The results of the Finnish Real Estate Agents’ summer and early autumn housing market forecast have been published.

“I’d say it’s like Star Wars movie episode IV “A New Hope.” In housing sales, hope is raised and homebuyers, and especially sellers, are on the move, but there is still a long way to go before the situation returns to normal. The rollercoaster-like movement of demand and prices that has continued for four years is still levelling off,” comments Jussi Mannerberg, CEO of SKVL.

Consumers’ purchase intentions have risen clearly – sellers are also motivated

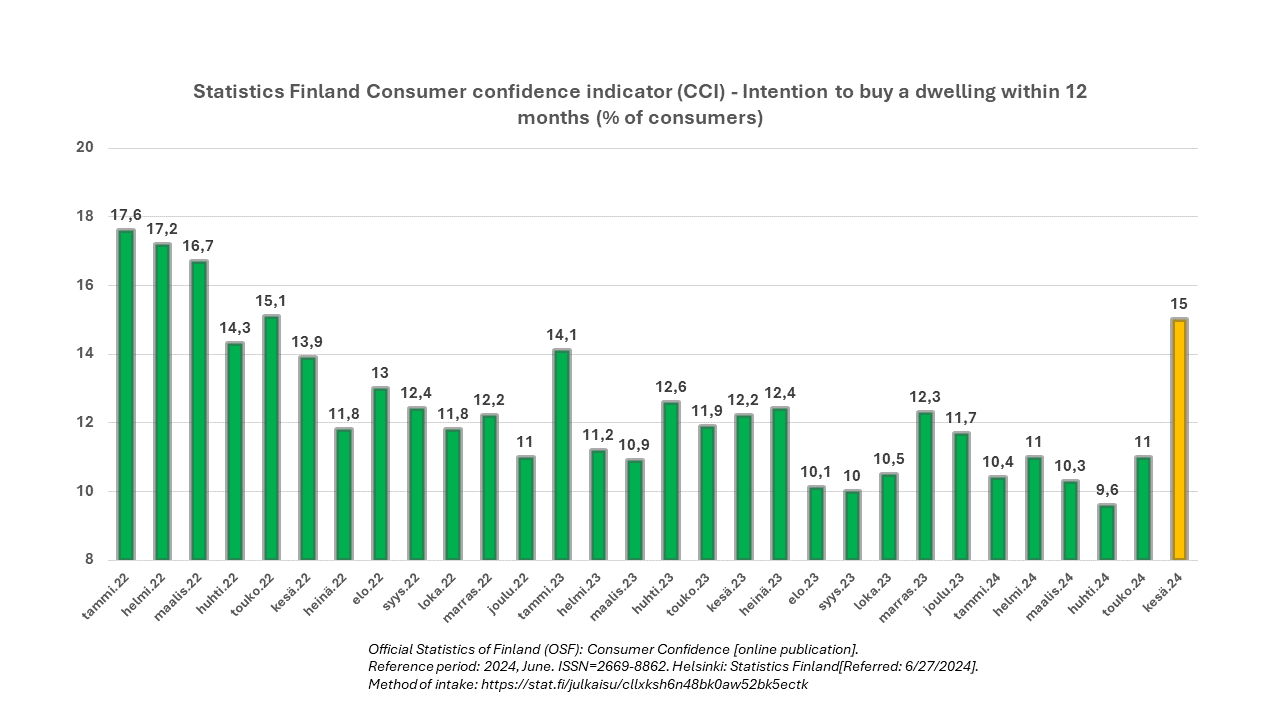

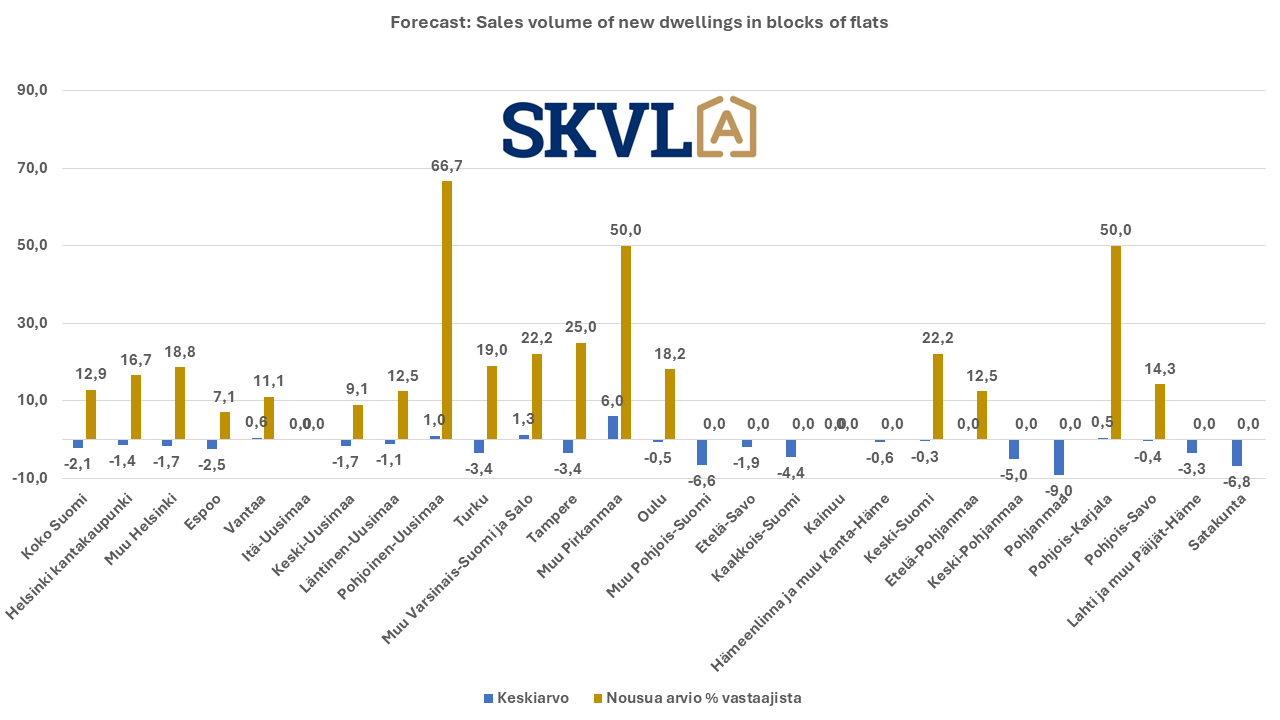

Statistics Finland’ s consumer confidence and intention to buy a dwelling within 12 months, published last week, have risen clearly already in May and June. “This is a clear sign that things are now starting to happen in housing sales. However, you should not believe in any tsunami, but in the fact that trade will start to be more stable, and prices will no longer fall,” SKVL’s Mannerberg continues.

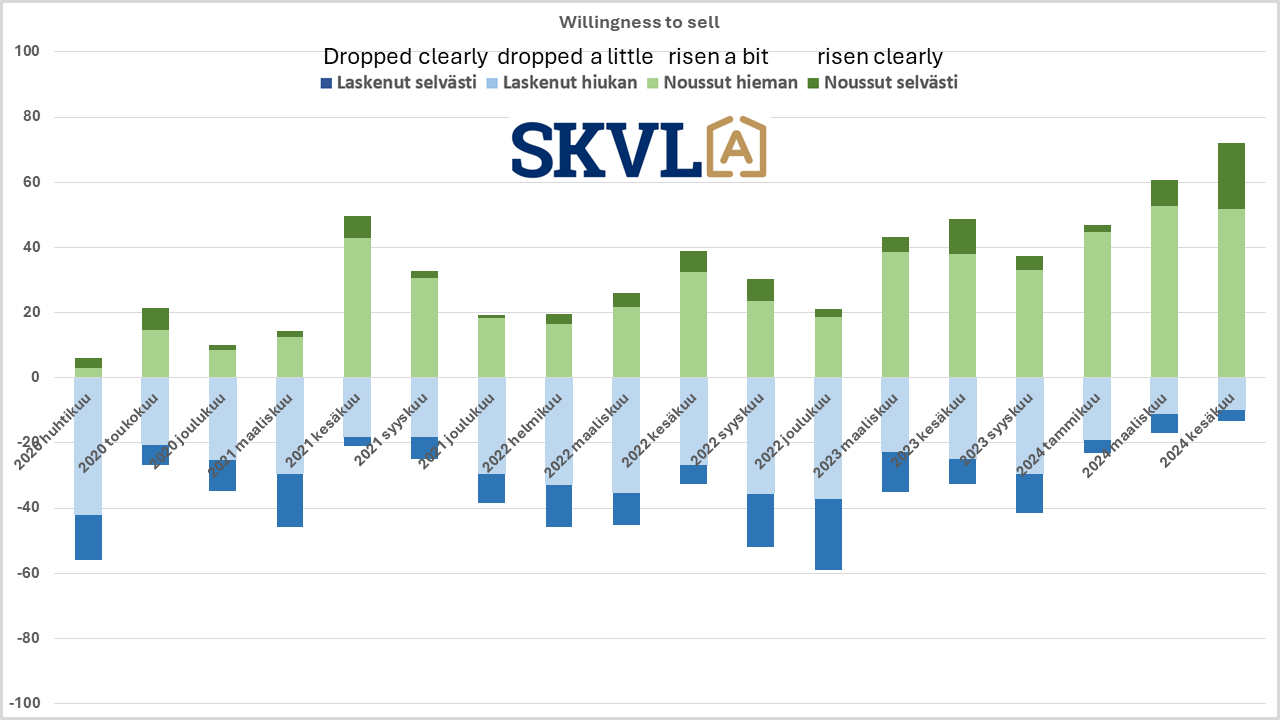

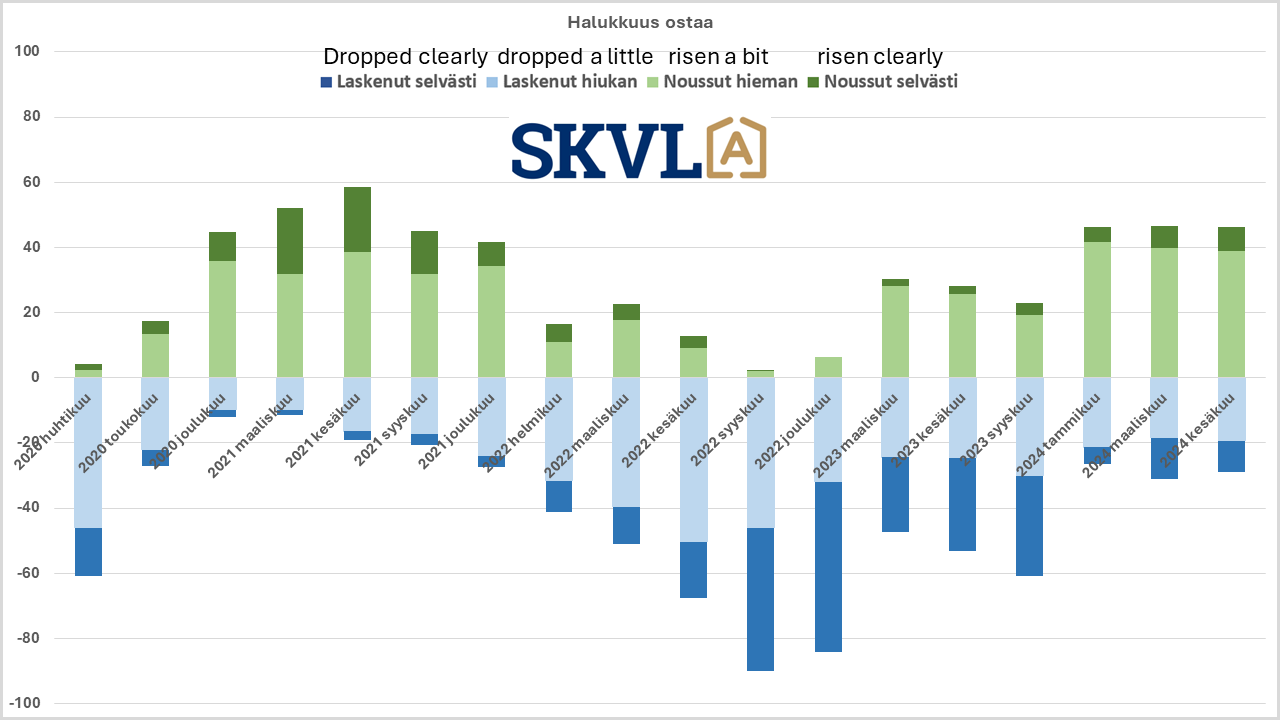

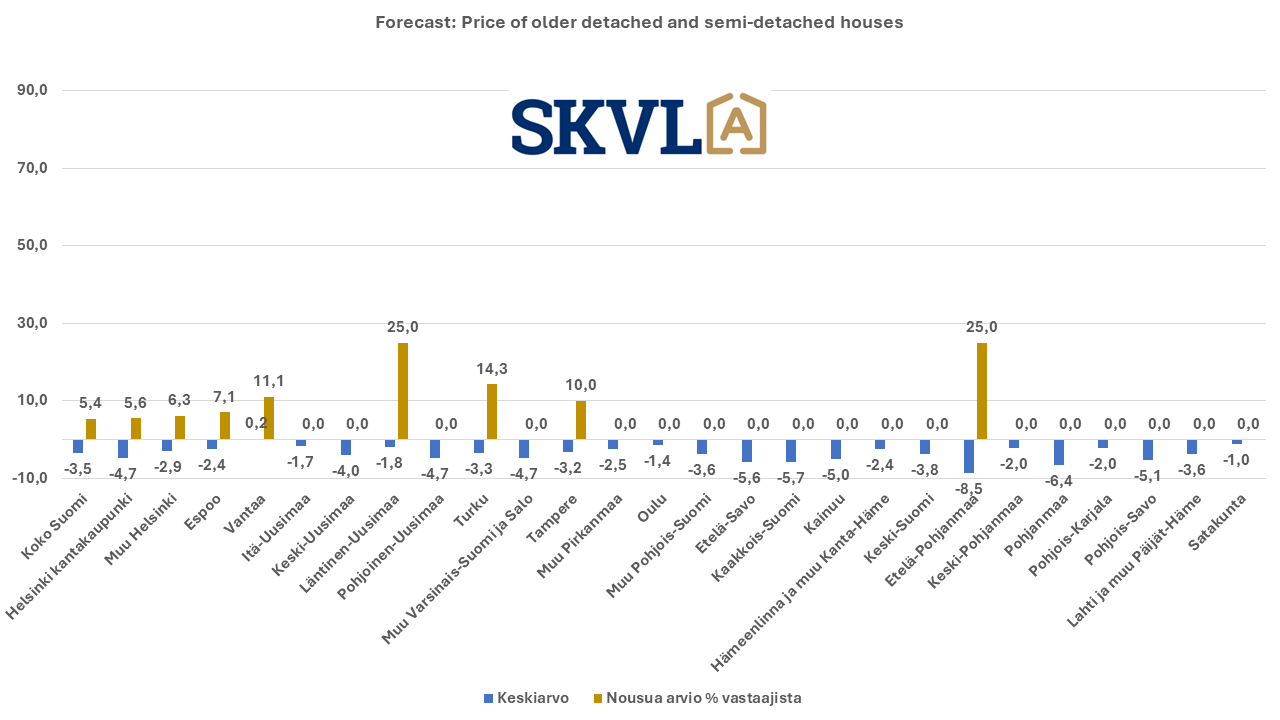

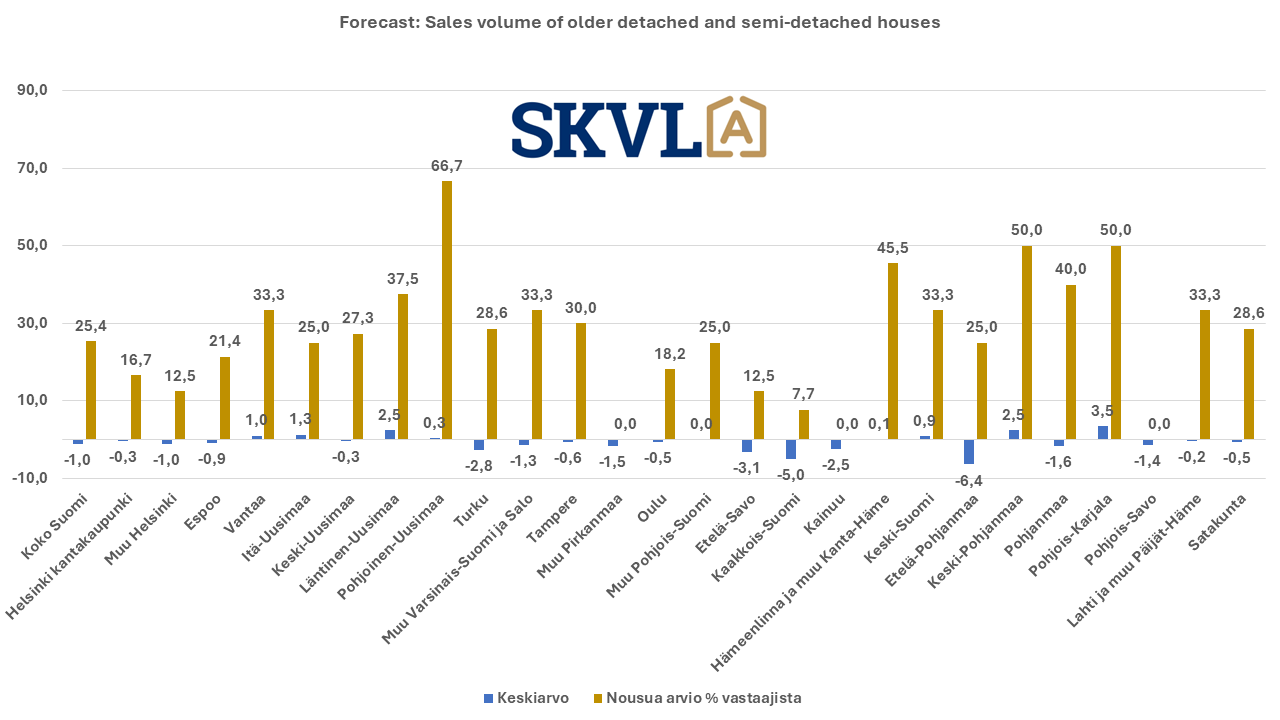

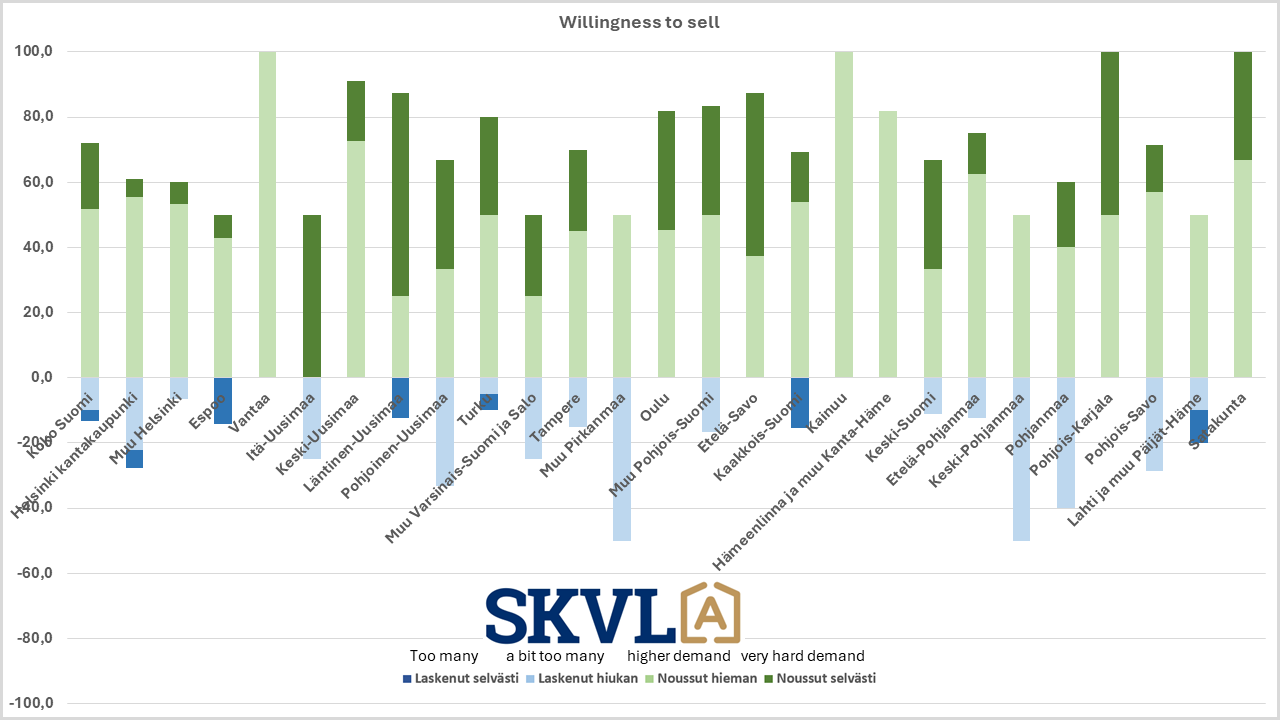

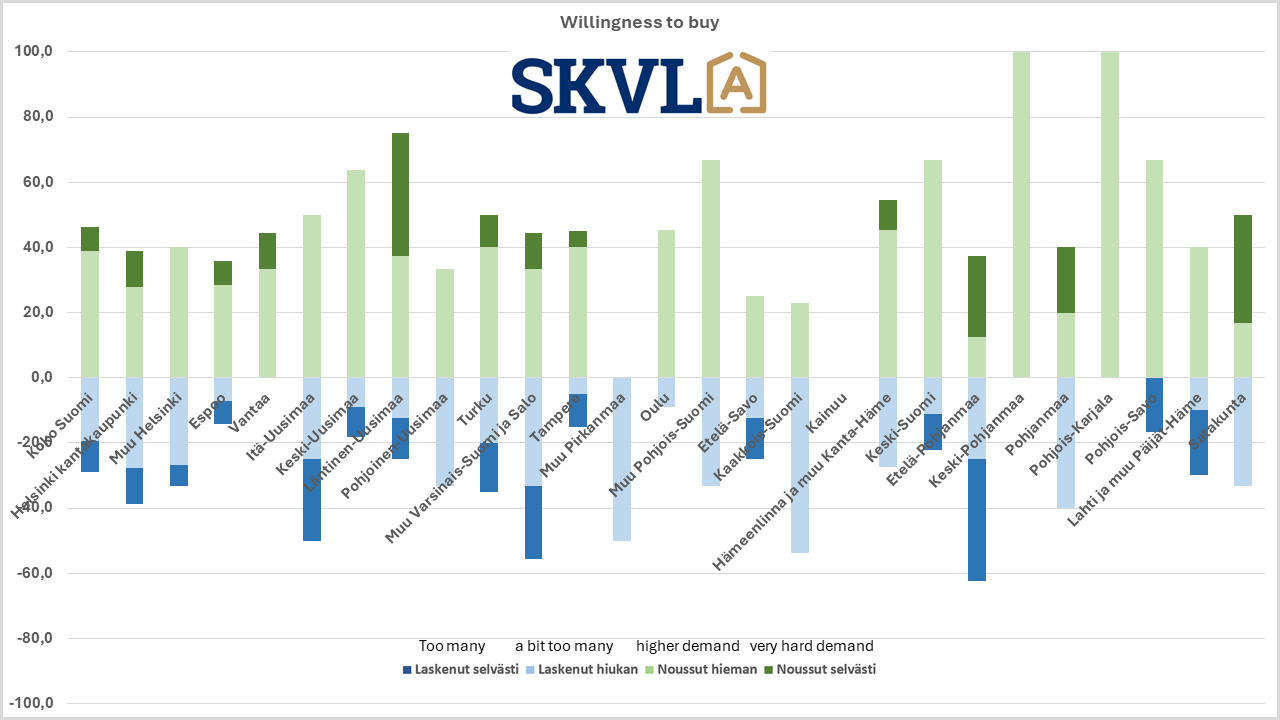

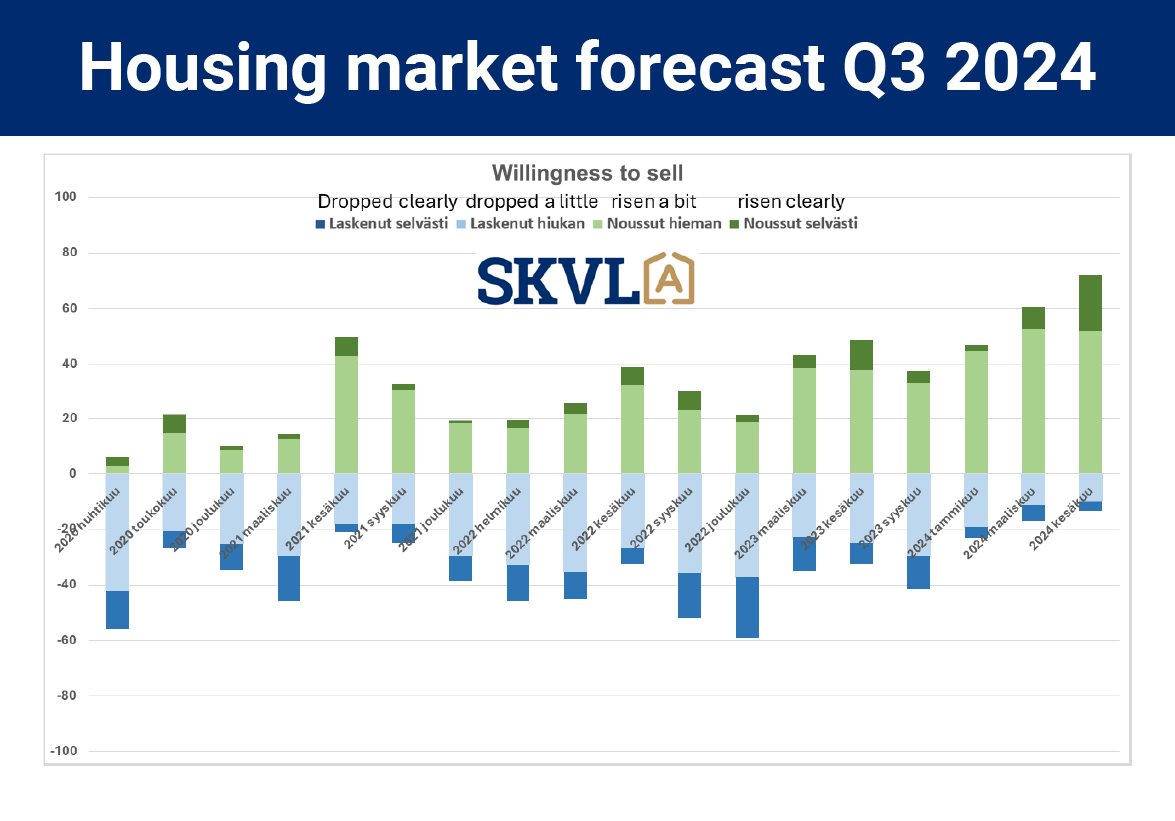

SKVL’s sellers’ willingness to sell indicator has risen strongly and the buyers’ willingness to buy indicator has remained at a good level but did not increase clearly from the previous quarter. This situation has led to a marked increase in supply. “Buyers have a lot of choice, which in part makes trading somewhat slower and options are weighed for a long time,” comments Mannerberg. It has been a quiet spring in some parts of Finland, but most brokers report some improvement in demand. With supply currently exceeding demand, no major upward or downward movements in prices are to be expected.

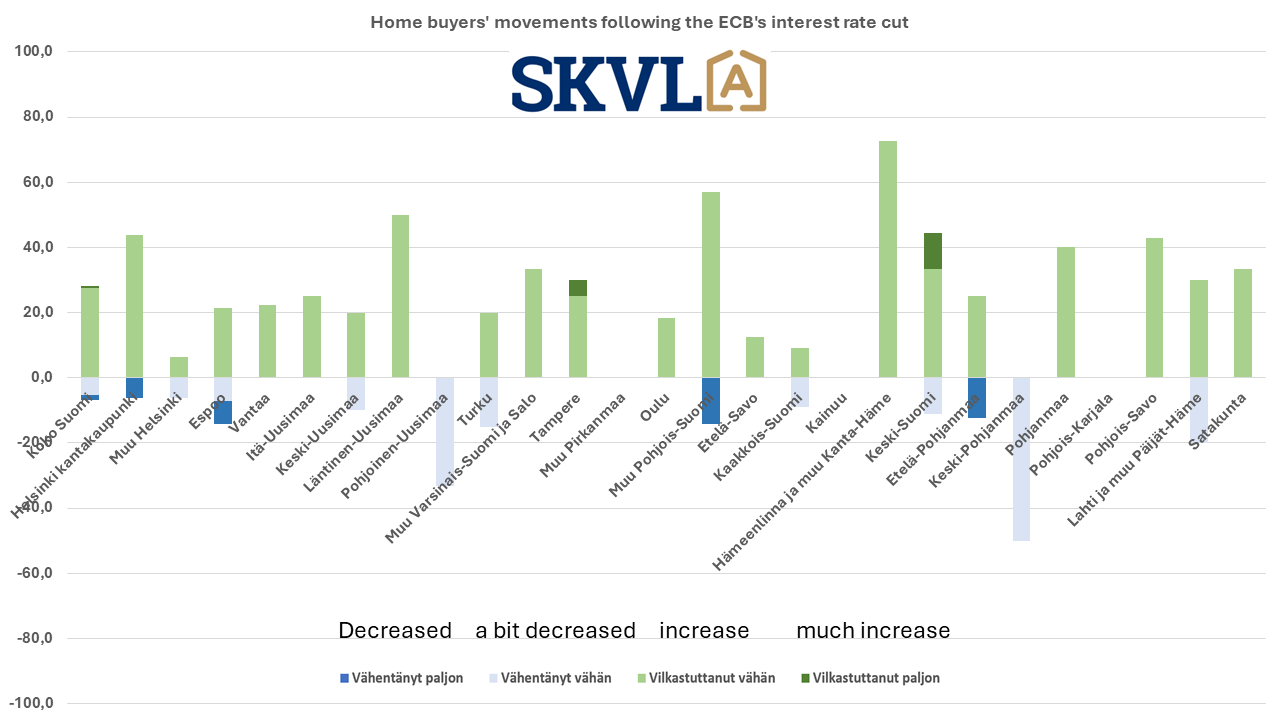

The impact of the interest rate cut has so far been mild

The much-anticipated ECB 0.25 % downward interest rate decision on June 6 had a very mild impact on buyer behavior. About 73 % of brokers did not notice any change or even saw a slight decrease in buyer movement. However, around 27 % of brokers noticed some increased interest. The Euribor 12-month interest rate has hardly moved since the interest rate decision, but the 3-month rate has quickly fallen to the same level as the 12-month rate.

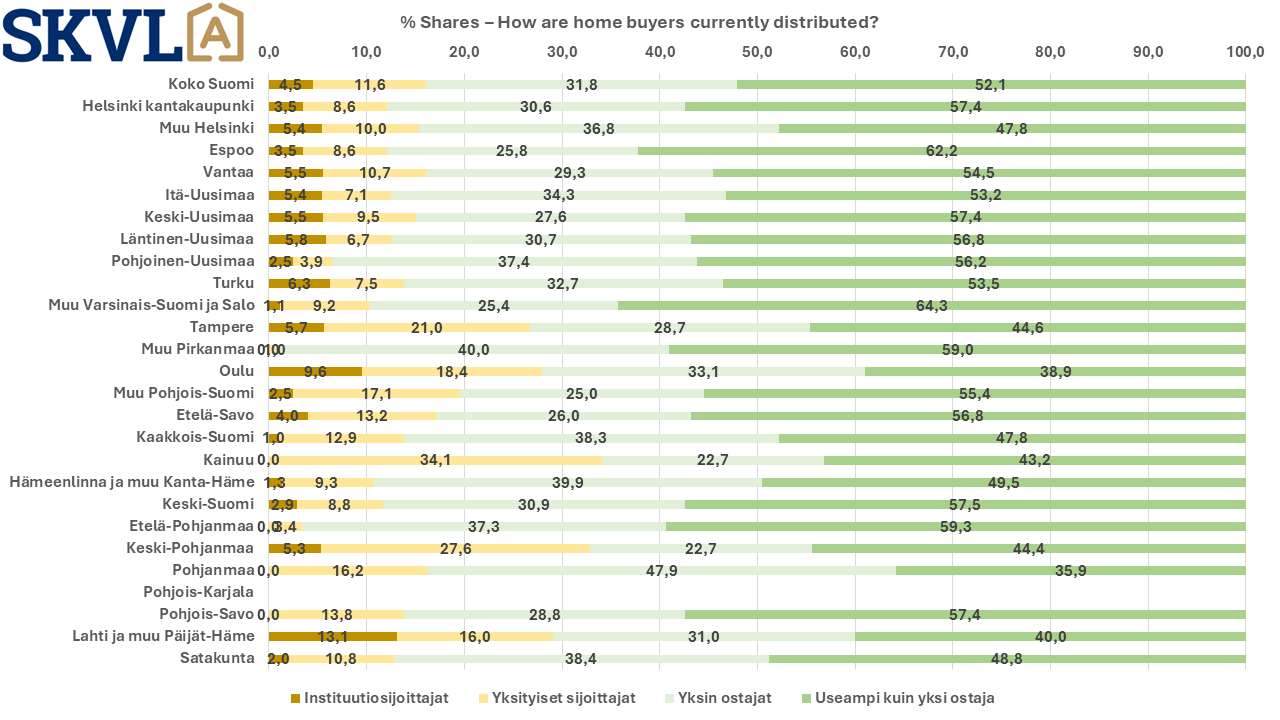

Increased number of investors

The number of investor buyers has also risen to about 16 % of buyers. About a third of investor buyers are institutional investors.

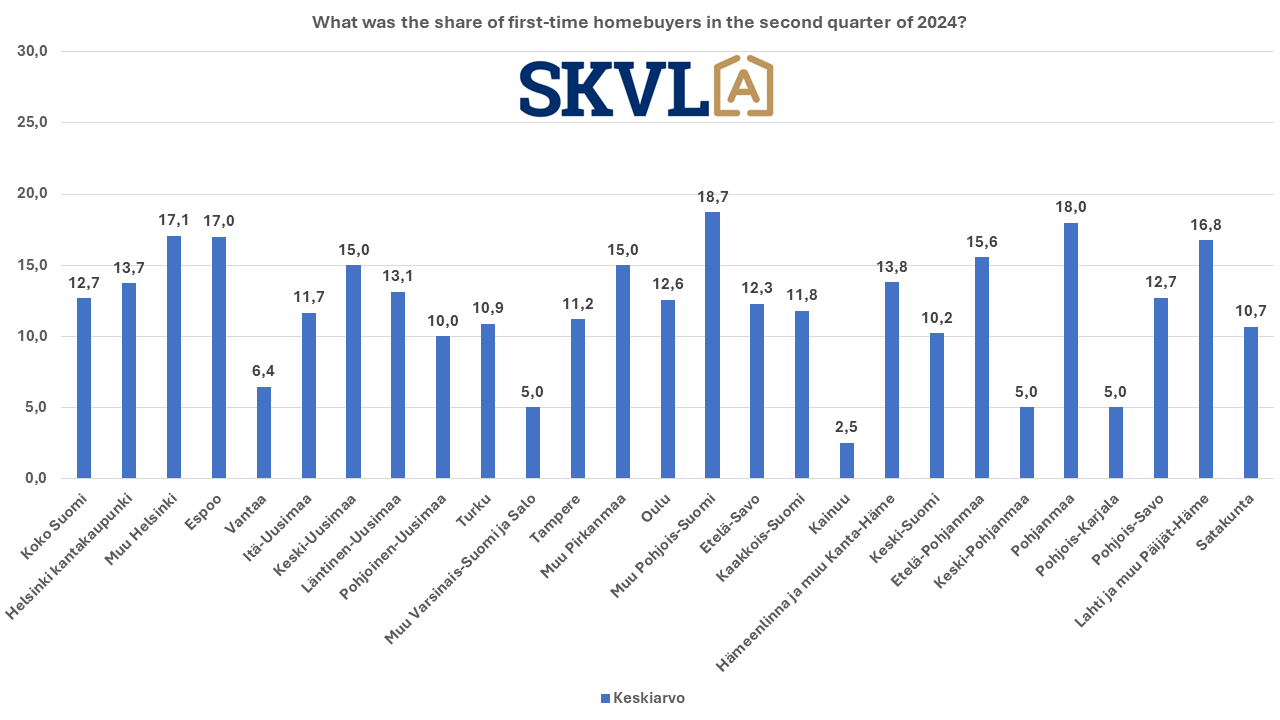

Currently, about 12 % of home buyers are buying their first home. About 37 % of those buying for themselves are one-person households and families account for about 63 % of buyers.

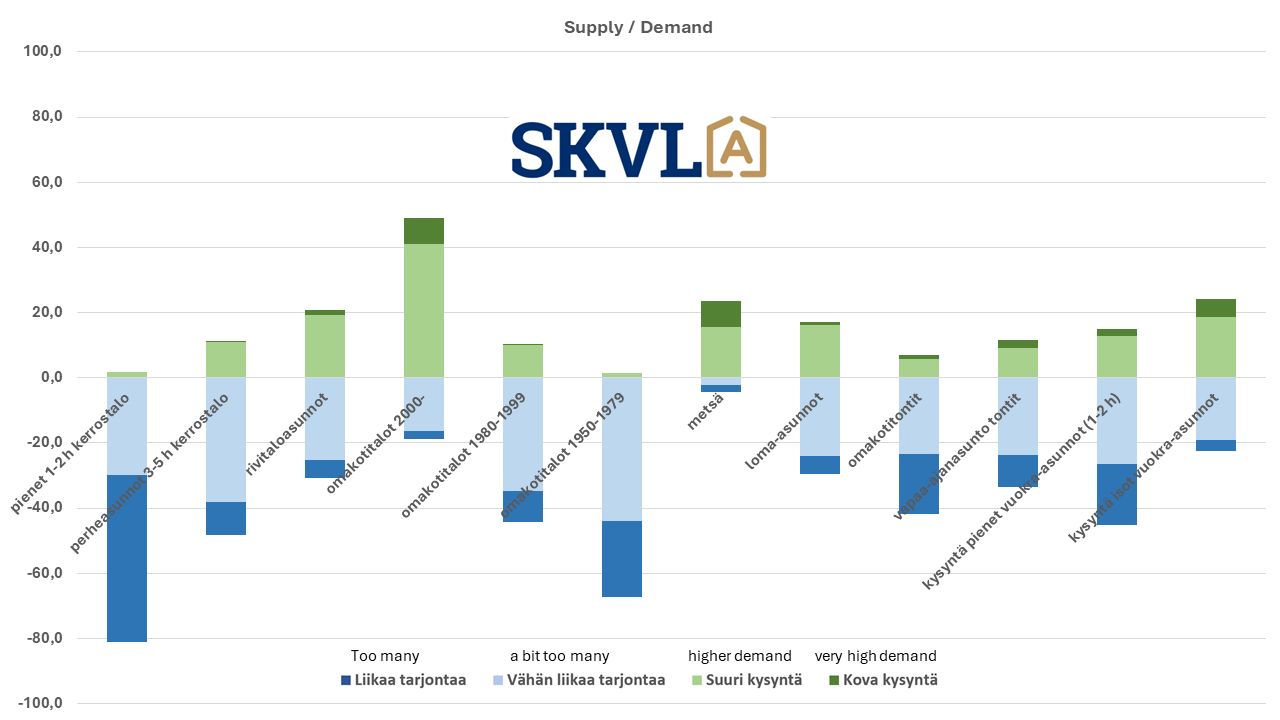

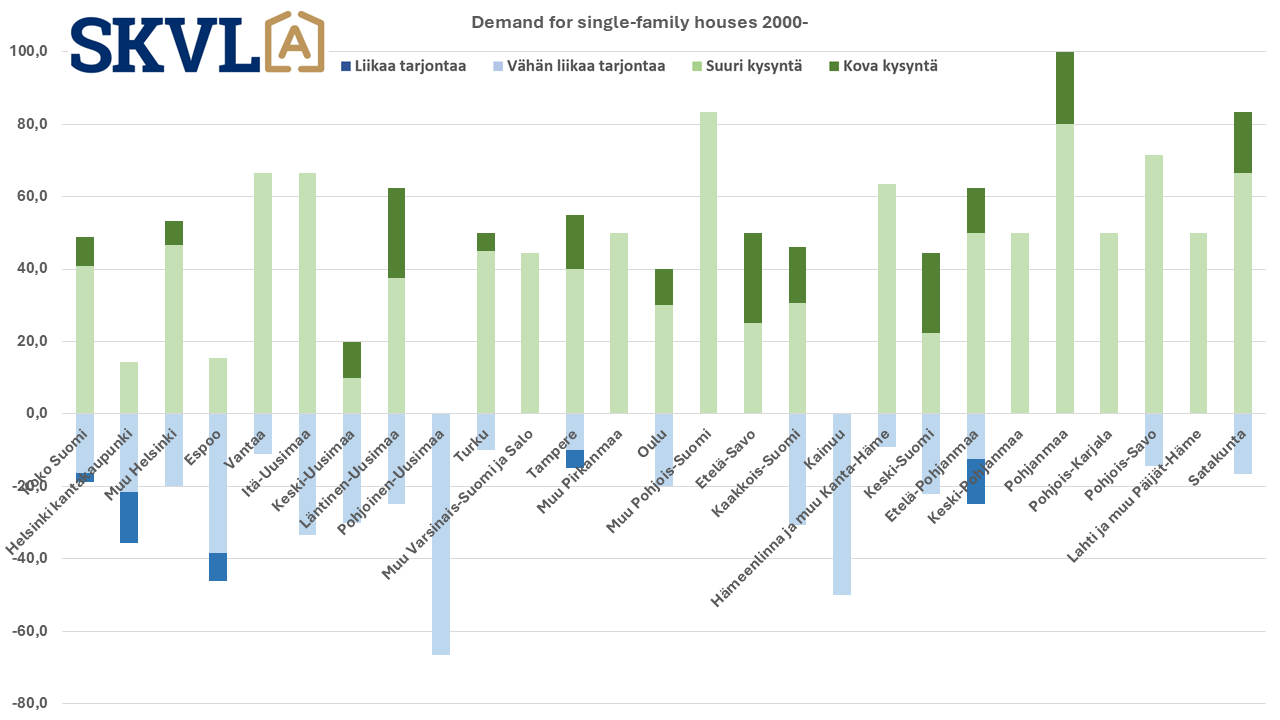

The biggest area of interest in the market is still newer detached houses and terraced houses in good condition

Detached houses built in the 2000s during the summer season and older houses that have been renovated are most in demand. In terraced houses, newer ones are also the most interesting, and the long-standing trend of having one’s own yard is still popular. The purchase of a house in need of renovation is hindered, especially in smaller towns, by the low collateral value in the bank’s loan decisions. The strict stance of some banks on older properties suitable as collateral clearly slows down housing sales in smaller localities, even though market prices are low.

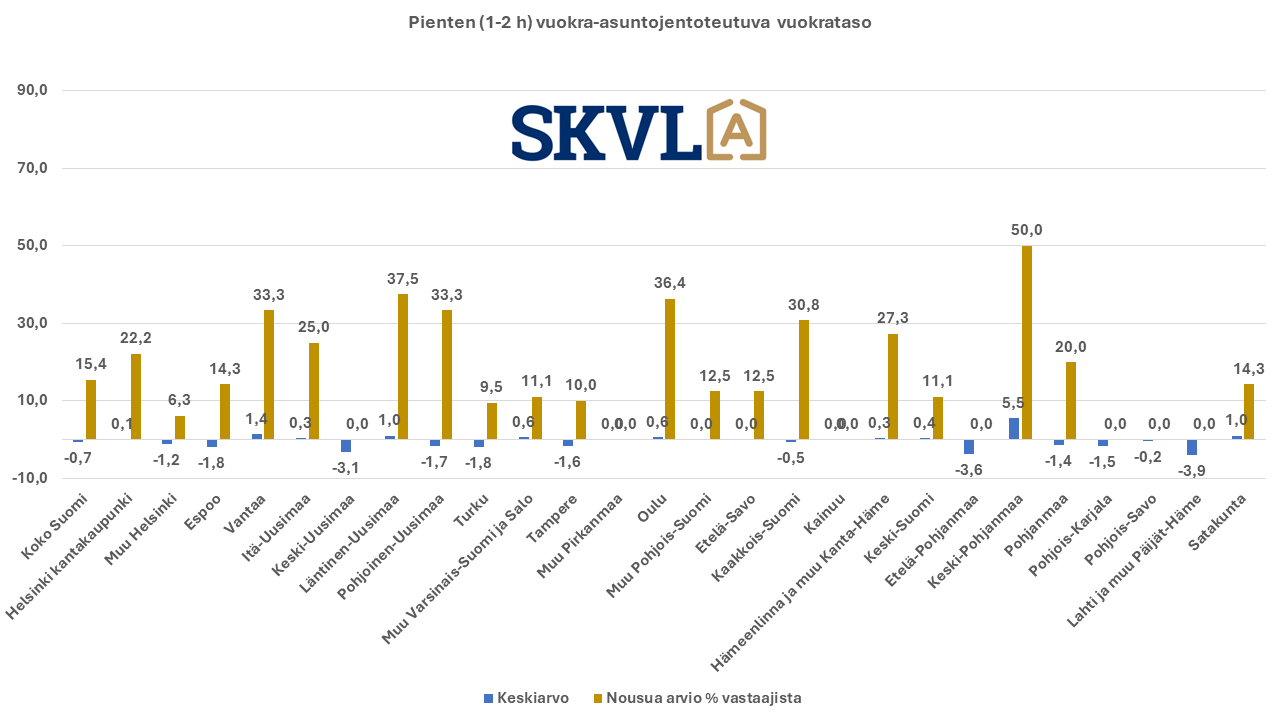

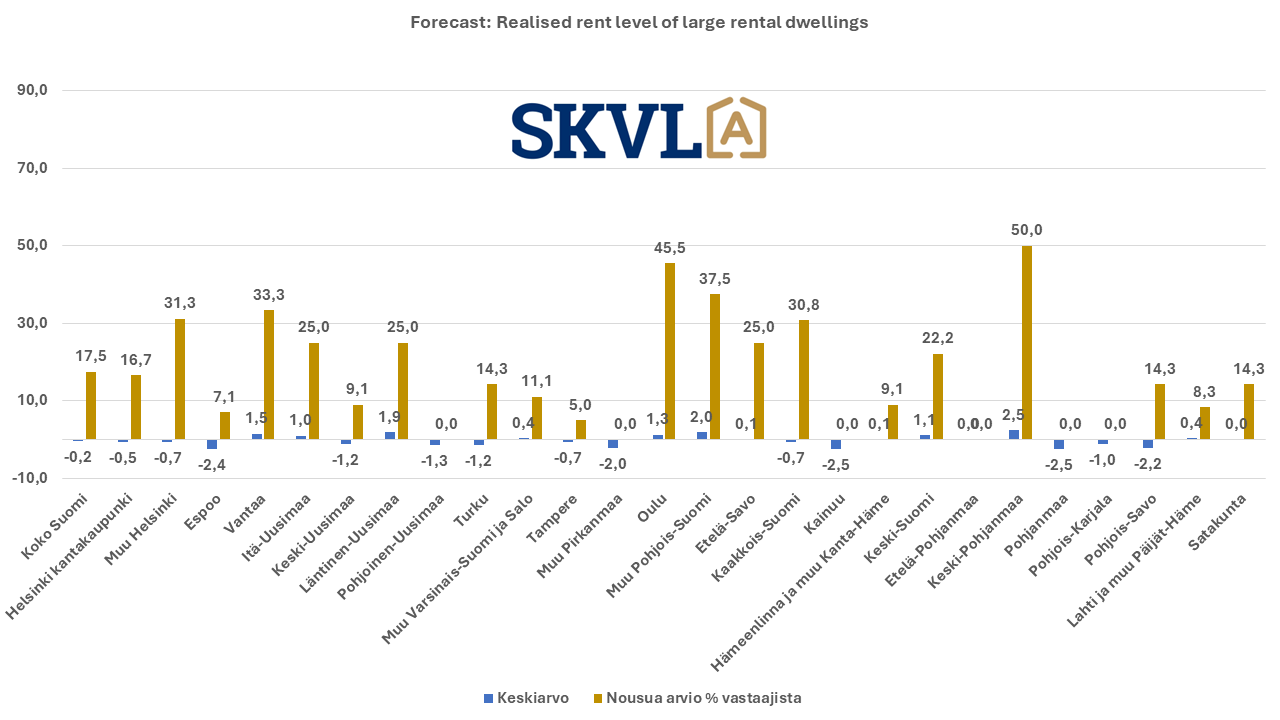

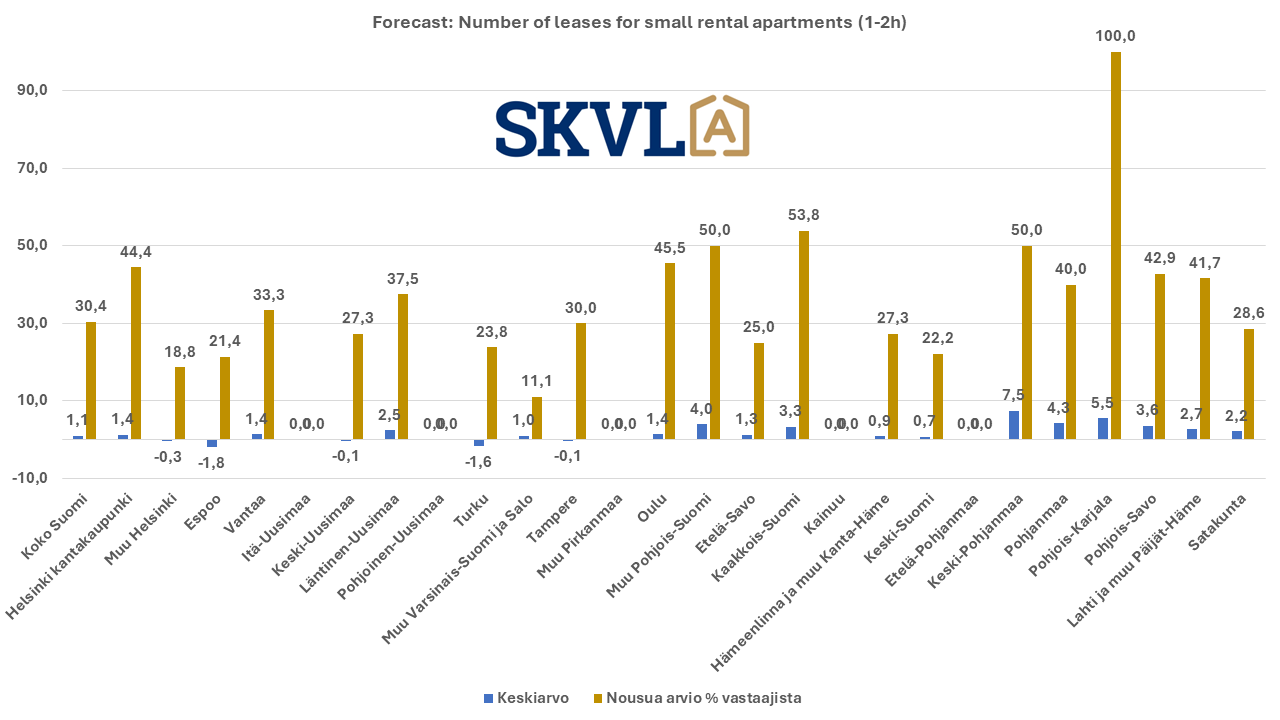

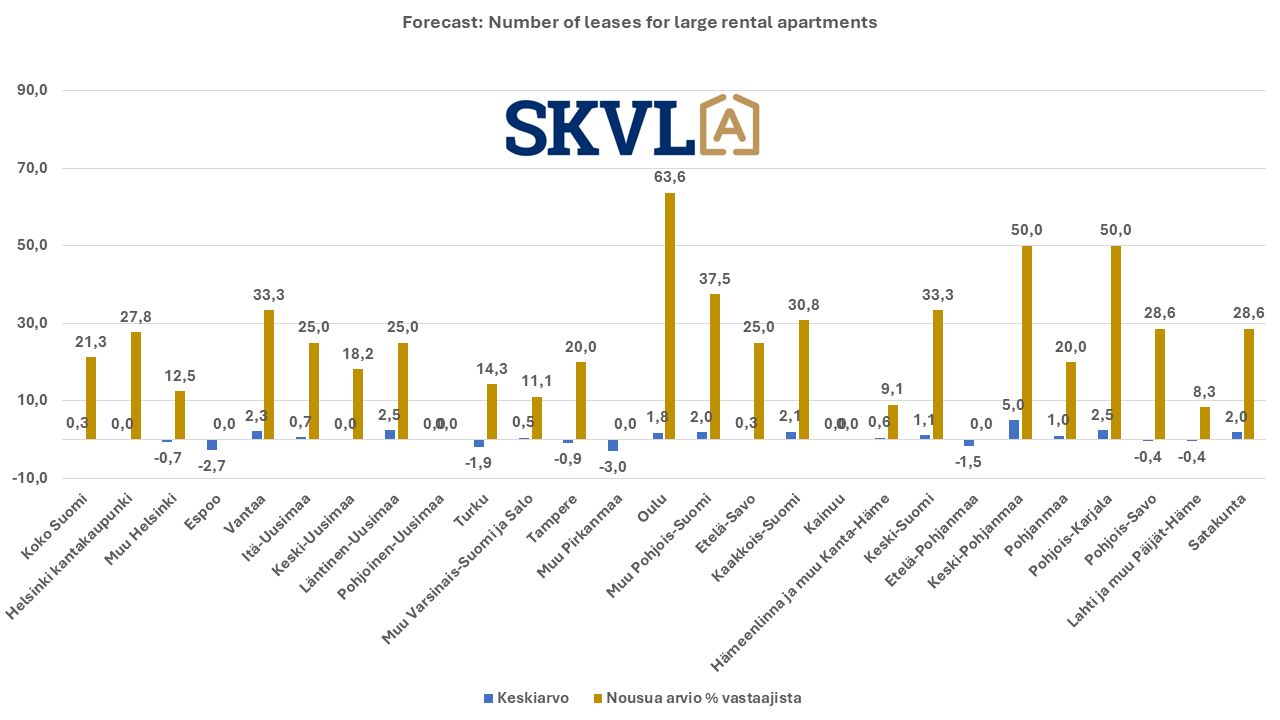

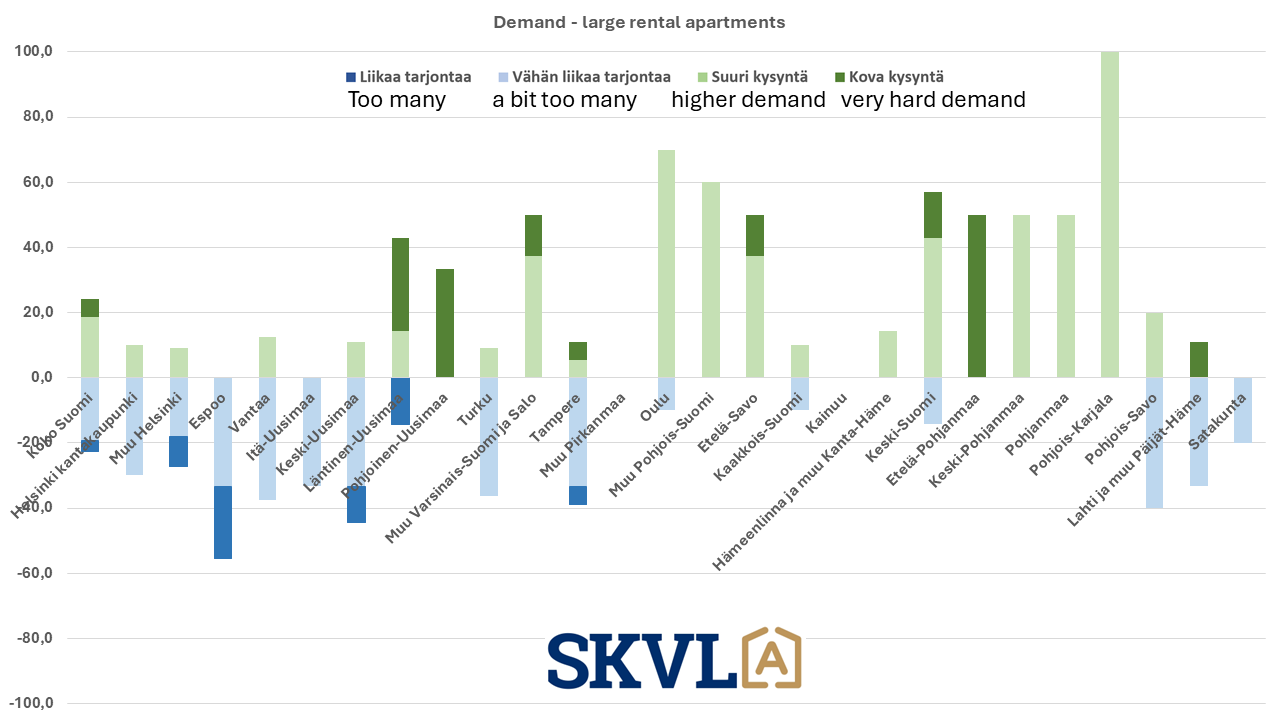

Rental apartments

There are no major changes in the rental housing market, but in some cities, students are already looking for good alternatives due to the declining supply. Once student places have been cleared, the demand for small rental apartments is at its best, and demand is strong in university towns. The large supply in most places keeps the rent level unchanged in both small and large apartments. Larger rental apartments are more sought after and their supply is less.

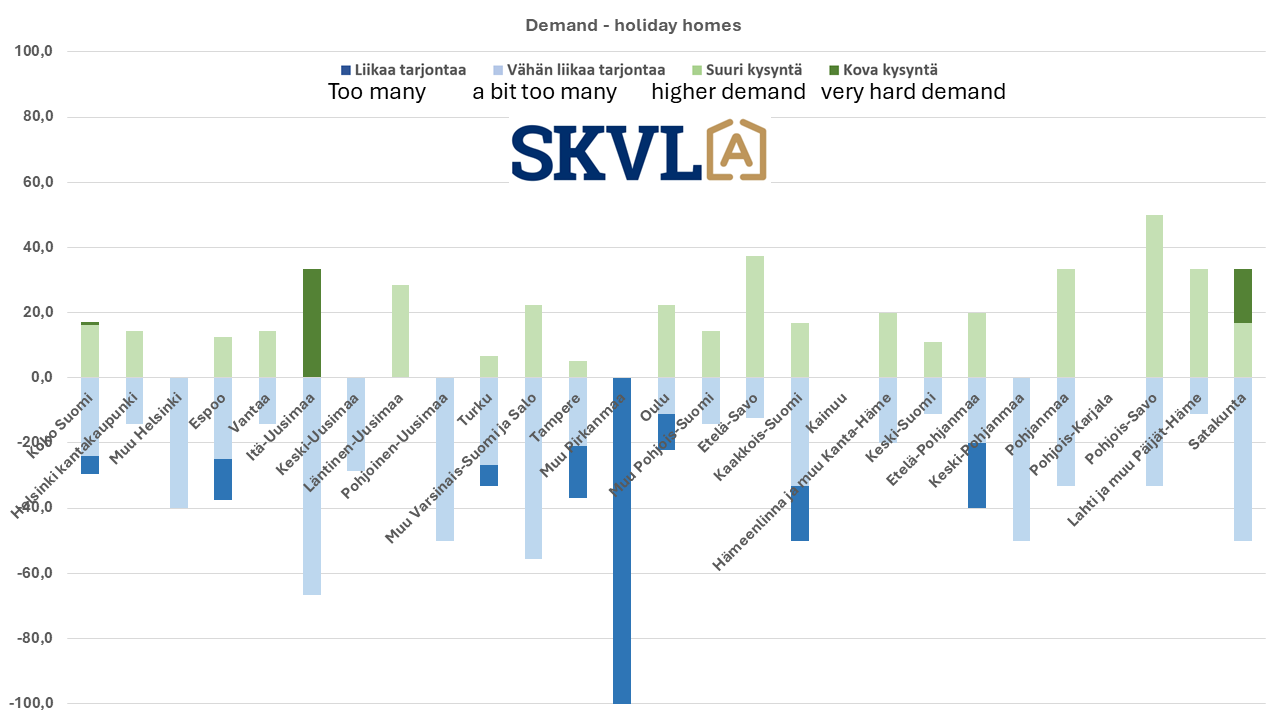

Holiday homes

Holiday home sales are now moderate but have returned to pre-corona volumes. Traditional cottage areas are the strongest, and now the ratio of price and quality level is clearly more attractive than in the past four years. The supply and demand for cottages has also remained at a good level in northern resorts, where even exceptionally valuable holiday homes have been sold. Frequent heatwaves in southern Europe increase interest in buying a holiday home in Finland among foreign buyers.

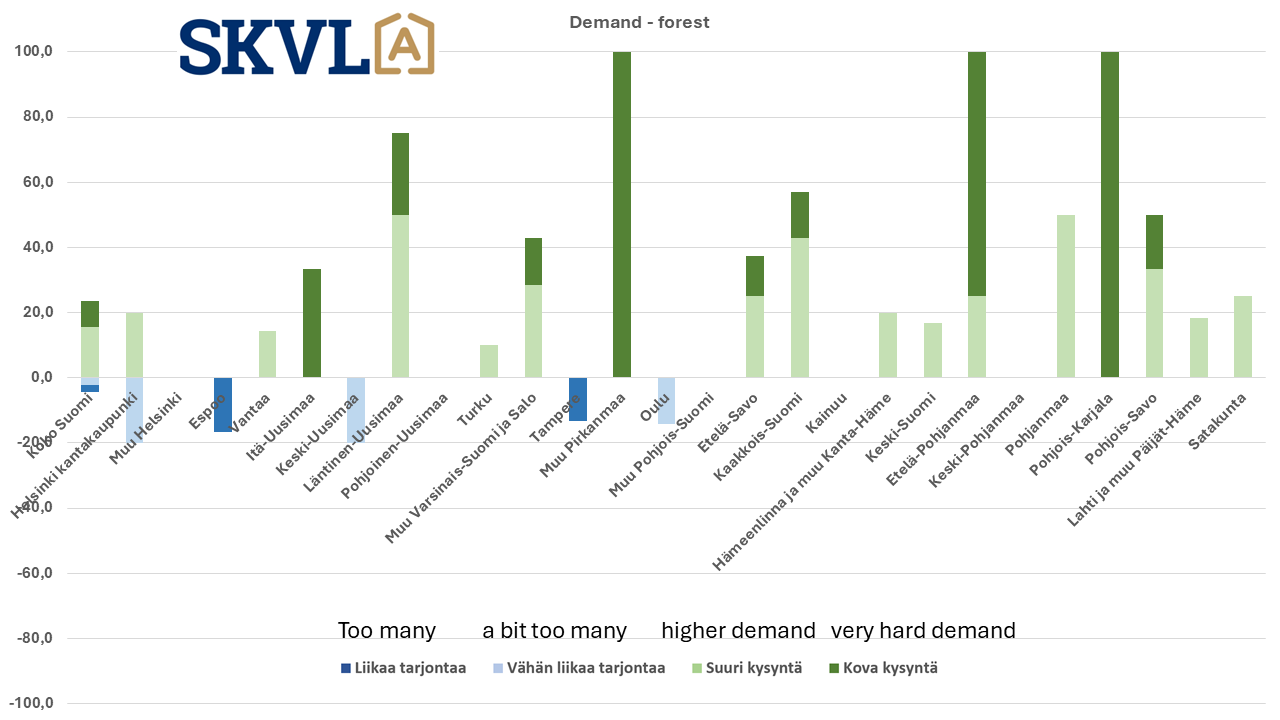

Forest

The demand for forests is high. The price of forest has levelled off, which has increased the interest of private buyers. In addition, the price of wood has remained high. Many investors also seek to diversify their investments and buy forests.

Regional comments SKVL housing market forecast 3/2024

Helsinki and the Helsinki city centre, the rest of the Helsinki Metropolitan Area and general analysis

The housing market in Helsinki is currently still somewhat challenging, especially outside the Helsinki metropolitan area and in peripheral areas. Buyers’ hesitation and caution remain strongly present, contributing to the slowness of trading. Sellers have also adapted to the new price levels, but this has not been enough to significantly revive the market.

Here are some key findings from the situation:

- Supply and demand:

- During the spring, the market has slowed down in some places. The transaction is not progressing because potential buyers cannot sell their own apartments.

- In the Helsinki metropolitan area, buyers have become a little encouraged and no longer focus on rising interest rates and falling prices, but trading is still challenging.

- n the most in-demand areas, trading is more lively and price requests are in line with current levels.

- Regional differences:

- In the outskirts of Helsinki, the situation is quieter: a lot of spectators, but only offers that do not lead to a sale. Some buyers have not yet realised that prices are no longer falling.

- In Eastern Helsinki, buyers continue to be cautious and confidence in their own finances is weak.

- There has not been much demand in Espoo during or after Midsummer. Lintuvaara has a lot of contacts.

- In northeastern Helsinki (eg. Tapanila, Puistola) is in high demand and people on displays.

- Detached and semi-detached houses in Vantaa that are less than five years old at reasonable prices move well. Good areas are Tammisto, Tikkurila, Hiekkaharju and Ruskeasanta.

- In Tammisto, the supply is low, and terraced houses sell in as little as a week.

- Tuusula: There is demand for family apartments in Lahela.

- General: Properties that are in clean condition and correctly priced will sell as long as the company or building is in good condition. Correct pricing remains the most important criterion.

- The number of spectators in Lauttasaari and the city centre has increased, but it is still difficult to make a purchase decision.

- Economic impact:

- Finland’s general economic situation and confidence in the government’s actions will have a greater impact on market recovery than interest rate decisions.

- Special areas:

- In good areas, good apartments sell at a good price, while in other areas, apartments do not sell even at a low price.

- Buyers’ and sellers’ perspectives:

- Sellers are willing to sell and there is a lot of supply on the market, but buyers are hesitant to make decisions.

- Statistics Finland’s index of buying a dwelling within 12 months has risen considerably during the spring.

- There is a lot of pent-up demand, but buyers are afraid to make deals in the current economic climate.

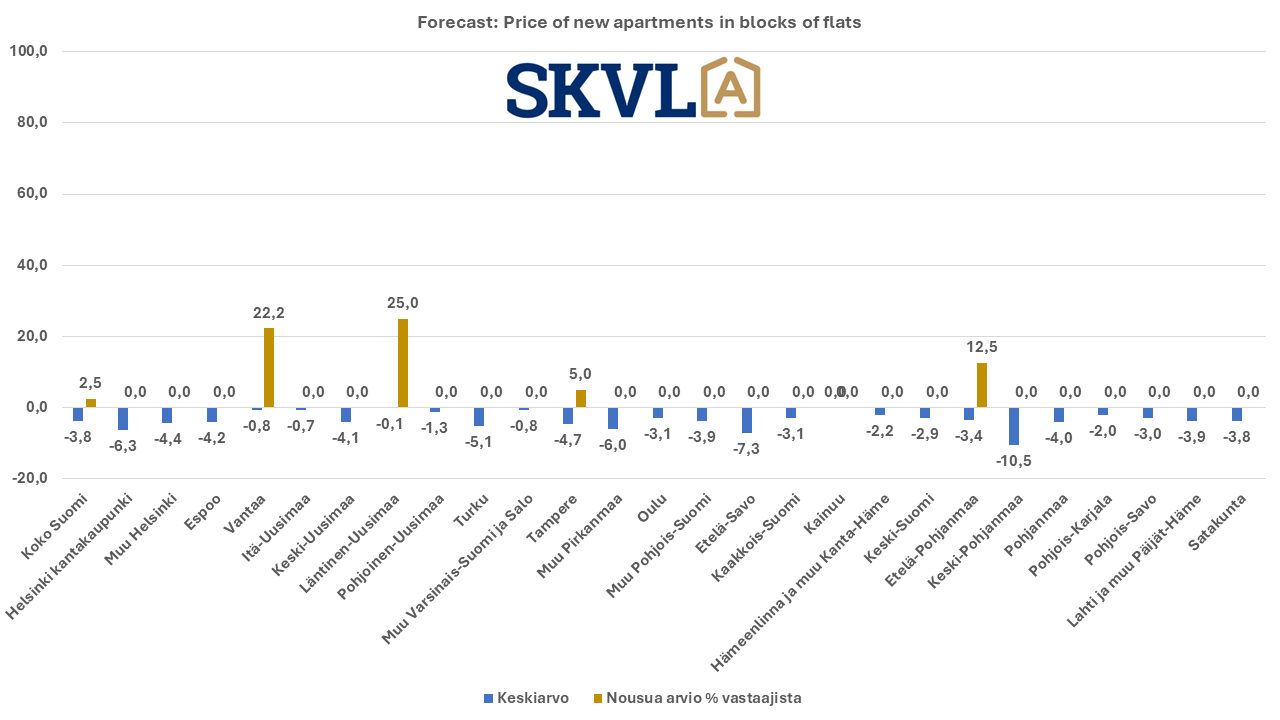

Market recovery requires increased confidence in employment, one’s own economy and the general macro-economy. In addition, price adjustments for new properties to the market level are necessary. The market is recovering slowly, but this requires the simultaneous realisation of several factors.

Eastern Uusimaa

The sales volumes of holiday homes have remained very low in early 2024. Modern family apartments in good condition and apartments in blocks of flats suitable for seniors are available for sale, but supply is limited.

New construction in Loviisa is very low, has been around for a long time. On the other hand, there are far too few new single-family houses entering the market in relation to demand, as well as holiday homes with detached plots.

Central Uusimaa

The atmosphere is quite stagnant, buyers’ inquiries about objects have decreased markedly. Sellers are eager to sell and think that prices are now significantly better and sales times are shorter. There will be as much to sell as you can take in. Rental apartments move relatively briskly.

Helsinki, Espoo, Vantaa, Central Uusimaa, Kirkkonummi. A lot of apartments are put up for sale (sales stocks are high) and buyers are also on displays, but no purchase decisions are made.

Western Uusimaa

In Hanko, the summer season is in full swing. Buyers are now in earnest as many believe that the fall in prices has stopped and prices will rise next. Of detached houses, the most interesting are reasonably priced new and old houses in good condition. In apartments in blocks of flats, more attention is paid to the condition of the housing company. There is a shortage of terraced houses. Wooden house shares are always interesting regardless of the market situation, but even in them the price must be right.

Vihti

The market situation is really nice.

Lohja

In small apartments, some demand. Apartments from the 90s move poorly.

A few weeks before and after the rate cut, sentiment towards home buyers has changed. In between, there was only heat and midsummer. Customers come drop by drop and offers are made more easily than at the beginning of the year, buyers did find an apartment but did not offer. (Western Uusimaa).

Kirkkonummi

Sites with yards in the 2000s, especially geothermal ones, are of particular interest.

During the past month, a lot of new properties have been sold in the surrounding municipalities in Western Uusimaa, and there have been estimates for new properties that are a few years old.

One phenomenon is that city dwellers who moved during the coronavirus pandemic are now returning to the city and going to buy a city apartment.

Rising interest rates and rising costs have accelerated generational change and there has been a rise in more large housing company forms, for example. detached houses for sale. These have been sold exceptionally quickly.

In recent months, the take-up of bridge financing for even larger apartments has increased.

Järvenpää

Newer townhouse three-room apartments sell out quickly.

Nurmijärvi

Supply has increased by 40% compared to January. Sellers’ willingness has increased, buyers’ interest has increased, but not yet willingness to buy.

Turku

The number of apartments for sale is commendable. Buyers are just waking up.

Perhaps a slight refreshment compared to the first quarter.

Trades will be made if the price is right. Even a small renovation, the situation becomes difficult. Banks do not finance, even if the target is otherwise good.

In the Turku, Kaarina, Naantali areas, properties will be sold nicely. Buyers usually have problems with collateral and selling their own home lasts if the asking price is wrong.

In Turku, new production of blocks of flats is very slow, but new terraced houses and detached houses are going. Any family home sale will do.

The student season has started calmly and there is a better likelihood of applications coming from the presentations. Small city centre rental apartments in Turku are of most interest. However, there is still a lot on offer, and I expect that the student season will significantly reduce the supply so that the quieter market at the end of the year would also be better balanced. Larger family apartments are also going well, where supply and demand are pretty much right. The demand for shared apartments has not yet started, but the situation is likely to change in July.

Rest of Southwest Finland and Salo

In the archipelago, the demand for holiday homes has decreased somewhat.

Salo

Fairly new detached houses and newer apartments in blocks of flats located in the city centre are in demand. Terraced houses are in reasonably good demand. The price of old single-family houses has fallen strongly. Outside the city centre, almost all apartments in blocks of flats are sold to investors, but investors’ purchase volumes are small compared to previous years. Single-family house plots are not in demand.

Tampere and the rest of Tampere Region

Some apartment types are in high demand in Tampere, such as larger, well-maintained, renovated row houses and detached houses.

The sale of city centre apartments is difficult despite the good development of our economic area. Currently, pricing is very important. People are price conscious.

In the Tampere, Pirkkala and Lempäälä areas, demand for fairly new or renovated family apartments is high. Actual prices are often very close to catch prices.

Let’s wait, sellers dream of peak prices during the coronavirus period and buyers always expect the offer to go through.

Oulu

The number of properties in terms of the supply of second-hand apartments is 1800 in Oulu, which means that there is supply. Of course, a very large proportion are small investment apartments completed after 2017. The supply of family housing is reasonably balanced. Trade prices are still fairly low and prices are likely to start to rise moderately and slowly during 2024.

In the Oulu region, families and single buyers have always bought apartments for their own use comfortably. Buyers really have a lot to choose from.

In Oulu, interest in apartments has grown. However, purchasing decisions are tight due to consumer uncertainty, and people do not dare to make a purchase decision.

Rest of Northern Finland

In Rovaniemi, the summer has not yet brought the desired pick-up in trade, but a lot of apartments are coming up for sale, which indicates that when sales start to take place, there will be positive activity in the market. There is a slight increase in demand for new properties, but we are not yet able to reach the shops with customers. The forecast is that the situation would unravel a little towards autumn. Construction companies still have plenty to sell, but we predict that there will always be a supply shortage in Rovaniemi in 2025 because there are no new projects starting up.

Fell holiday home market: The supply for sales has been good, the situation has been at a similar level for 1.5 years. Slightly more has now become available for sale at the beginning of summer, while in winter. Holiday homes under 200,000 euros move well or reasonably. The €250,000+ market hasn’t been as good, but now in the past month there have been a few inquiries about more valuable items and even a deal. Hopefully, the market will also pick up for more valuable properties. The exception is that very valuable items have been sold anyway.

South Savonia

Trading is challenging. Buyers haggle and making a purchase decision is difficult. In addition, access to funding has become more difficult. Trade in apartments in blocks of flats is quiet.

In Mikkeli, housing sales are very varied and site-dependent. Small apartments in blocks of flats do not seem to be moving, and investors’ thoughts on prices do not yet meet the views of sellers.

There is demand for renovated family apartments, especially for single-family houses built in the 2000s.

Southeast Finland

In Kouvola, the market remains quiet.

Near the eastern border, the immobility of Russian capital continues to sustain the local stagnation of housing sales. Housing investors will hopefully be mobilised soon thanks to the downward trend in interest rates.

Lappeenranta: market quiet and similar to last year – limit problem.

The situation near the eastern border (in Imatra) is particularly difficult already geographically and due to the decline in tourism. We would like to see stimulus measures and a support package from the state for East Karelia.

Hämeenlinna and the rest of Kanta-Häme

In the areas Lammi-Tuulos-Hauho-Hämeenkoski and partly Padasjoki, dry land cottages for sale. Clearly more demand, and demand for them has calmed down even further compared to 2023. Otherwise, the whole beginning of the year has been surprisingly lively.

In Forssa, housing sales have picked up clearly in some places.

Terraced houses in good condition and single-family houses from the 2000s would go quickly. Renovated apartments difficult to sell. Banks face challenges.

Items coming up for sale and understanding the right selling price for sellers is challenging. Expensive destinations, unless in top condition and top location, are hardly in demand.

Detached houses have gone well, in the Renko area of Hämeenlinna. In the eastern part of Hämeenlinna, poor demand for single-family houses, demand for apartment buildings is quiet.

Central Finland

Trade is reasonable in Jyväskylä. Clearly better than the last year and a half.

There are currently a record number of houses and semi-detached houses for sale. Catch prices have decreased slightly compared to previous years. A relatively small number of people are looking for single-family houses, and the same people can be seen in the presentations of different houses. Pricing and attractiveness are currently more influenced by location. Low demand for apartment buildings, unless the asking price has been taken to a very low level. Interest in terraced house living has remained unchanged, but buyers are careful about when the premises have been renovated. The sale of old properties is difficult and banks look at the property with particular attention and the levels of collateral values are poor.

New, four-bedroom houses and terraced houses are of interest to buyers. The demand for studios, two-room apartments and three-room apartments is still low.

South Ostrobothnia

Buyers have clearly started to make purchasing decisions. Transactions are obtained especially for detached houses and terraced houses in good condition.

Getting a loan is really difficult even for smaller purchases.

In Lapua there are occasional shops (detached houses), in Kauhava some display requests, not many shops. Evijärvi, Lappajärvi, no shops. In Seinäjoki, the sale of single-family houses from the 80s will be approximately 30% lower than in 2021 and 2022.

Trade is sluggish, only there is competition for single-family houses in good condition. Used shares and detached houses to be renovated are of no interest to buyers – the collateral issue is a significant hindrance in renovation projects.

Central Ostrobothnia

The first half of 2024 was clearly busier than the beginning and end of 2023. The backlog began to unravel and even old single-family houses that had been for sale for a long time found a buyer. And the good single-family houses up to 10 years old, which came as a new commission, went quickly.

Ostrobothnia

The market is still slow. Summer has typically become more to sell, but buyers are a bit scarce.

The Vaasa and Korsholm areas are quiet.

In Vaasa, the situation has clearly improved. The situation is clearly better than last year.

Northern Savonia

It’s quiet, investors are just under a rock. Economic uncertainty is reflected in all decisions.

After March-April, a clear pick-up.

There is clearly good demand for single-family houses built in the 2000s, there should be more supply. There were no buyers for older detached houses and renovation sites, even though the price requests had been clearly lowered. Access to funding for the projects in question is also tight. There is a collateral gap in these projects and there must be more self-financing. Three-room apartments and larger apartments sell slowly, especially in companies built before 2000. The leisure property market has still not really got off to a good start.

Lahti and the rest of Päijät-Häme

Items are coming up well for sale – but demand is still poor. It was expected that spring, summer and a slight interest rate cut would have boosted the market, but this did not happen. Expectations for autumn are high. Pent-up demand, when it unwinds, deals will be made at rising prices and there will again be a shortage of things to sell. So now is the time to buy while prices are still low – but for how long. A new generation of investors entered the market. Young people in their thirties are now on the market when they have noticed that “you can get good things cheaply” when an older retiring investor uses the money from the apartment in addition to their pension.

In Nastola, the situation is weak, there is hardly any demand.

In the Päijät-Häme region, few holiday homes have been sold this year. There would be demand in Lahti for terraced houses from the 2000s.

Satakunta

Pori and the peripheral villages: a quiet situation. For their part, banks are holding back trade in peripheral villages and elsewhere.

In Pori, the situation has remained the same, i.e. demand is still rather subdued.

Rauma

Buyers are really on the move. There are plenty of requests for private displays, and the general presentation is also visited by customers. You will be on the screen with a purchase in mind. Well-renovated, well-maintained and newer detached houses north of the city are still sought-after goods. The price level must be correct and justified. Buyers are more aware of actual prices, which may be partly due to the fact that many buyers have been looking for a home for several years and have become familiar with the market. Interest is most difficult to find in single-family houses from the 1970s that are in condition for renovation, where risk structures are considered too frightening or the renovation as a whole too large. There have also been cases where a bank does not lend a project because the object to be purchased is not suitable for the bank as collateral for the loan.