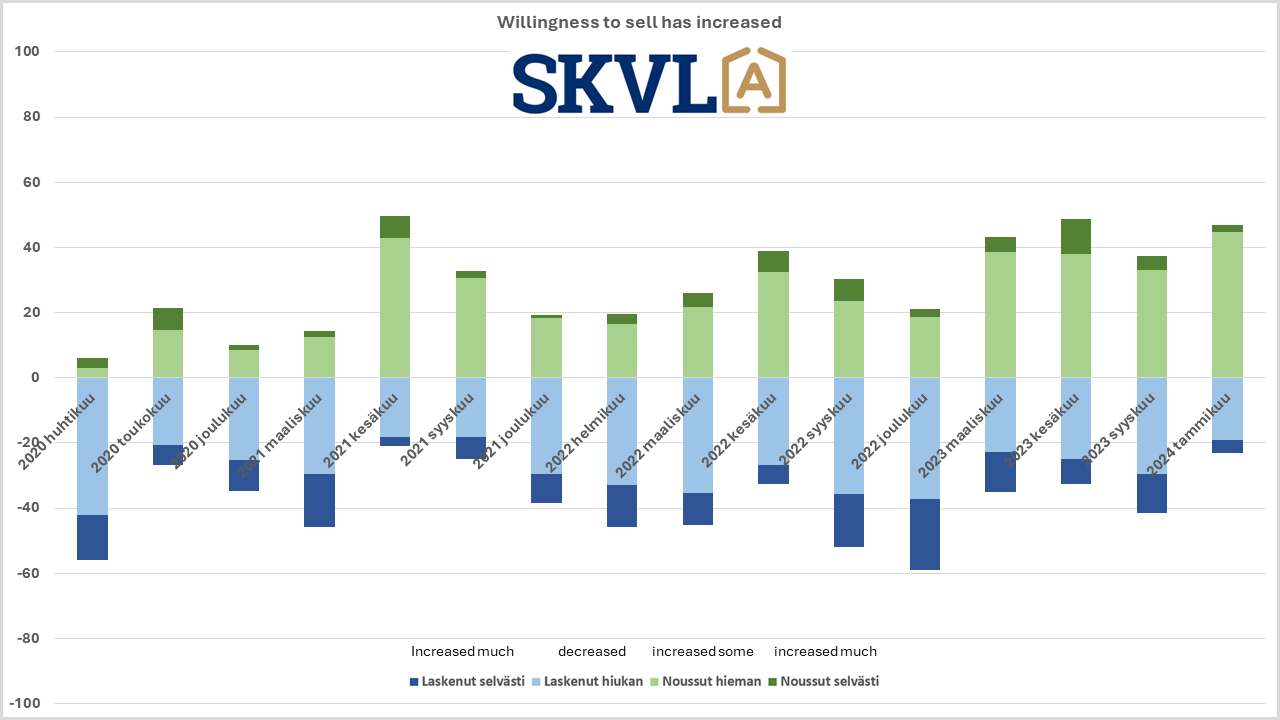

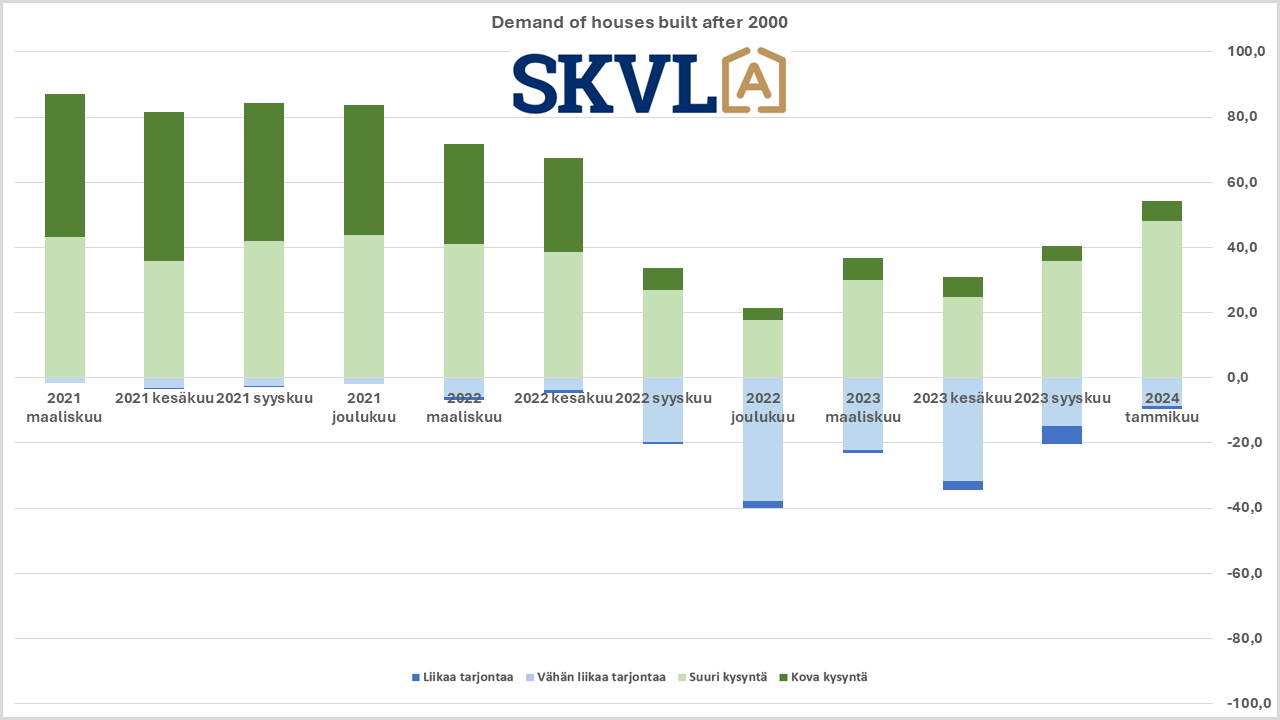

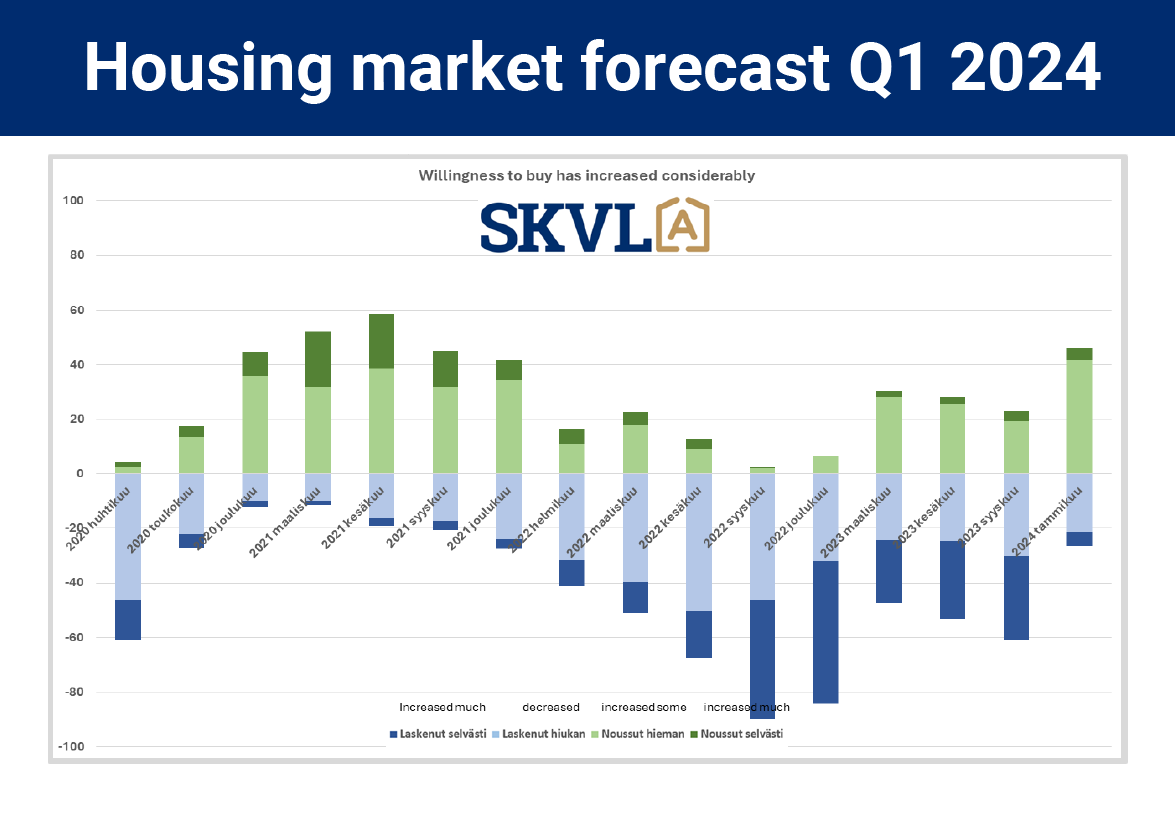

The Finnish housing market has taken a rapid turn as buyers’ interest has risen sharply. “SKVL’s purchase intent indicator saw the biggest turnaround in the entire measurement history at the turn of the year,” says SKVL’s CEO Mannerberg. “There has also been a clear upward turn in willingness to sell,” he continues.

The metropolitan area is now attracting buyers

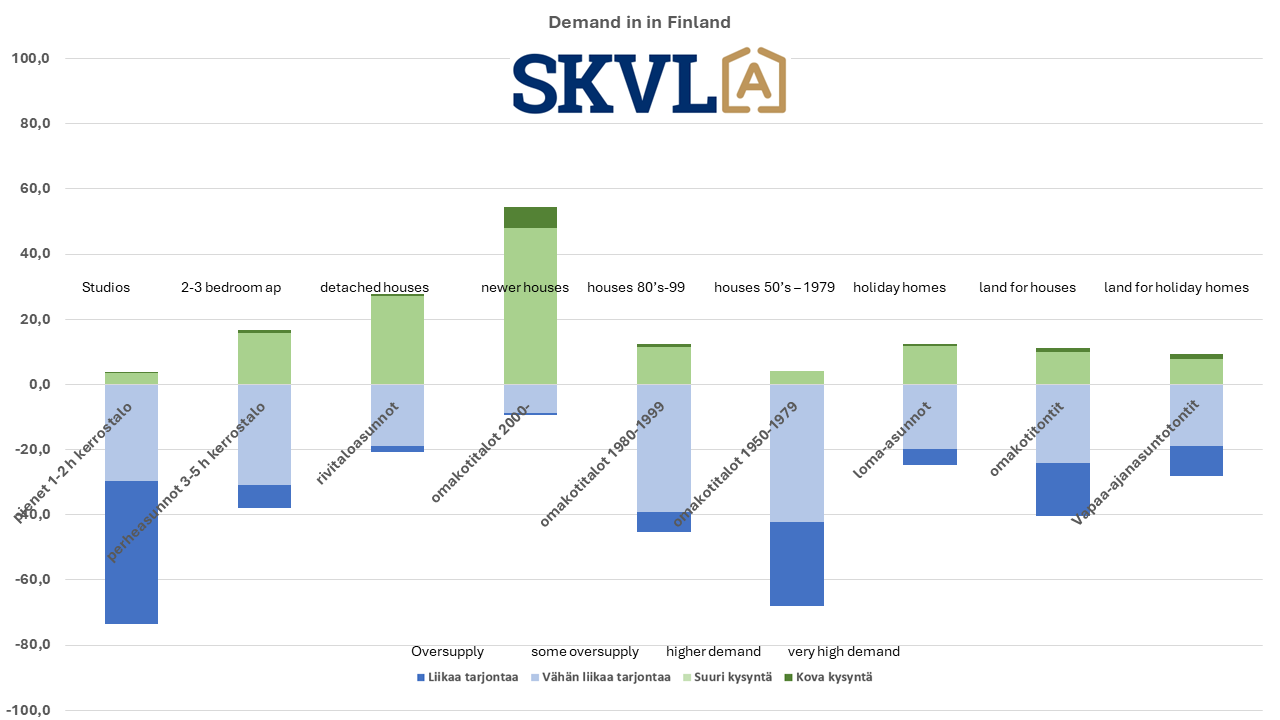

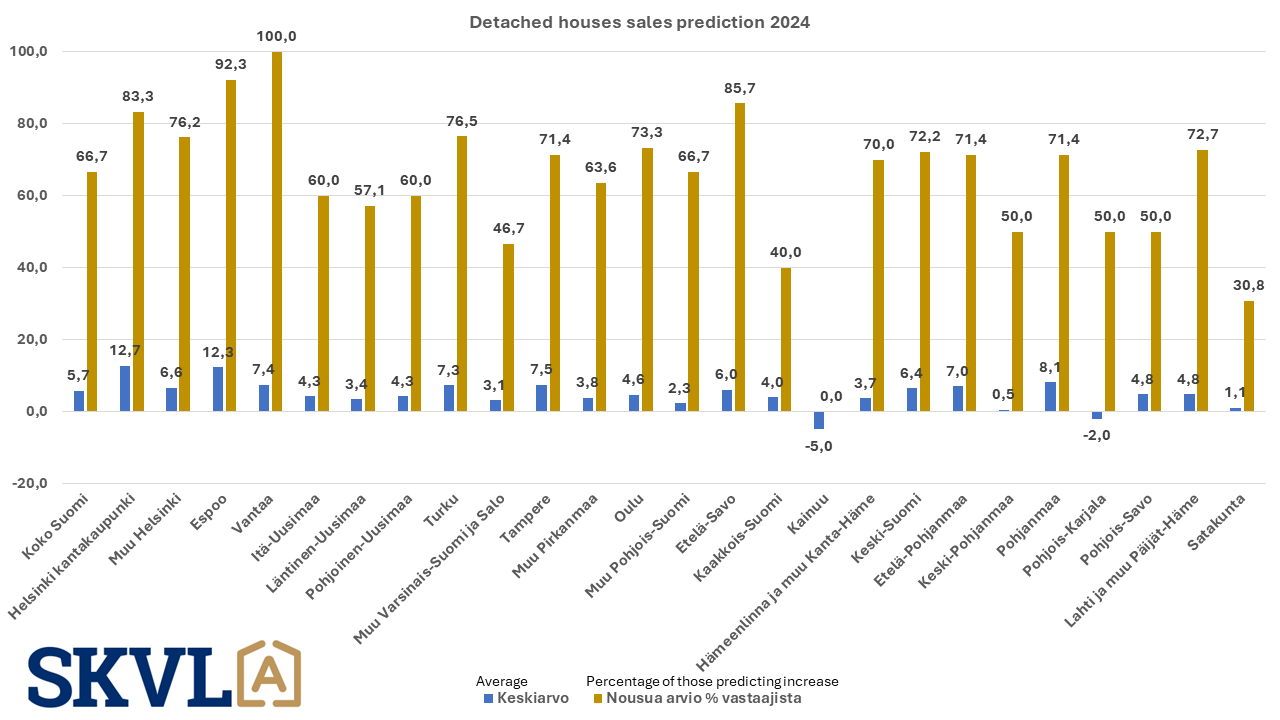

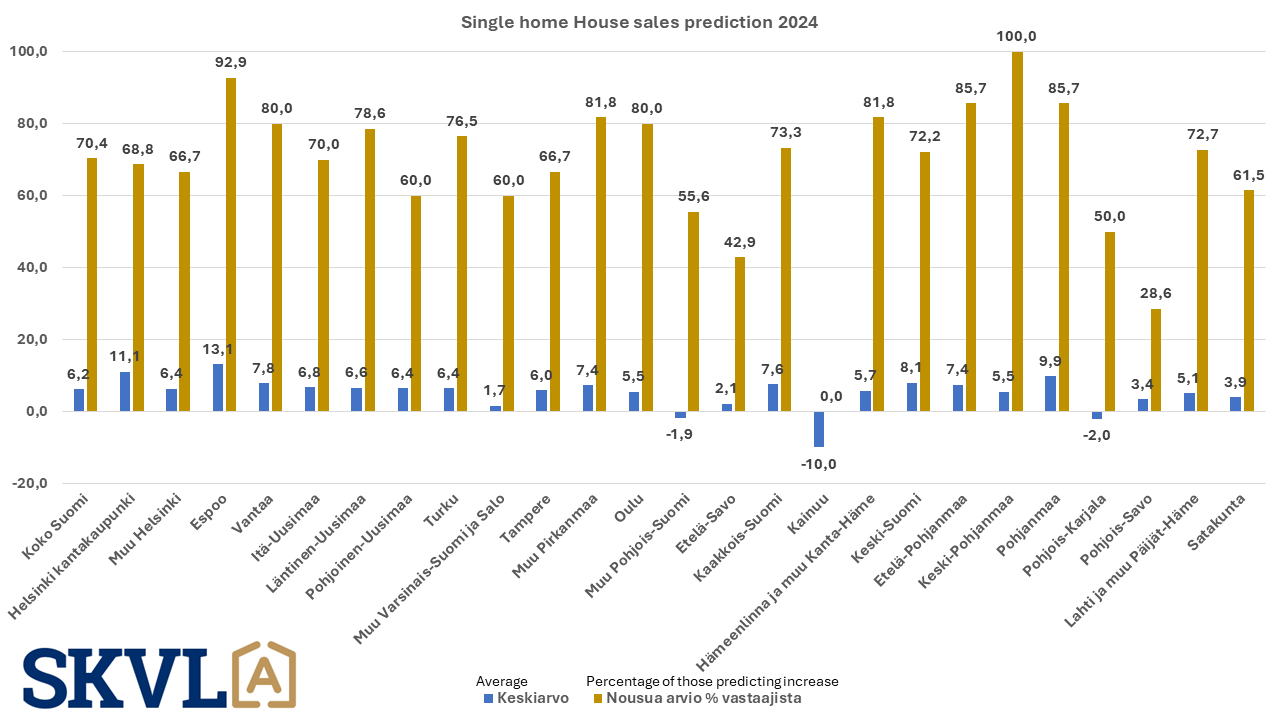

The year for the housing market starts with a capital drive. The demand for small apartments, which has been quiet for a long time, is now on the rise. The peak in demand at the end of last year is now likely to remain at the new normal level and bring the expected balance to the market. The demand for newer and well-maintained single-family houses continues to be the strongest of all housing types. Especially Helsinki, Espoo, Vantaa and Tampere have now woken up and the outlook in these areas is strong.

The forecast made by SKVL’s member professionals estimates that compared to the strong fourth quarter at the end of 2023, the beginning of 2024 will continue to be a period of growth. A clear rise in house prices is not yet expected, but neither is it expected. “The market backlog that has lasted for more than a year is now starting to clear at a reasonable pace,” comments Jussi Mannerberg, CEO of SKVL. “Our forecast now shows a continuous increase in demand for family homes,” he continues.

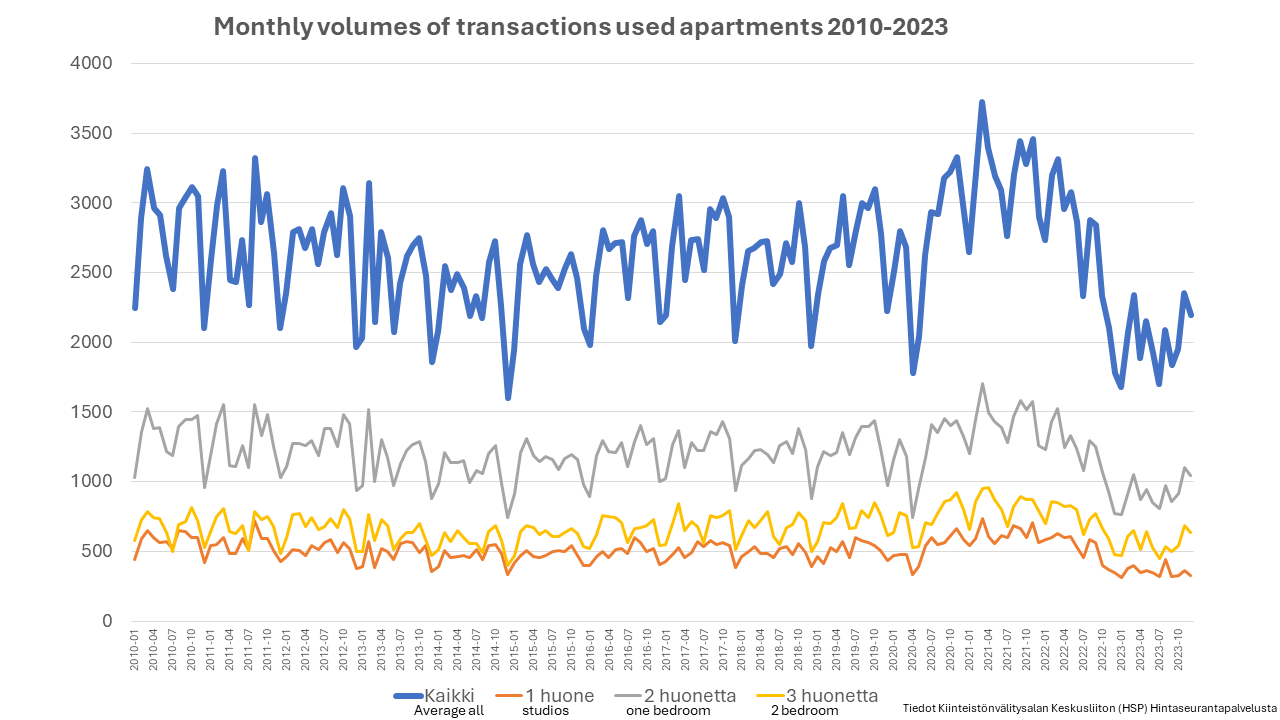

The year 2023 sank along with new production, but sales of old apartments remained reasonable

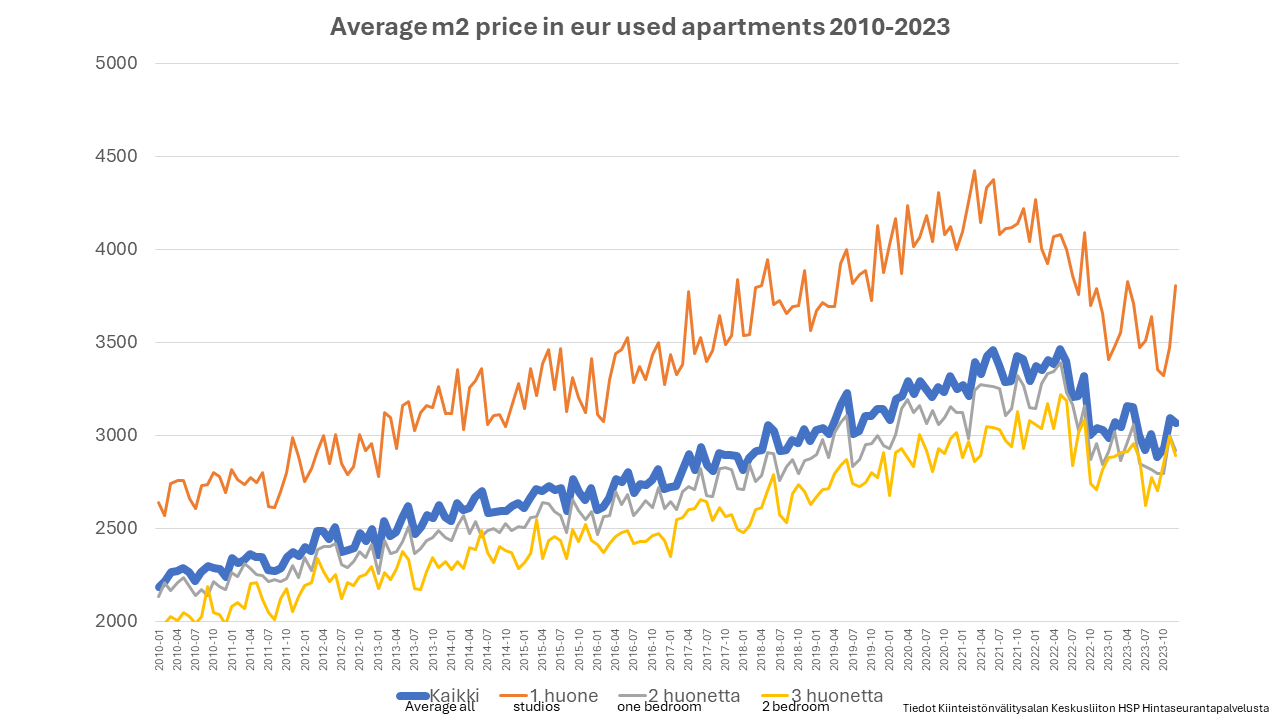

In light of the actual figures for 2023, it can be seen that the biggest changes in the sale of old dwellings took place in the sale of small dwellings. However, on average, sales of family homes were much better than many might imagine. During the last quarter of 2023, sales of small dwellings also increased as first-time homebuyers flocked to attractive price levels. For example, in the Helsinki metropolitan area, their trade volumes jumped significantly. Normalization was also seen in sales of family dwellings. In terms of price level, family dwellings held their own surprisingly well in growth centers. The low figures for new home sales were perhaps the main reason why sales of old homes slowed down so much – especially the exit of investors from new property sales created an oversupply. Now we have seen investors move on to buying old homes.

Falling interest rates the most significant factor in market recovery

The impact of the fall in Euribor rates is the biggest contributor to the acceleration of the housing market. “We certainly expect action from the ECB. Finns are resilient, but now we need help from Europe in the form of lower interest rates. Inflation figures in Finland have fallen rapidly and the ECB has put the brakes on the ECB due to the still somewhat higher inflation readings in larger countries,” says Mannerberg. “There is a small risk that inflation in Europe will temporarily start to rise slightly again if global crises, such as challenges in international shipping near the Middle East, increase costs,” he continues.

Share of first-time homebuyers drops to normal level – investors have woken up

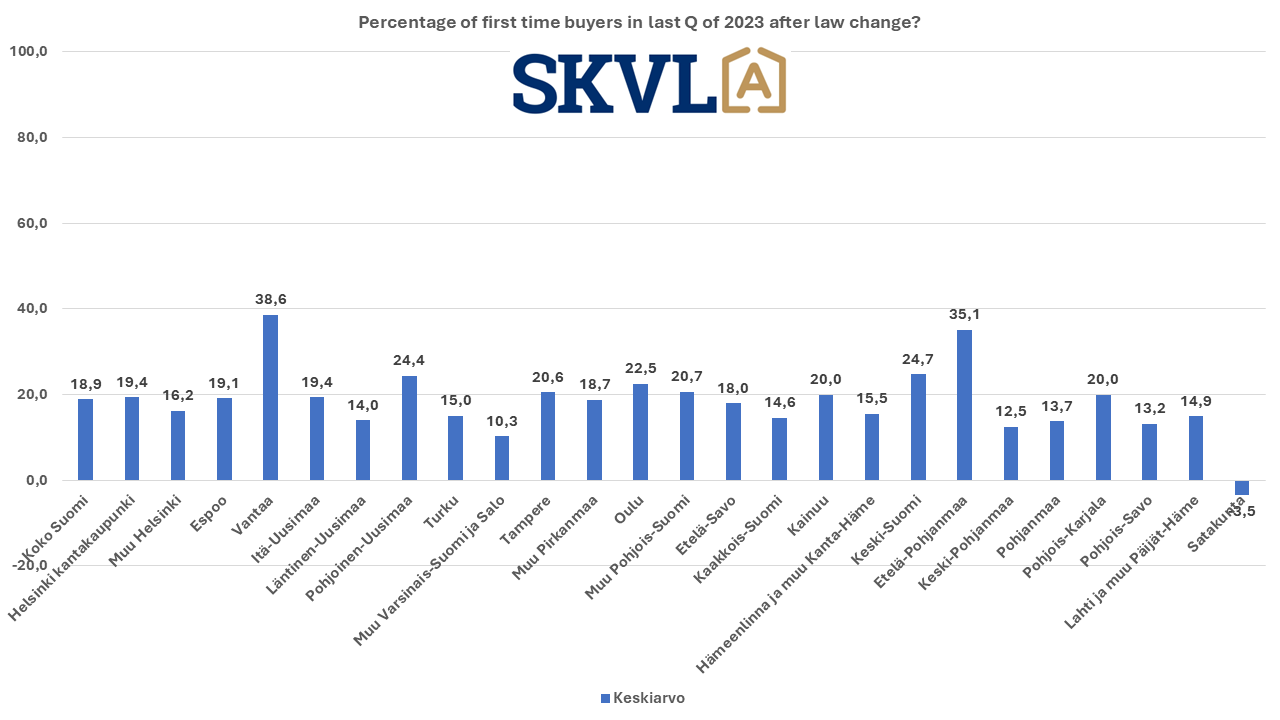

The share of first-time homebuyers rose to around 20 per cent in the change drive for the end of the transfer tax exemption at the end of last year.

We now expect the share of first-time homebuyers to fall to about 10% of transaction volumes. The number of investor buyers has now clearly recovered and represents approximately 10% of buyers. About 60% of the buyers are households and about 30% are buyers of their own home alone.

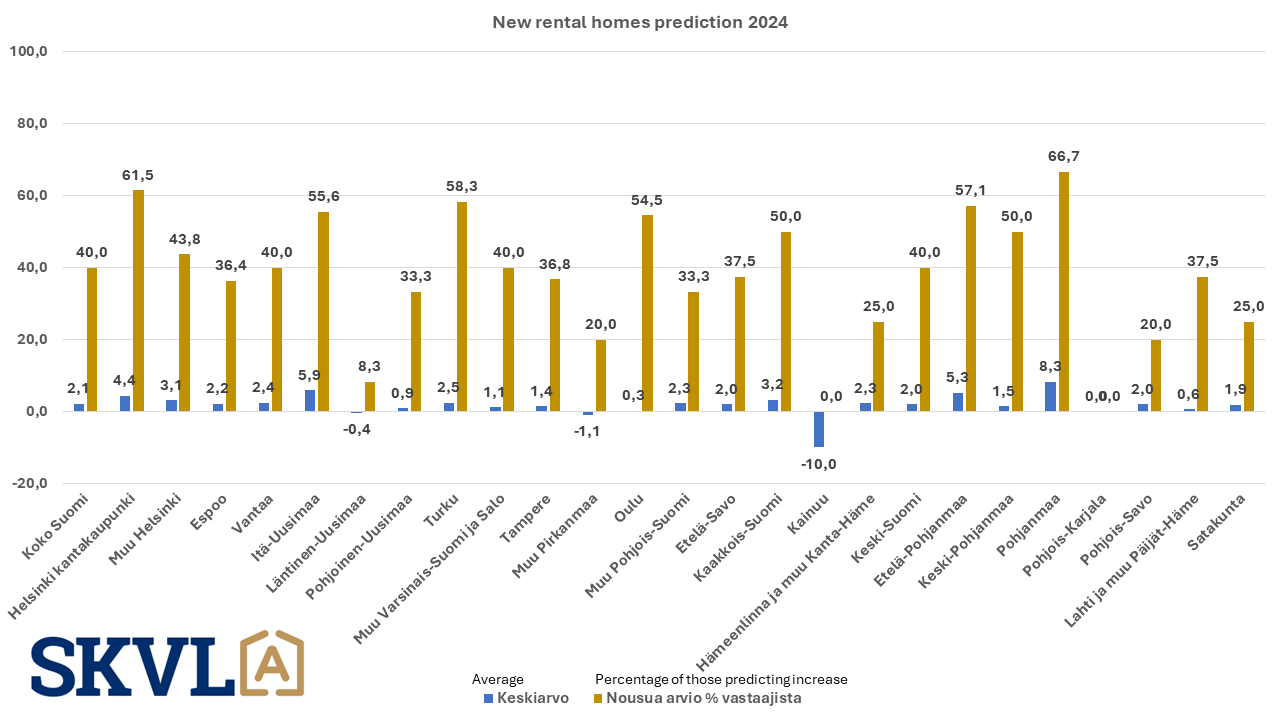

The rental housing market continues to grow slightly. The appeal of larger rental apartments is still greater. Rent levels are not expected to change in the free market.

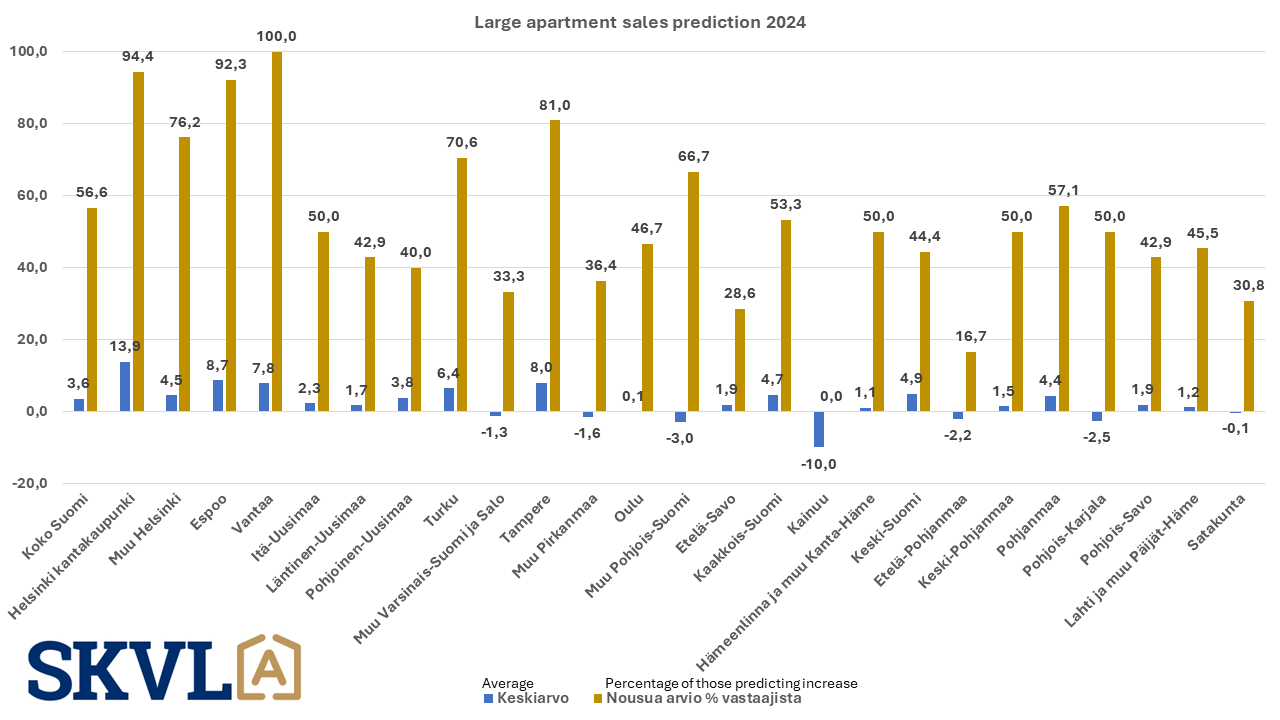

Full-year forecast moderate: 5–10 per cent growth in trade volumes

The full-year forecast, which is the most challenging, estimates that the number of housing sales will grow by about 5–10 per cent for single-family homes, semi-detached houses and terraced houses. No significant price increases are expected at the moment, but prices are likely to rise by 1–3 per cent in 2024 for newer single-family houses that are most in demand. Sales of old apartments in blocks of flats are also expected to grow moderately and prices to grow by a small 1–3 per cent, mainly in the Helsinki city center and Espoo. These changes are likely to take place in relation to the actual price level and should not be confused with the clearly higher prices of a couple of years ago.

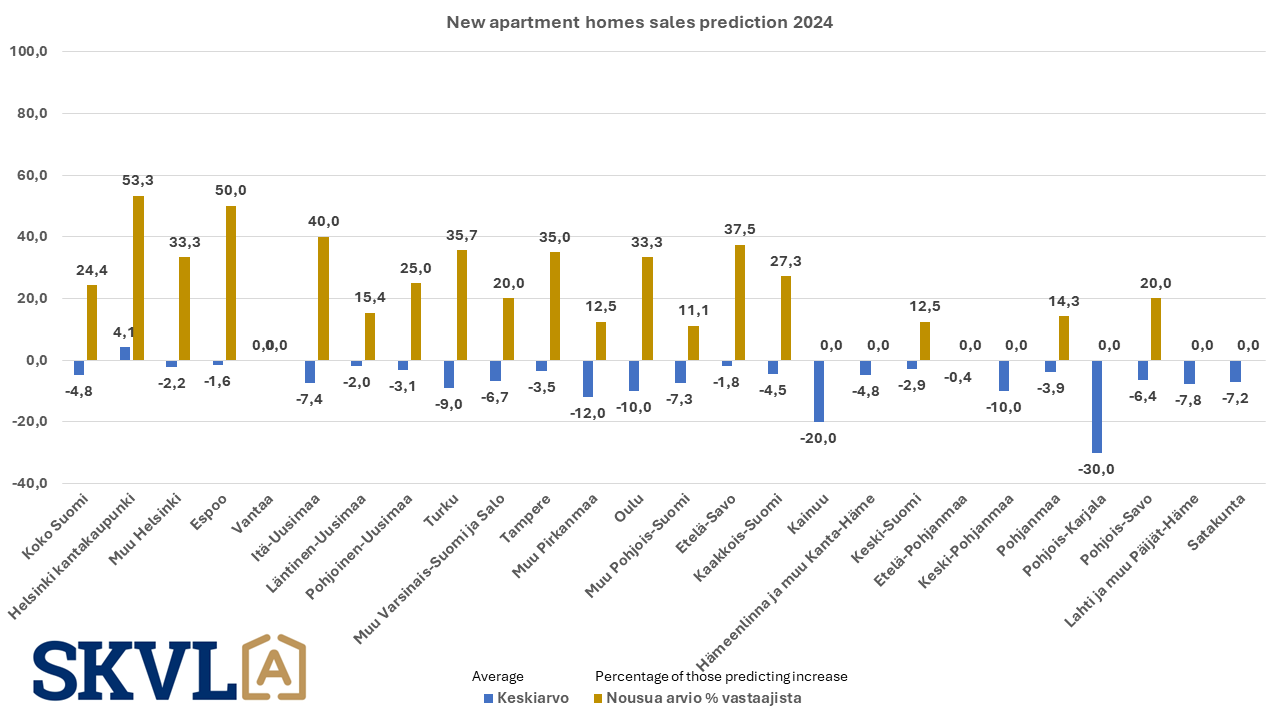

No significant change in sales of new apartments in blocks of flats, but transactions are being made

There are still no high expectations of growth in sales of new apartments in blocks of flats. The year 2024 will be a search for a fresh start, and new construction project starts are likely to be seen closer to 2025. Trade volume is forecast to fall further by a few percentage points.

Regional comments SKVL housing market forecast 1/2024

The last quarter of last year was lively for the market as demand and trade volumes grew. However, the beginning of 2024 has been calm, which is typical for January. Sales are expected to grow significantly during 2024. It is assumed that trade volumes will increase significantly by spring or summer 2024 at the latest, especially if Euribor rates continue to decline.

The market has improved, and trade has picked up. Sellers’ willingness to sell has increased, and foreign customers are an ever-growing customer group. Buyers prefer to look for larger apartments because there is a good supply. Some sellers have high price expectations, which can slow down trade.

Steady demand for good family apartments and affordable 1-2 room apartments, but some sellers keep their price expectations too high. In the Töölö area, trade is quieter, and there are still differences of opinion with buyers on asking prices.

In conclusion, the market situation has improved especially in the inner city of Helsinki, but regional differences and price expectations continue to affect trade.

Rest of Helsinki

Oversupply of new apartments, especially studios and two-room apartments. There is demand for terraced, semi-detached and detached houses in good condition that do not have electric heating. The market is picking up.

Sellers have too high expectations of the price level of their own apartment in the current market.

Many first-time homebuyers did not buy a home in 2023 and are now calmly continuing their search for an apartment. Sellers have a desire to sell, but buyers are extremely precise and selective about the apartment being purchased.

The broker is struggling to sort things out, most often to no avail. Buyers’ offers are still underwhelming. In the areas of Kallio and Munkkiniemi, demand is rising and buyer contacts have increased.

New, especially newer single-level private houses are in demand.

Espoo

Difficult to predict, but it would seem that on the used housing trade, demand will increase in all categories. New apartments are not yet growing in Espoo and Helsinki in the first quarter.

There is demand for reasonably priced family apartments (max. € 400,000), large loans are hardly taken. Foreigners are a good group of buyers (educated people with jobs). There are buyers, but interest rates on loans and housing costs now determine what is bought, even those in slightly worse condition will go if the price is reasonable. A small surface renovation will make it habitable. The shopping atmosphere has refreshed considerably, there is a lot of moving pressure and demand for family apartments in good condition.

Vantaa

Vantaa has too much supply of new apartments in blocks of flats. There is demand in terraced houses and detached houses.

Items are coming up for sale steadily. There are few buyers, but they are serious about moving and they are getting sales.

Eastern Uusimaa

In Porvoo, the supply of new properties is low, but sufficient in relation to demand – i.e. a balanced situation for the time being before demand picks up. As sellers, a fairly balanced distribution from one-person households to investors, meaning that no group is highlighted. The demand for modern detached houses and apartments in good condition suitable for family use is clearly brisk in relation to the low supply. There would be demand for new, single-level single-family houses and family apartments. The market situation in the downtown area is relatively good. Low demand in the Kevätkumpu area. On the holiday home side, supply is expected to increase as we head towards summer 2024. Supply has been below average between 2022 and 2023, but demand has remained fairly strong.

For the past year, the market situation in Loviisa has been surprisingly good in relation to the public picture of the general market situation. Regional changes have hardly been visible, with certain regions performing as well or badly as before. The situation in Loviisa compared to Porvoo, for example, has been very different, because the price level has been even low for a very long time. Rather, due to the coronavirus, demand has increased and, in part, the price level has even risen from the old, remote work is here to stay and the threshold for moving permanently has therefore lowered considerably.

Western Uusimaa

In the Vihti area, the turn of the year has been quiet in all respects. The start of the fourth quarter was busier last year, but slowed down towards the end of the year. Trade in the area is quite nice. There are a lot of items for sale and there are plenty of interested buyers.

The market situation in Tammisaaari is waiting. Buyers expect interest rate cuts and sellers hold off sales in anticipation of better times. The clearly positive spirit has been since the beginning of November and will continue. Bought if a suitable one is found.

Kirkkonummi has good demand for terraced, semi-detached, detached and detached houses from the 2000s.

Northern and Central Uusimaa

In the Tuusula and Kerava areas, single-family houses are constantly pulling, no matter what the situation. Family apartments in the price range of €350–400,000 can be sold for terraced, couple or detached houses. Those on rented plots move more slowly. Buyers nowadays pay more attention to whether the apartment is on their own or rented plot. The form of heating is also important, energy-efficient ones sell better. Plot sales of detached houses quiet.

In Hyvinkää and North Tuusula, trade has clearly picked up, but offers are still being considered long and hard. Renovated apartments are still popular, there is not much demand for those to be renovated. November and December 2023 were the first so-called “Cold Wars”. normal months of sales since August 2022.

In the Nurmijärvi area, the demand for terraced houses and detached houses (in 2000-) is reasonable, financing is successful, and for parents in need of renovation (in 1980) access to financing is more difficult or impossible. In newer apartments in blocks of flats, prices do not meet buyers’ desires, and in older ones (1970s) demand is quiet. There is a shortage of the most demanded apartments.

In the Nurmijärvi area, the rest of the year went reasonably well. More sales would have been made if there had been more supply (approx. €300,000) of single-family houses. There were many first-time homebuyers on the move and continue to search, even though they now have to pay transfer tax.

Mäntsälä is quieter for all other apartment/plot types, except for detached houses from the 2000s. In single-family houses in the 2000s, prices have come down clearly, the most expensive ones remain unsold at the moment.

Central Uusimaa

In December, the number of transactions has varied by locality, and the demand for single-family houses has picked up. Studio apartments stand still, no demand for buying or renting a part of studio apartments. Three-room apartments in blocks of flats have been sold, first-time homebuyers or those with families in a divorce situation are buying alone, because children must have their own room. Older buyers have also been on the move, considering an apartment in an apartment building instead of a detached house in their current form of housing. Young families with children with high incomes continue to buy fairly new single-family houses and detached houses, or they need to be completely renovated. There is also interest in apartments to be renovated in blocks of flats and terraced houses, where prices have fallen a lot if, for example, there is a lot of interest in the future. plumbing renovation and apartments in original condition.

In Järvenpää , demand for fairly new family apartments is higher, demand for old ones is quieter.

Turku

The housing market in Turku has normalised, except that there is no interest in new-build apartments in blocks of flats due to too high a price level and too small apartments.

New apartments are coming up for sale and there are quite a lot of valuation visits. People have been encouraged to think about sales. Trade was really good towards the end of the year.

Turku city centre always sells if the apartment is in good condition. There is demand for large apartment buildings in the city centre that are in good condition. On the outskirts of the city centre, the sales period is longer and good single-family houses are of interest in the surrounding municipalities. Old single-family houses in poor condition are slower to sell. Apartments in blocks of flats in the city centre sell, terraced houses near the city centre, as well as detached houses near the city centre and/or in adjacent towns with good transport connections.

Rest of Southwest Finland and Salo

Sales in Turku and nearby cities are small. The quiet period of winter is reflected in a normal way, on the other hand, the plug on buyers’ decision-making is slowly unraveling. The increased number of mortgage negotiations with local banks also predicts a better time for this year.

In Salo, demand has recovered slightly, but supply is low.

Naantali is alive and well. The demand extends to all kinds of objects. Making a purchase decision is the sum of several factors that takes more time than we were used to during the pandemic. In Naantali, trade takes place when catch prices are at the right level.

The market situation is twofold: there is great interest in new and fairly new apartments and houses, less interest in older ones, and prices of old single-family houses (1950–1985) have fallen significantly. The demand for single-family house plots is minimal. The demand for holiday homes is at a normal level. Investors are still buying, but remarkably little compared to the 0% interest rate period.

In Kaarina, housing sales are at the 2017 price level.

In Paimio, housing sales take place when the price is at the right level. There is a shortage of single-level terraced houses in every locality (3 h+k).

Tampere

We need more good new apartments for sale. Renovation is of no interest to buyers in urban destinations.

As growth centres, the Tampere environment and the Tampere Region have kept their prices fairly well and, in principle, also fairly well in single-family houses despite the local recession. The significant increase in construction costs has also kept prices in normal properties at the same level as in recent years. Investors are not yet on the move in large numbers, but they are waking up. New construction has dropped by more than 70% at the end of last year, so we can expect a major shortage of new housing in 2–3 years, when only a very small number of apartments will be completed. As a result, the demand for old apartments will rise.

Demand has improved slightly, especially in family apartments and newer detached houses. The situation looks a little better than last autumn. There is oversupply due to the recent construction boom. Particularly challenging areas are Peltolammi and Multisilta.

In the Tampere, Nokia, Ylöjärvi, Pirkkala and Kangasala areas, large terraced houses from a good housing company move well. Location matters above all. Fairly new detached houses on their own plot and geothermal heating or similar are also in high demand.

Families and couples move, that is, a clear purchase decision has been made, something is acquired. Sellers should wake up now, because there is demand. Trade volumes have clearly increased.

Rest of Pirkanmaa

In Ylöjärvi, the 80s houses are overrepresented and, for example, the apartments of the estates are in rather poor condition. Even a low price does not increase the desire to buy. Sellers gradually wake up, a lot of pricings are made, cottage sellers think about selling an old cottage.

In Sastamala, trade seems to be weaker at the beginning of the year, but perhaps it will improve towards spring.

In Nokia, the demand for terraced houses is still high and new terraced houses are very attractive.

Oulu

Demand for three-room apartments in good condition and larger terraced houses and semi-detached houses, as well as single-family houses completed after the 2000s.

In the Oulu region, first-time homebuyers became more active due to the tax reduction, but thanks to other buyers, transaction volumes were high. There are still many new and newer small apartments available in and around the city center. Otherwise, the good situation has been all along; People have put apartments up for sale nicely and there have been plenty of buyers. News that interest rates will soon begin to decline and energy prices will return to normal levels will certainly have a positive impact on trading in early spring. Good demand is in the area of zip code 90830.

Rest of Northern Finland

In the Rovaniemi market area, there are high expectations that the market will pick up from February onwards. People are thinking about changing apartments when the future outlook has already brightened. In terms of new apartments, the market is seeing a recovery in demand. The challenge is that only a few housing companies are likely to be completed in the area in 2024, which may affect the market, especially during the summer, so that the sale runs out. In terms of new construction, prices will rise because costs have not changed, but increased. Prices in second-hand ones did not rise or fall much. There is a shortage of good apartments for sale in Rovaniemi.

In the Kuusamo/Ruka area, the end of the year brought faith in the future. Demand has increased in the Kuusamo city centre area. New, small apartments are in demand. In addition, there is high demand for newer family apartments. People are still looking for detached houses by the lake, although they are prepared to be flexible about quality requirements. The price of money puts you on the pruning of dreams. In Ruka, demand increased towards the end of the year and a positive spring season is expected.

In the Sea Lapland region, the end of the year (October-December) was very good due to the tax change, and the last deals were made in a hurry in the intervening days. Peaceful detached houses near the city are of interest. Large rental terraced houses are being taken out of hand.

South Savonia

The market is still bearish and trading is not happening. A change in interest rates or a reduction in transfer tax will have little effect because the total transaction prices are so low. The biggest bottleneck is financing decisions, i.e. not getting money. Especially non-shore sites outside the town plan area do not receive the right financing offers.

There is more demand than supply for apartments downstairs and in the elevator building in the city centre. Demand for inexpensive private houses, as well as expensive single-family houses, and steady interest in leisure real estate.

Southeast Finland

The market in Lappeenranta is challenging, and sales of new apartments have almost stopped.

In Kouvola, there are still quite prudent buyers on the move. The actual prices and price development are largely based on renovations carried out and planned in the housing company. Renovations carried out at sites affect the demand for the site. The prices of renovations have often gotten out of hand; In addition to a mortgage, many people do not have the opportunity to take out a renovation loan in addition.

In Kotka, Kotkansaari is sought after because the developing Kantasatama and XAMK Kotka campus, which will be completed this year, will bring students to Kotkansaari. Tidy, correctly priced apartments sell well.

In the Imatra region, the Ruokolahti market has picked up slightly towards the end of the year, and customers are once again making purchasing decisions regardless of the global situation.

Hämeenlinna and the rest of Kanta-Häme

Hämeenlinna and its surroundings are looking forward to the atmosphere, there is a lot of thought about whether to put them up for sale.

In Riihimäki in Kanta-Häme, trade was really good in the last quarter of the year. There were a lot of first-time homebuyers and that cheered me up. The best sales of the year were made in August-December. Since the beginning of the year, there have been more inquiries about single-family houses than at the end of the year.

In Hämeenlinna, the number of presentations is on the rise, but decision-making is still sluggish. The items for sale are mainly the same, only changing brokers from time to time. There will still be relatively few new items for sale.

There are too many bankruptcies and layoffs in the Forssa area, people do not dare to make decisions. The construction industry stands completely in the locality, in addition to which there is a municipality of migration loss.

The beginning of the year has got off to a very good start in the area Lammi-Tuulos-Hauho-Hämeenkoski and Padasjoki (holiday homes). A few deals already made and a few more agreed.

Central Finland

The apartments for sale in Keuruu are mainly old, the price level is moderate. There has been no new production of condominiums in the locality for almost ten years, and no new construction is in sight for the coming year either.

In Jyväskylä, new single-family house areas are of interest to buyers. The end of the year was busier due to the abolition of the tax exemption for first-time homebuyers. The beginning of the year has got off to a slow start, although a little more contacts from sellers and buyers are starting to wake up a little as interest rates fall, but there is still a poor supply. A slight glimmer of light at the end of the tunnel is visible. Hopefully, at last, things will get better there. The situation sounding, but hopeful in some ways. It is expected that there will be sites that have been hit by the crisis and that the target would be in a suitably demanded location. Copping at its best. In the city centre, rental apartments move well. Further away a little slower, but everyone who came to rent is rented.

In Jyväskylä, trade is picking up. Towards the end of the year, the activation of first-time homebuyers was emphasised. Sales of dwellings in blocks of flats picked up at the end of last year and now seem to continue in the early part of the year. Challenges arise from the fact that sellers are not used to prices falling from a couple of years ago, for example. However, the market is improving slightly here, but very moderately. In the early part of the year, there has been demand for family apartments, as the former home has been sold, and the next one should be found soon. There have also been people looking for an apartment alone. A slight boost for both home buyers and sellers.

South Ostrobothnia

In Kauhajoki, the market situation has remained almost at the same level as in 2022. In our region, there are no major ups and downs, house prices are moderate and there has been little need to go into forced sales.

Central Ostrobothnia

In Kokkola, city centre properties in apartment buildings continue to be in good demand and single-family houses near the city centre remain in good demand. New apartment buildings in the city centre stuck.

Ostrobothnia

The number of properties for sale in Vaasa is quite low. But there are small glimmers of hope that this will start to get better. Cautious optimism. Sellers do not want to understand that the price level of their apartment has also fallen to the current level.

North Karelia

There is a clear scarcity of sites in Joensuu and North Karelia in general. When exchanging an apartment, you do not dare to put your own for sale if you do not have any information about the next property. Nothing radical has happened in the price levels, good properties are selling at a good price level.

Northern Savonia

In the Siilinjärvi area, sellers have started to become more active and have also accepted realistic price requests in accordance with the market situation. Furthermore, banks’ lending criteria are strict and collateral values are lowered. In the 1960s and 1970s, it has become more difficult to arrange loans for single-family house projects. As a result of moving away from centres, demand for sites remains low. The market for projects built in the 2000s is recovering, and financing for them is also more likely to be arranged.

There seems to be a waiting situation in the market.

Lahti and the rest of Päijät-Häme

Buyers think for a really long time before making a purchase decision. There is a lot going on screens, but decision-making is still slow. The market in the Lahti area remains very challenging. The forecast is that the beginning of the year will go quietly. In the Lahti-Hollola area, there could be more buyers in traffic or trade, if there were more supply, especially from single-family houses, terraced houses and blocks of flats from the 1990s and later.

Challenging and excessive supply in apartment buildings, in newer detached houses there is demand, but no supply. Price level too high for market conditions. In the Lahti and Nastola areas, the situation is rather poor.

Satakunta

Pori and its surroundings: apartments in good condition are doing well, renovation sites are doing poorly.

Family apartments, such as semi-detached houses and detached houses, would be in high demand in the Länsi-Pori area.

At the turn of the year, first-time homebuyers were the primary buyers in the Kokemäenjoki river valley.

There is nothing on offer that can be bought, and there will be a lot of things for sale for which there are no buyers. In general, the number of properties for sale is starting to be low.