SKVL’s local experts in housing sales have updated their forecasts for the rest of 2024.

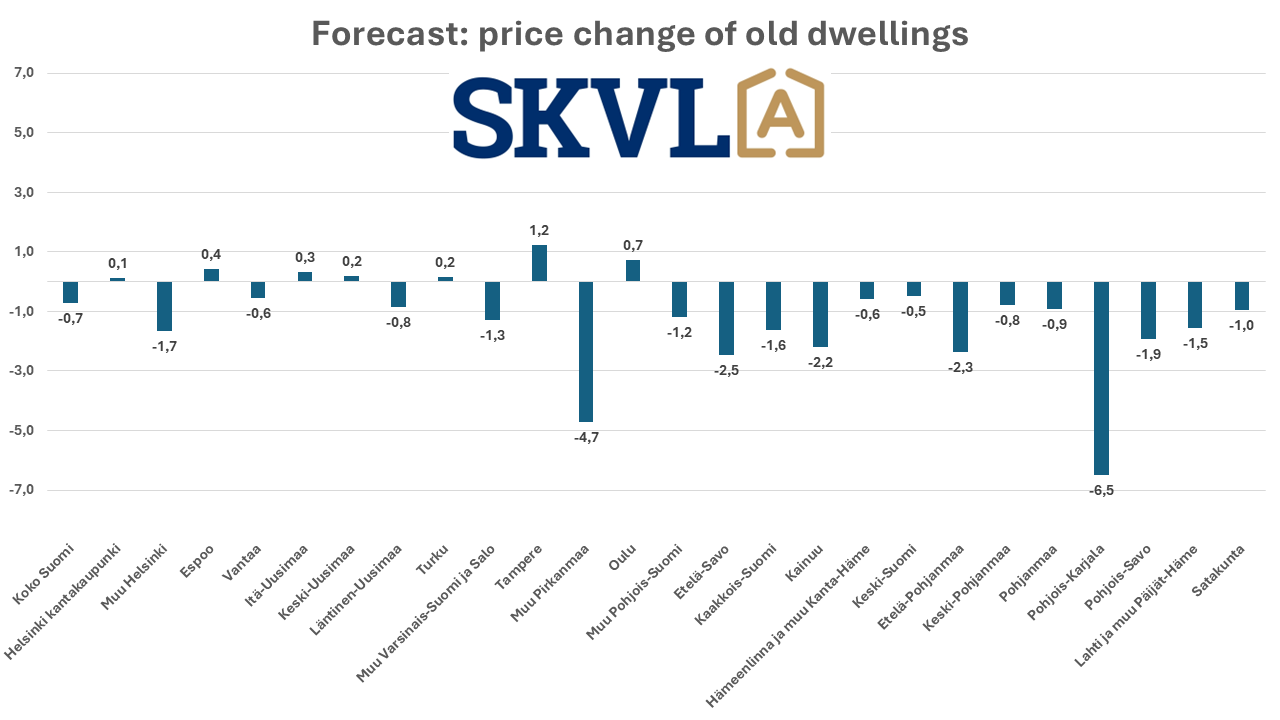

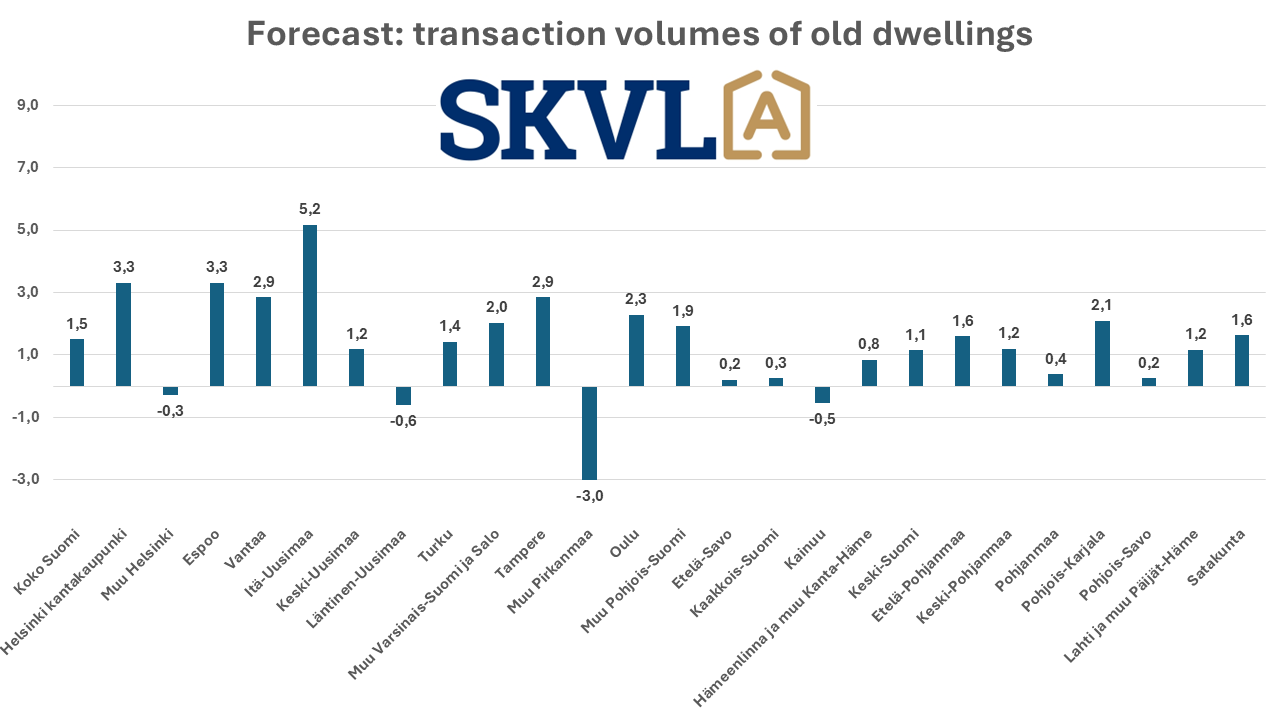

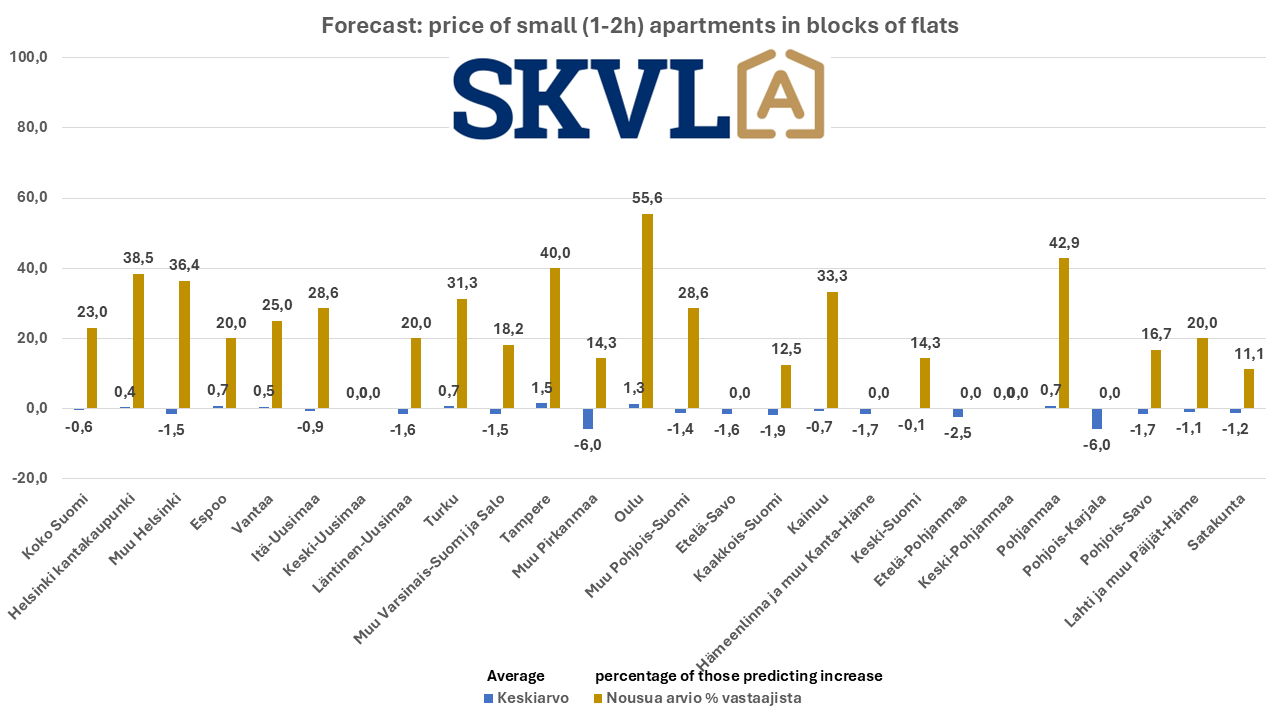

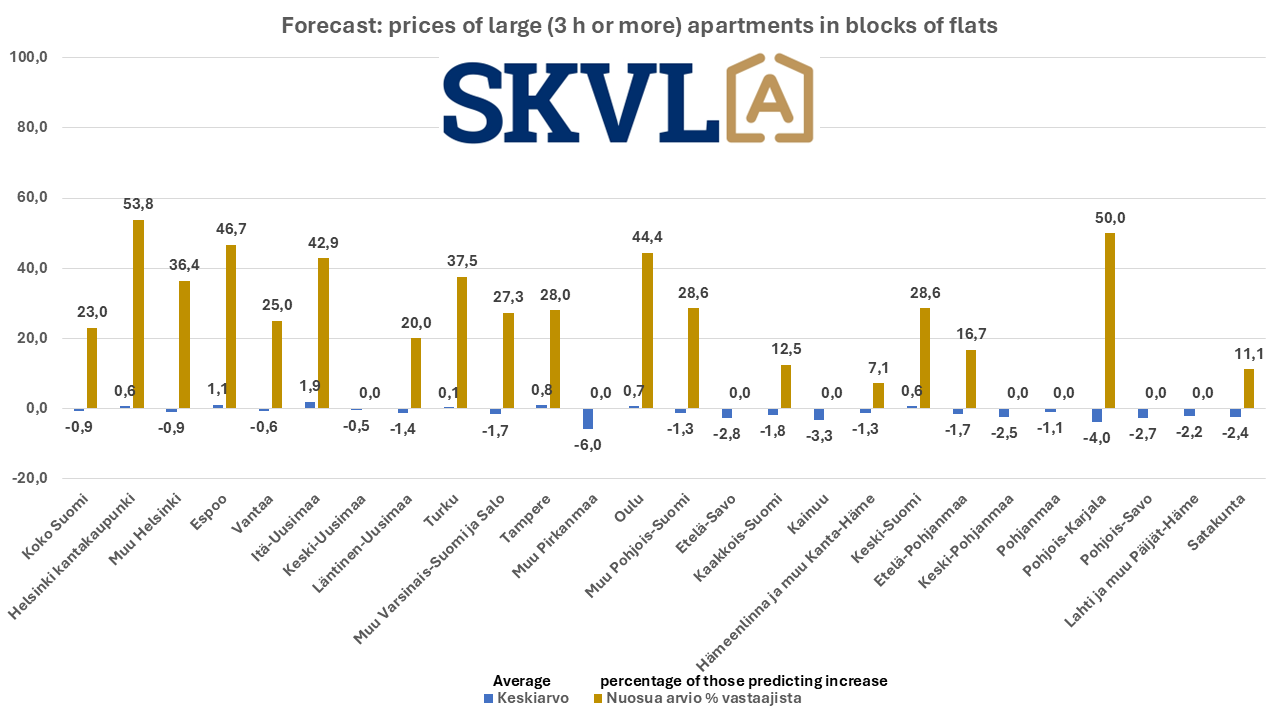

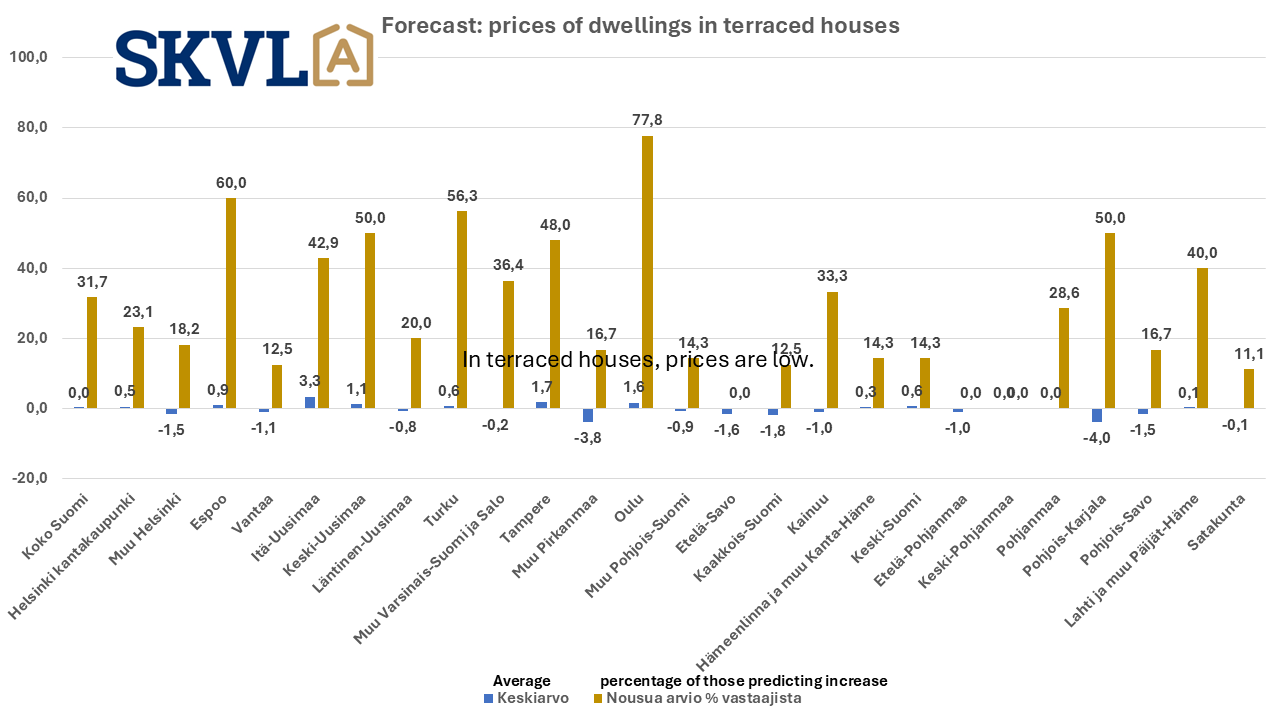

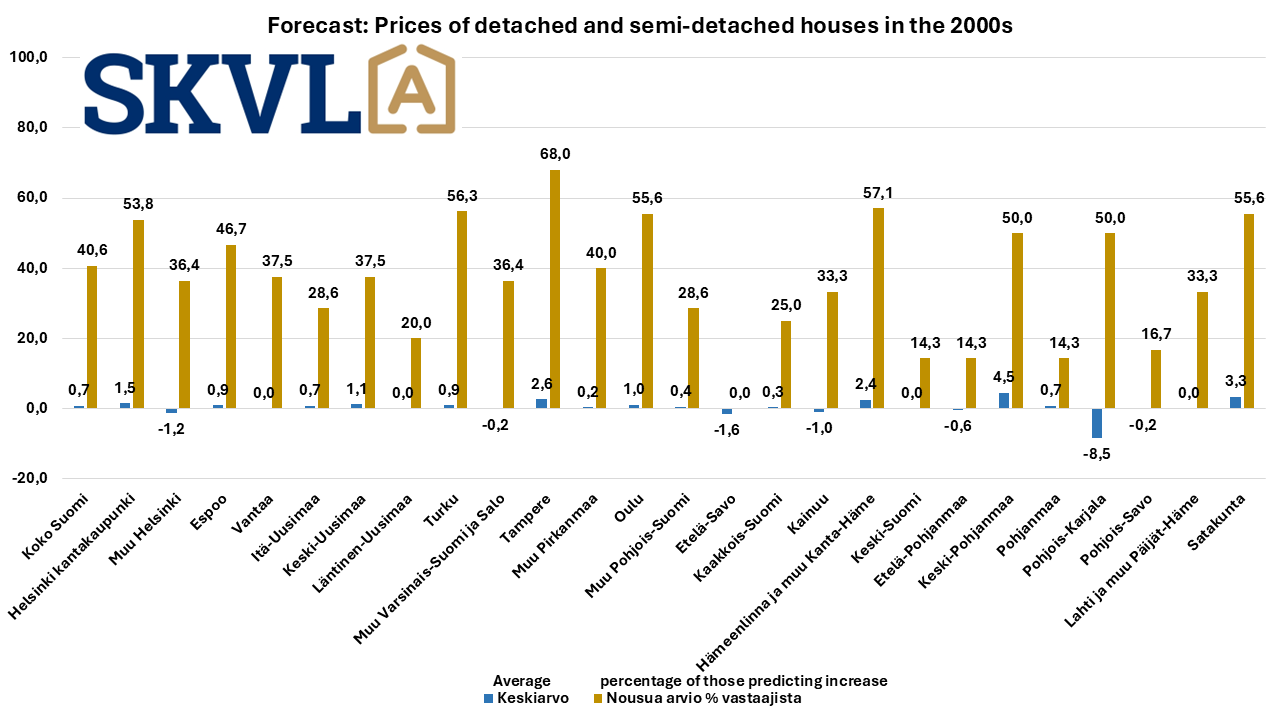

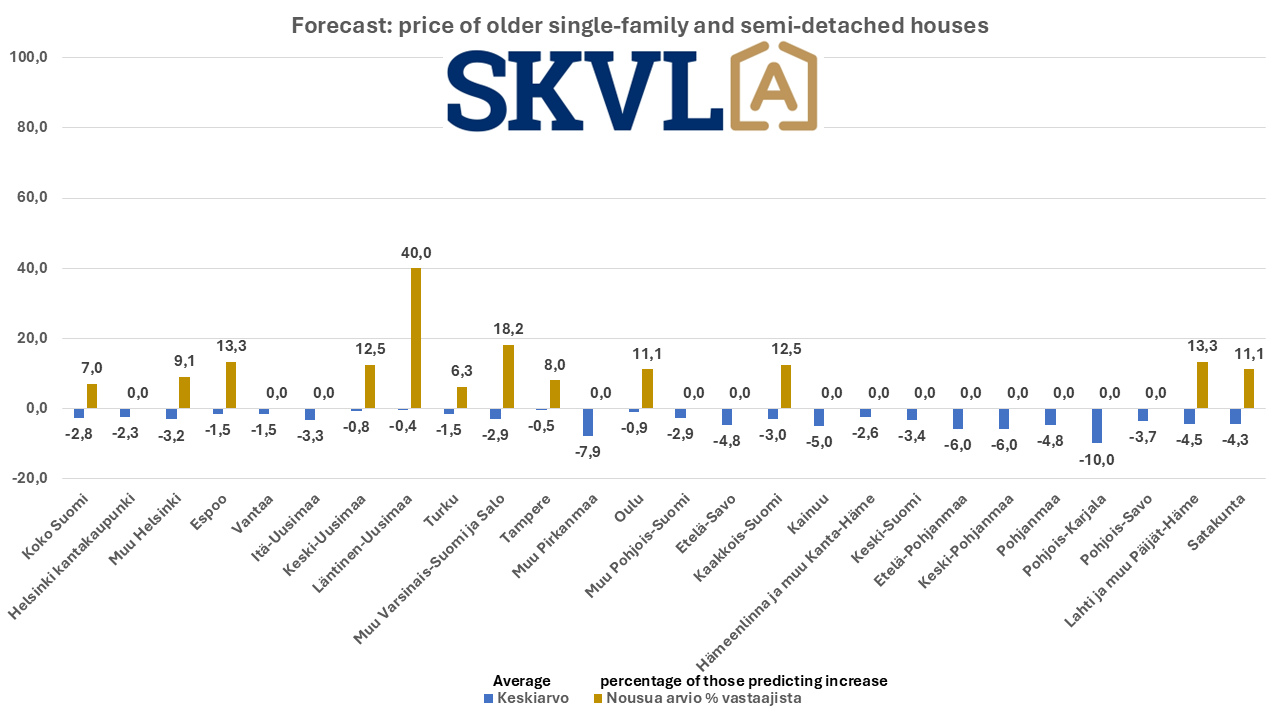

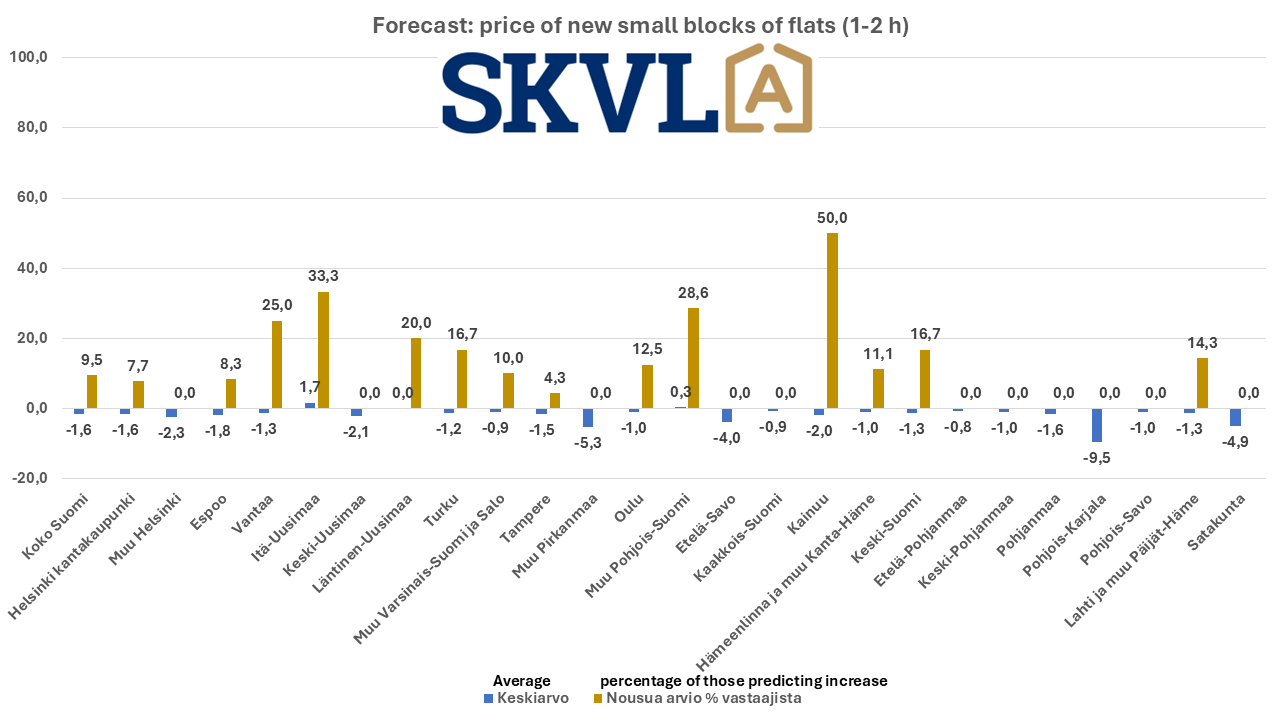

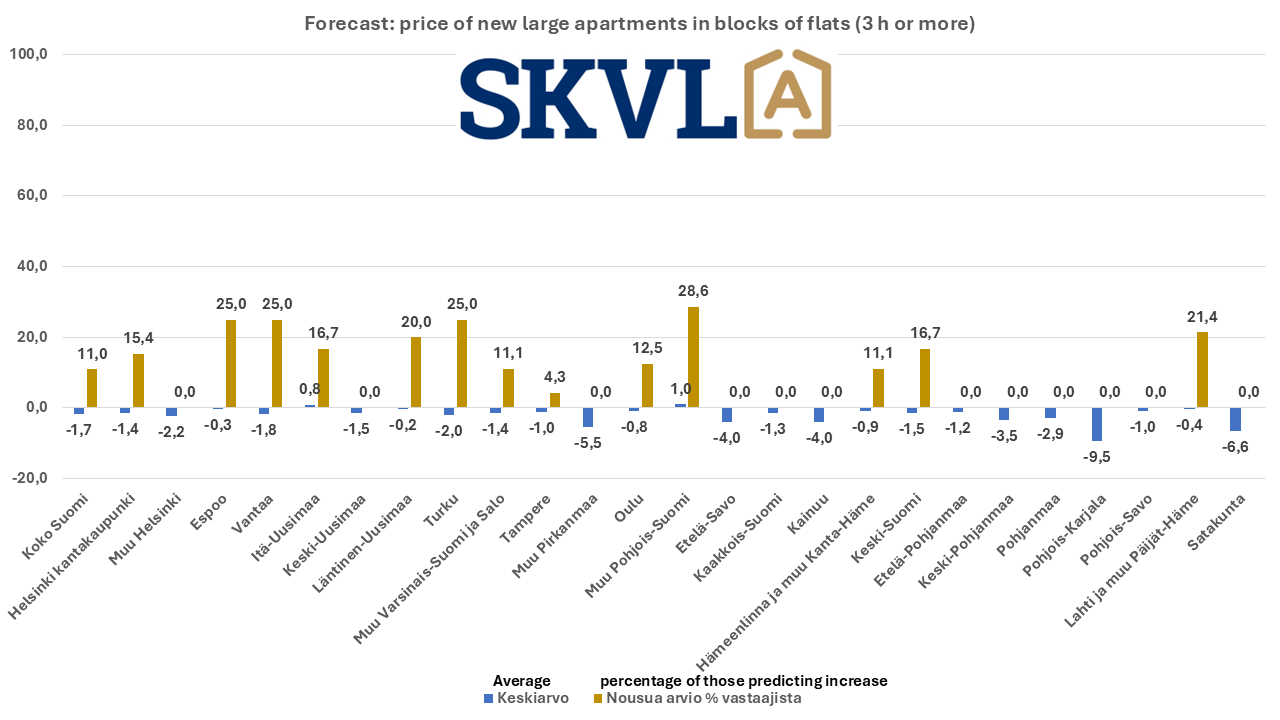

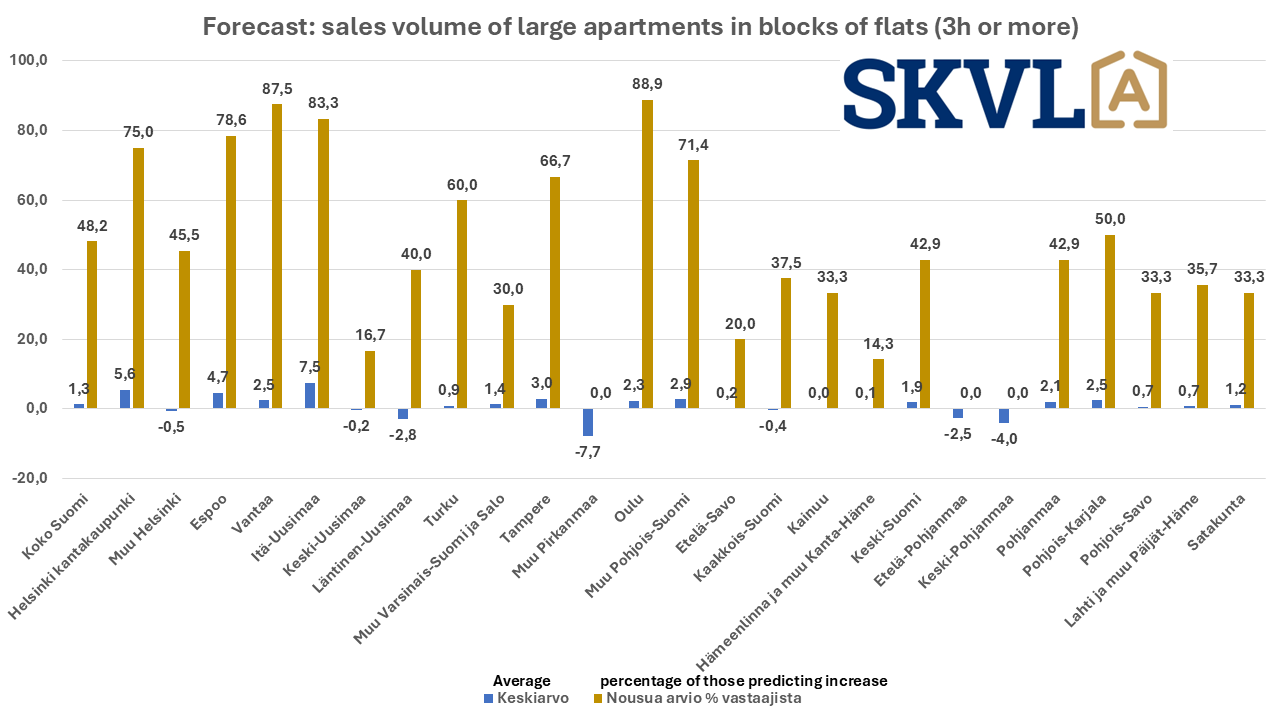

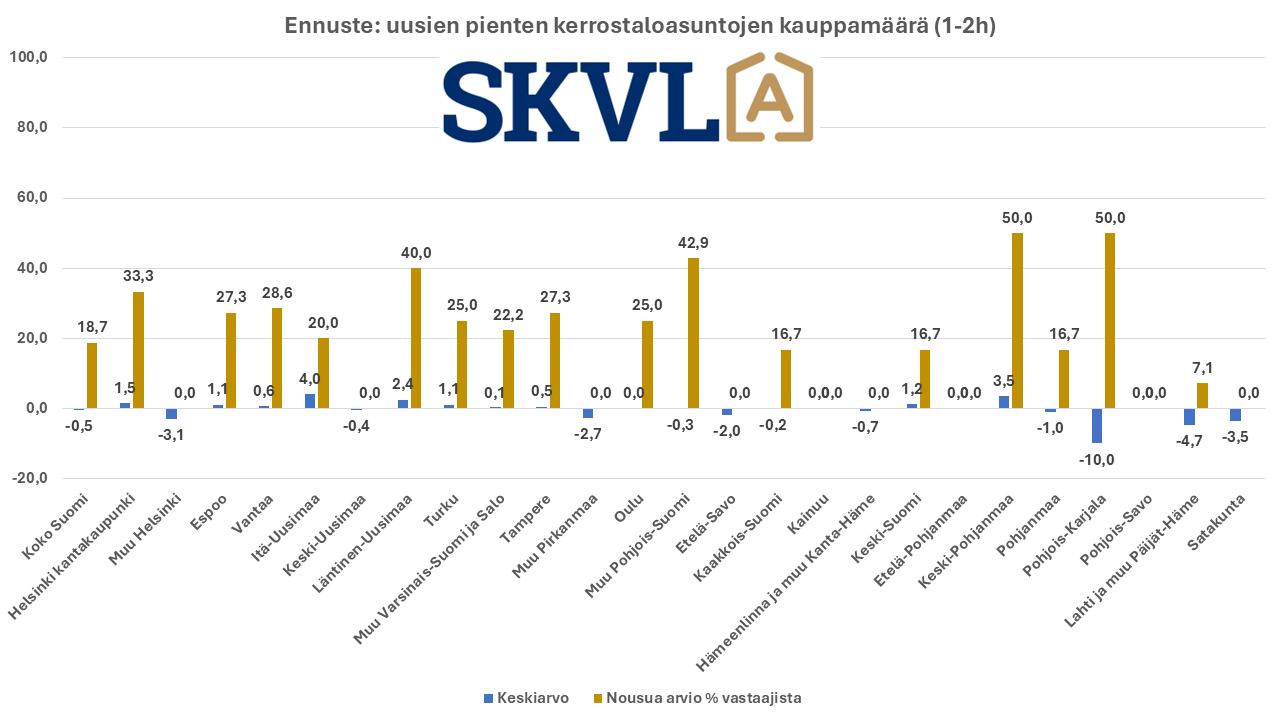

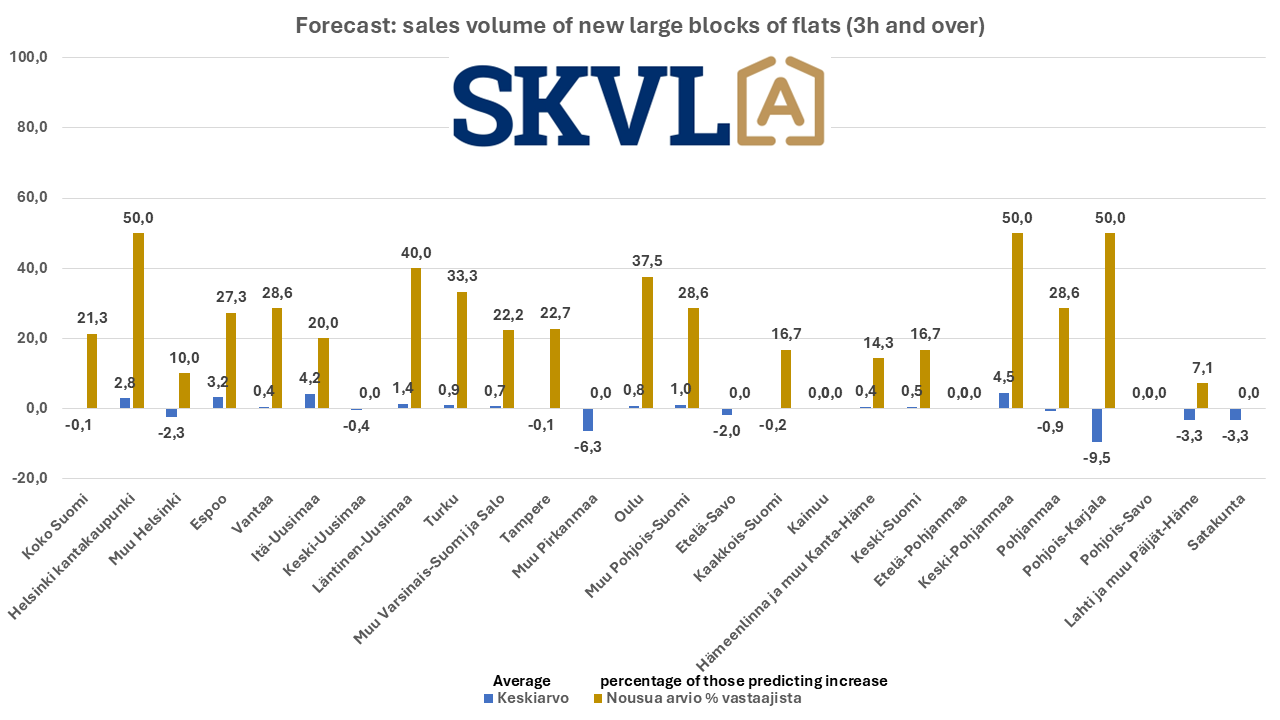

“Housing sales picked up by an average of about 1–3% compared to the previous quarter. In some localities and in the most demanded housing types, the pick-up may be slightly faster, but uncertainties in people’s personal finances, such as so many co-operation negotiations, are still holding back the rapid growth,” says Jussi Mannerberg, CEO of SKVL. “We expect housing prices to remain mainly at the current level during the autumn, with the exception of the smallest apartments in blocks of flats, older single-family houses and new buildings, where prices may continue to fall somewhat,” he continues. “The slowness of the three largest banks, in particular, is currently the biggest problem for the practical realisation of housing transactions within the desired schedules,” comments Mannerberg.

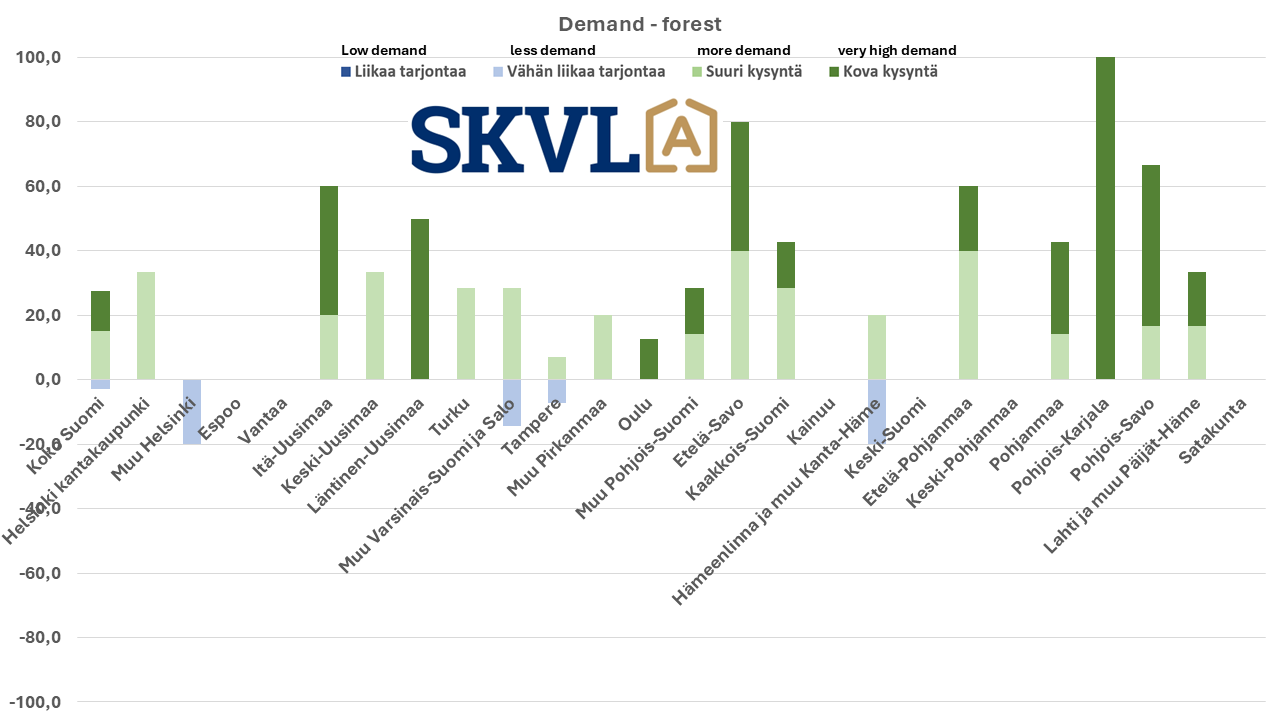

Supply at a good level – Demand clearly increased towards autumn

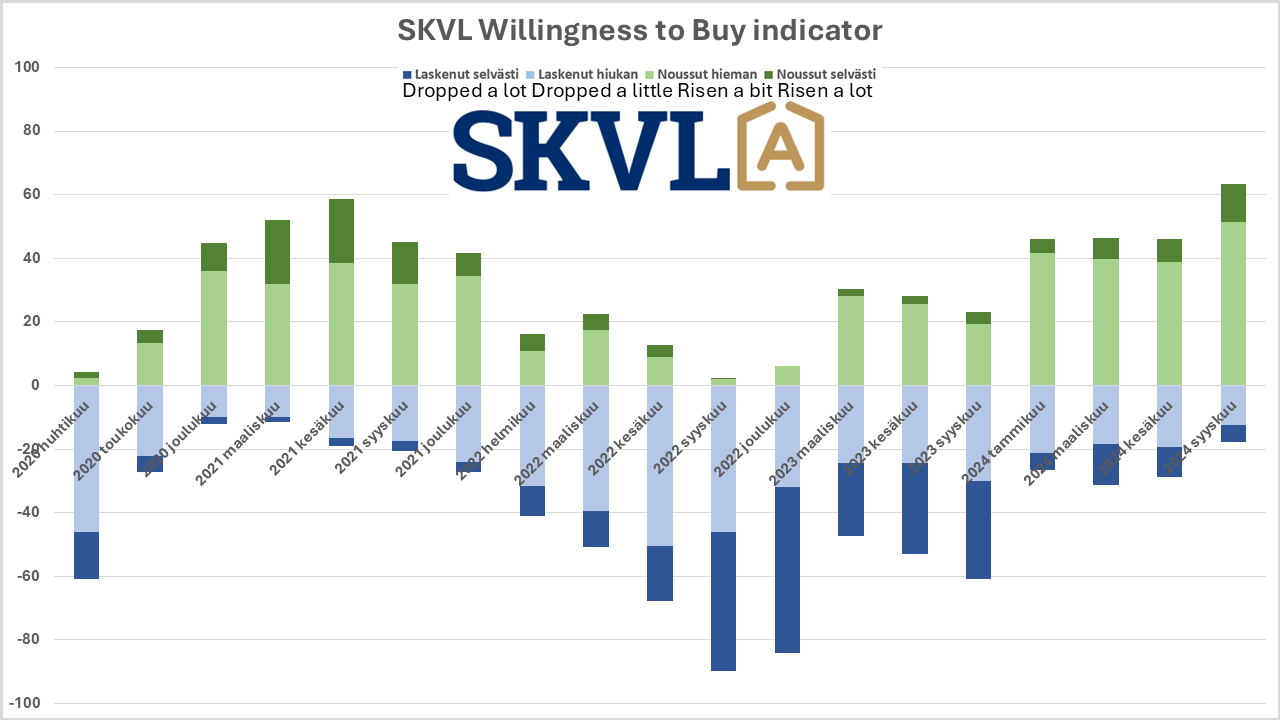

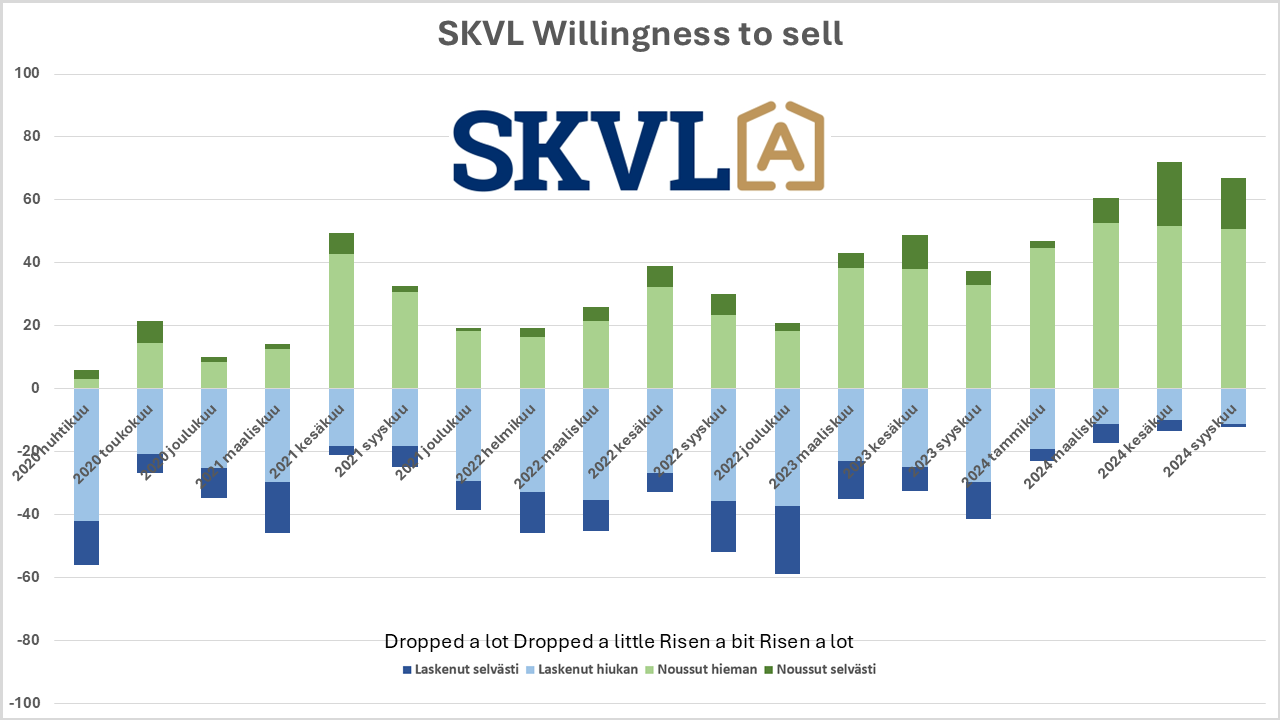

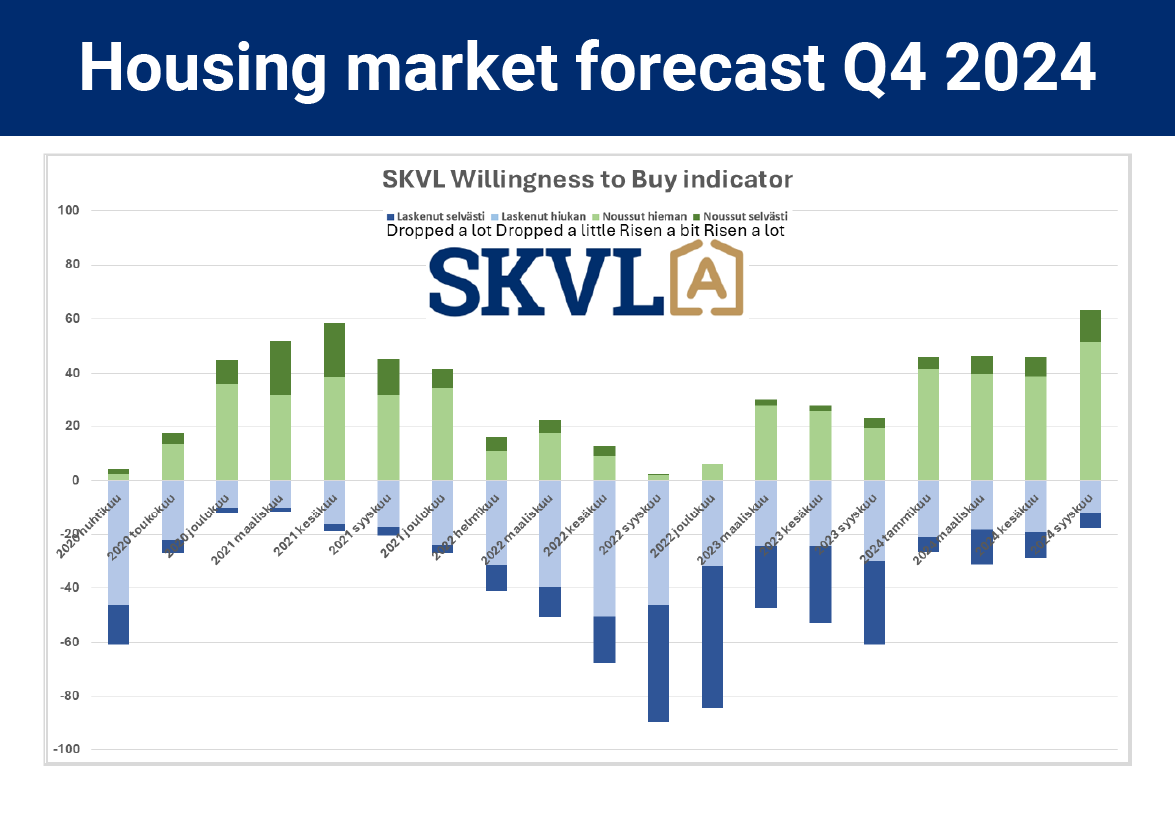

According to SKVL’s willingness to buy indicator, home sellers are now motivated. The desire of buyers to make a purchase decision has significantly increased. From the sellers’ point of view, the lower price level has mainly been understood, and now things are starting to happen in the market as buyers sell their own apartments.

Traditionally, price increases are hindered by demand not exceeding supply. In principle, there is now a situation that is good for buyers, as the assortment as well as the price level are attractive.

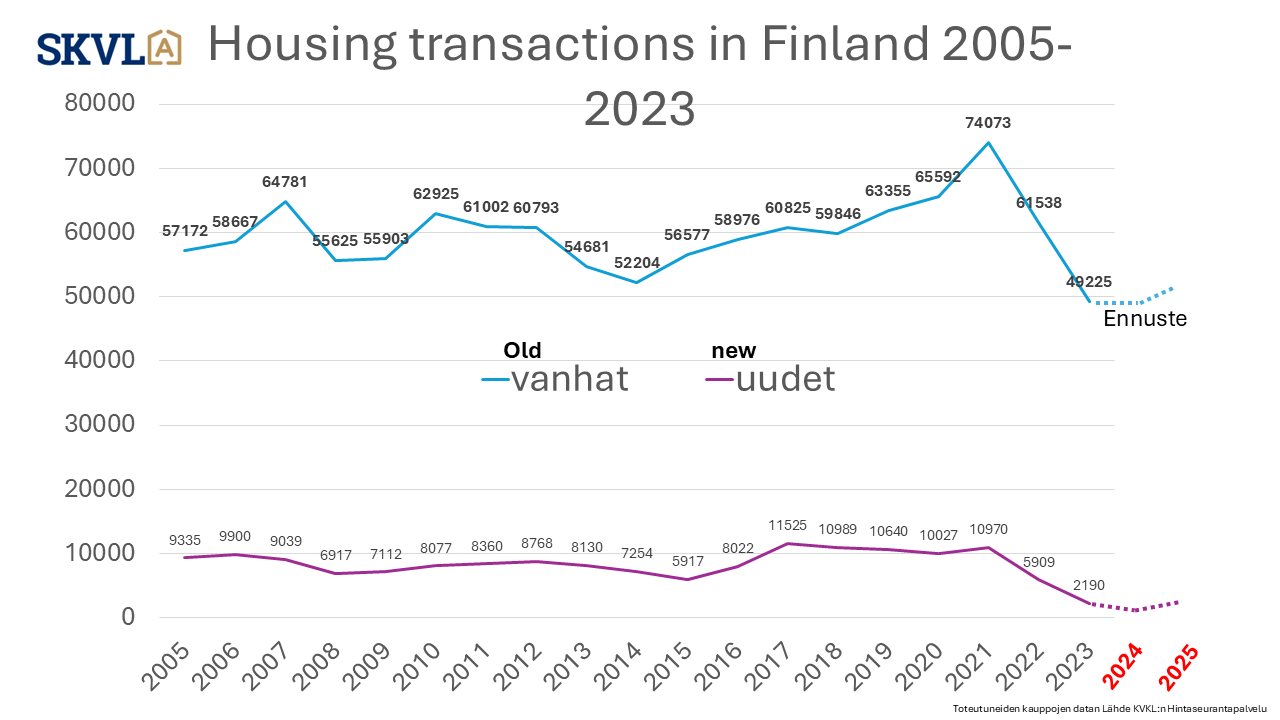

“We expect the total trade volumes in 2024 to remain at the same level as in 2023. The reason for this is that even though trade volumes are accelerating now in the autumn, the pick-up at the end of last year for a while was so strong that it is not yet possible to rise above it. Next year, if interest rates fall close to 2%, we believe that trade will pick up clearly after the snowy winter in the spring,” Mannerberg estimates.

Banks have not kept pace – significant delays in closing deals

The market has picked up by a few percentage points since the summer. At the same time, backlogs in mortgage processing have increased significantly. We regularly see delays of more than 1 month in the processing of matters and up to 2-3 months go by when the deals are closed after the offer. This causes a lot of difficulties for apartment exchangers in multi-apartment chains, where even the last sale depends on the completion of previous transactions in the chain.

The new e-commerce systems have not made matters much easier, as they are also handled by a bank. “Banks are now expected to engage in much more flexible cooperation and training in new operating methods that brokers already have a good grasp of,” says Jussi Mannerberg, CEO of SKVL.

There are also strange phenomena in the financing of housing transactions

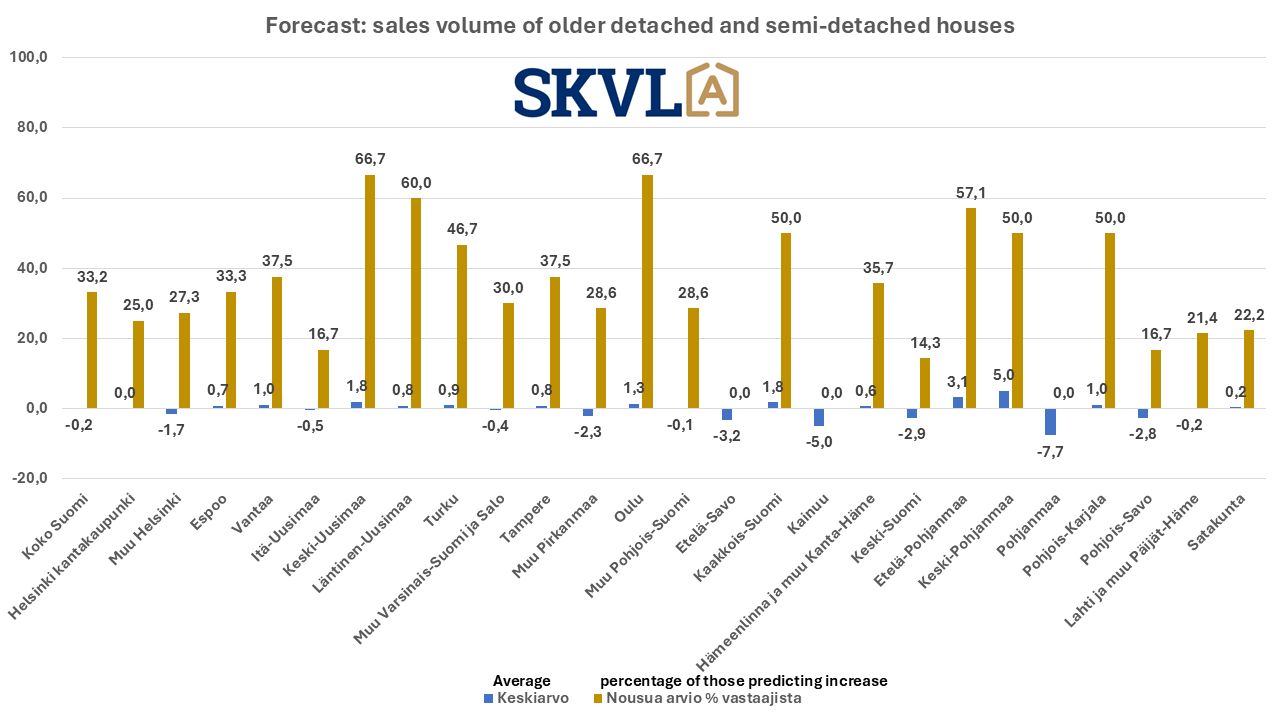

There are still some buyers who make brazenly low bids, but most of the time they only lead to resentment and no deals are made. Price awareness among buyers and careful examination of the apartment before making a decision is very typical. “Now that banks are too demanding on the condition and age of the home, it causes a significant decrease in the value of national assets. You can’t get credit if there is even a small question mark in the condition inspection,” laments SKVL’s Mannerberg. Often the age of the house alone is reluctant for the bank to make a loan decision, even if the house is in excellent condition,” he continues. At the moment, we are also seeing really strange phenomena at municipal borders, where credit is easier to obtain in one municipality than a few kilometres away in another. Especially the larger banks are overcautious here and hinder home and house sales in many areas.

“It’s quite sad that people can’t buy affordable apartments where they want,” says Mannerberg, CEO of Finland’s largest network of brokers.

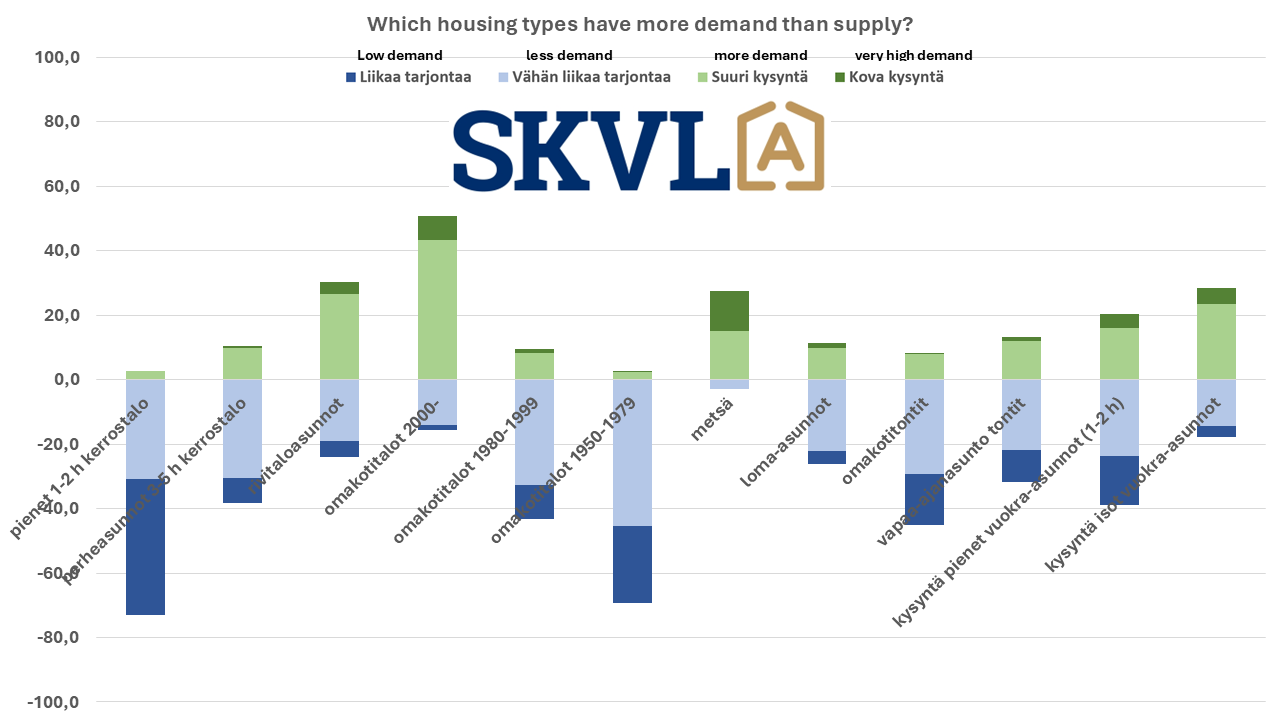

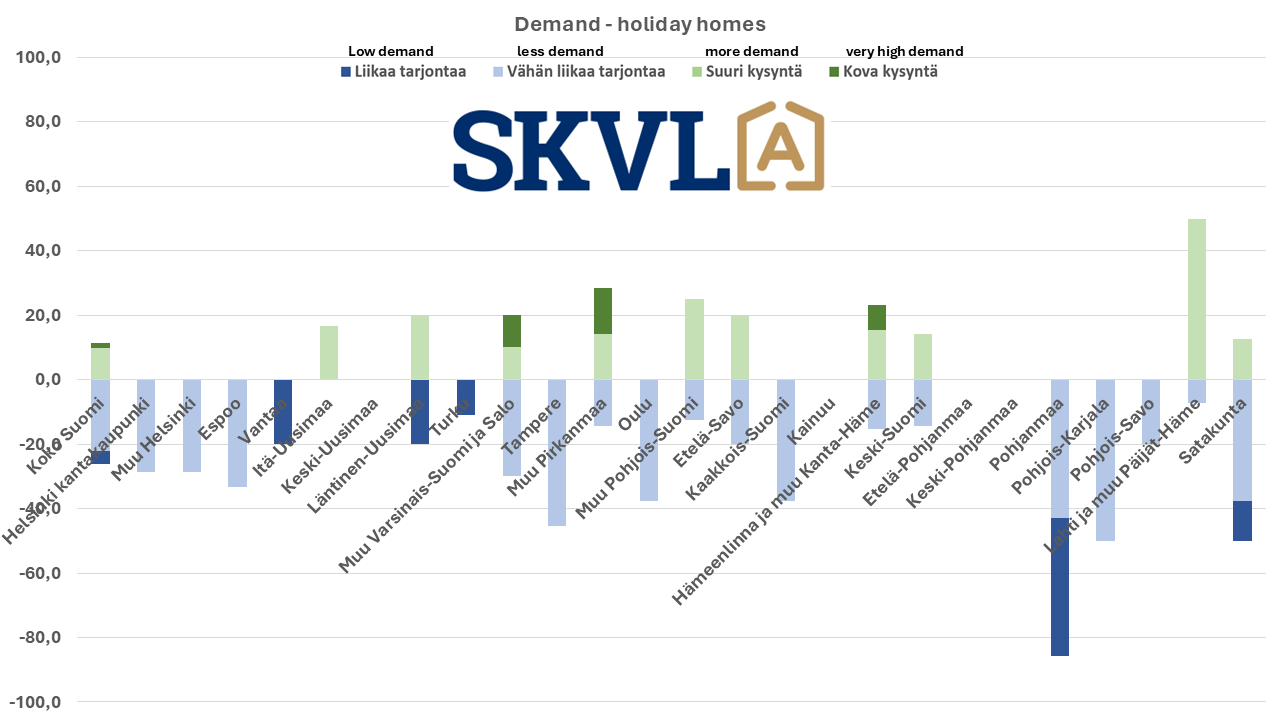

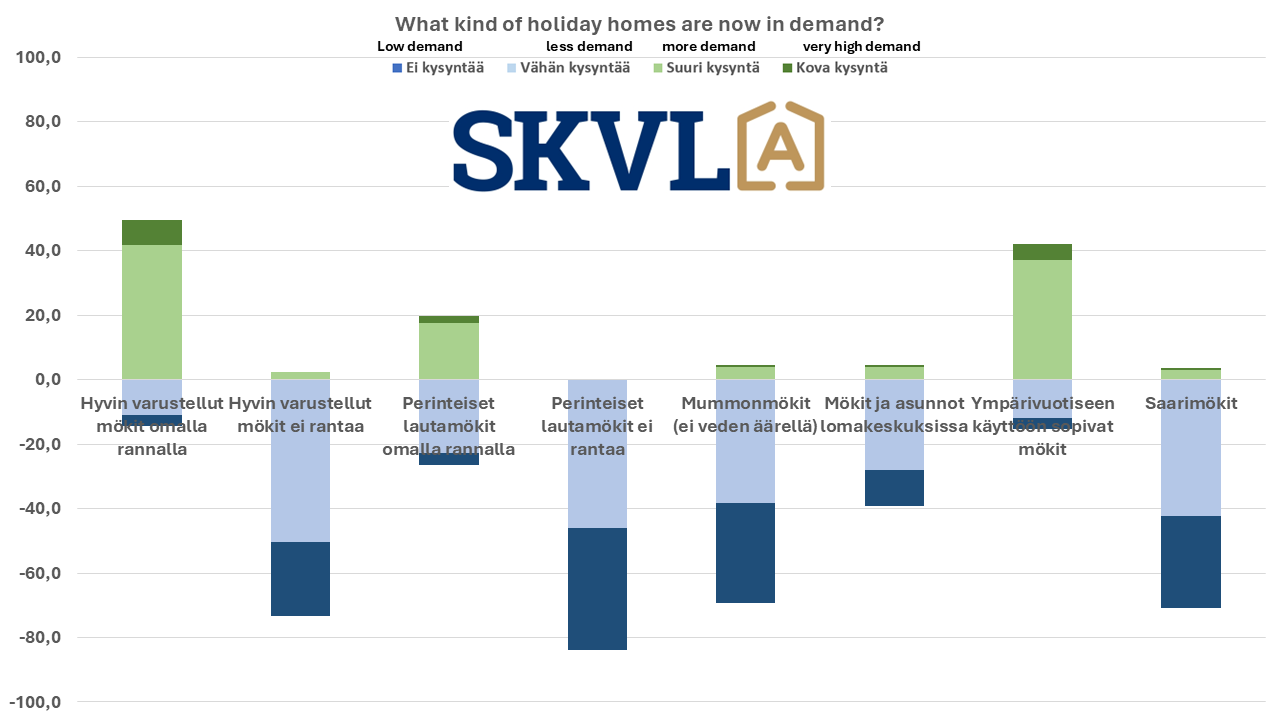

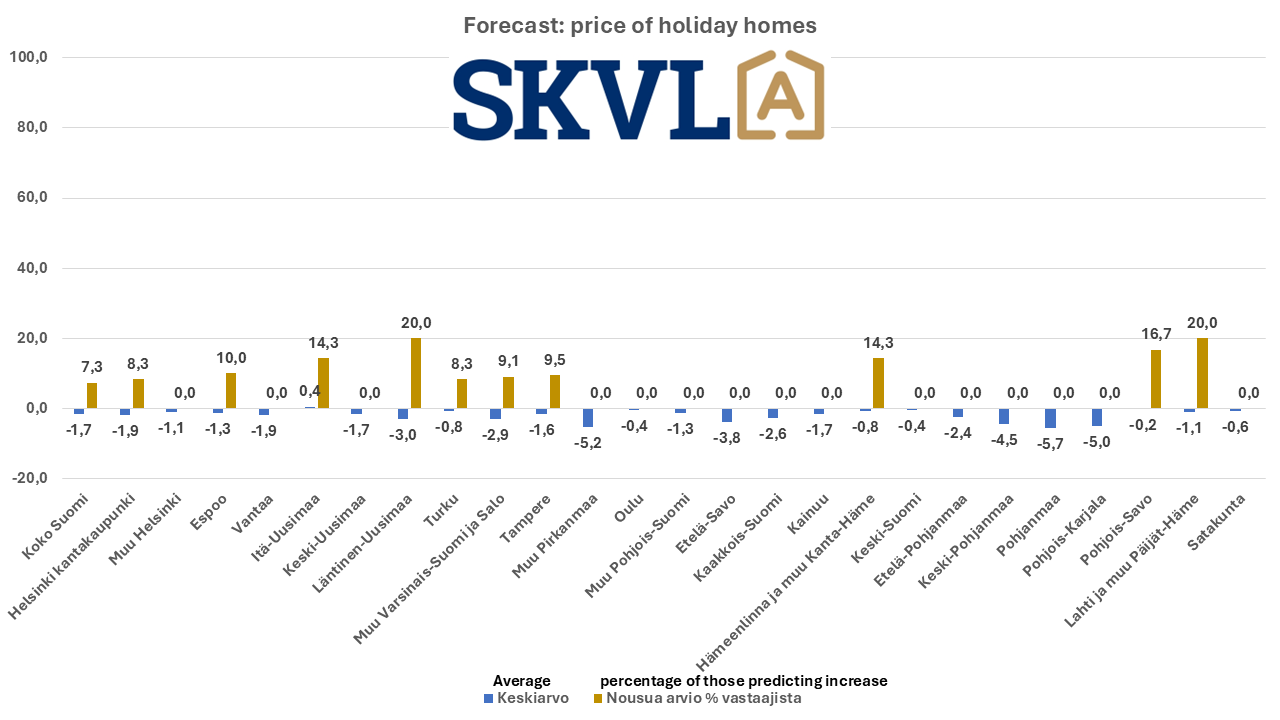

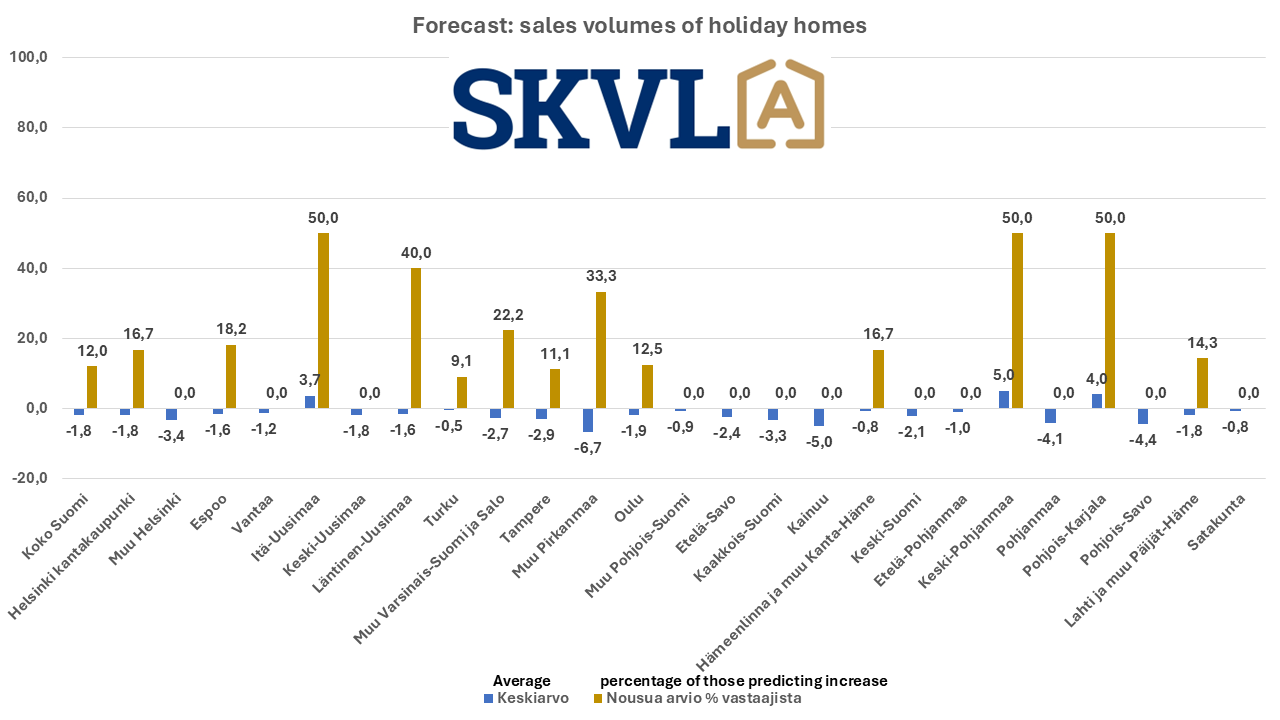

Holiday homes have sold better this year

The most demanded type of holiday home is still a house with good amenities on the shore of a big water. Board cabins on the beaches will also be of interest to buyers. The possibility of year-round use in a holiday home is a significant factor in the choice. In particular, the attractiveness of so-called dry land grandma’s cottages has decreased after the coronavirus period, and the only factor facilitating their sales is the attractive price level.

Holiday home sales have returned to the level they were at before the coronavirus epidemic and have picked up slightly from last year. The price level has come down somewhat. Somewhat surprisingly, luxury cottages have been in demand and have also been traded with foreign Central European buyers. Global warming is also beginning to show for many as a motive to buy a holiday home further north than in Central Europe, which is hot in the summer. The demand for island cottages is clearly slower except in the most popular river basins in Southwest Finland, Uusimaa and South Savo.

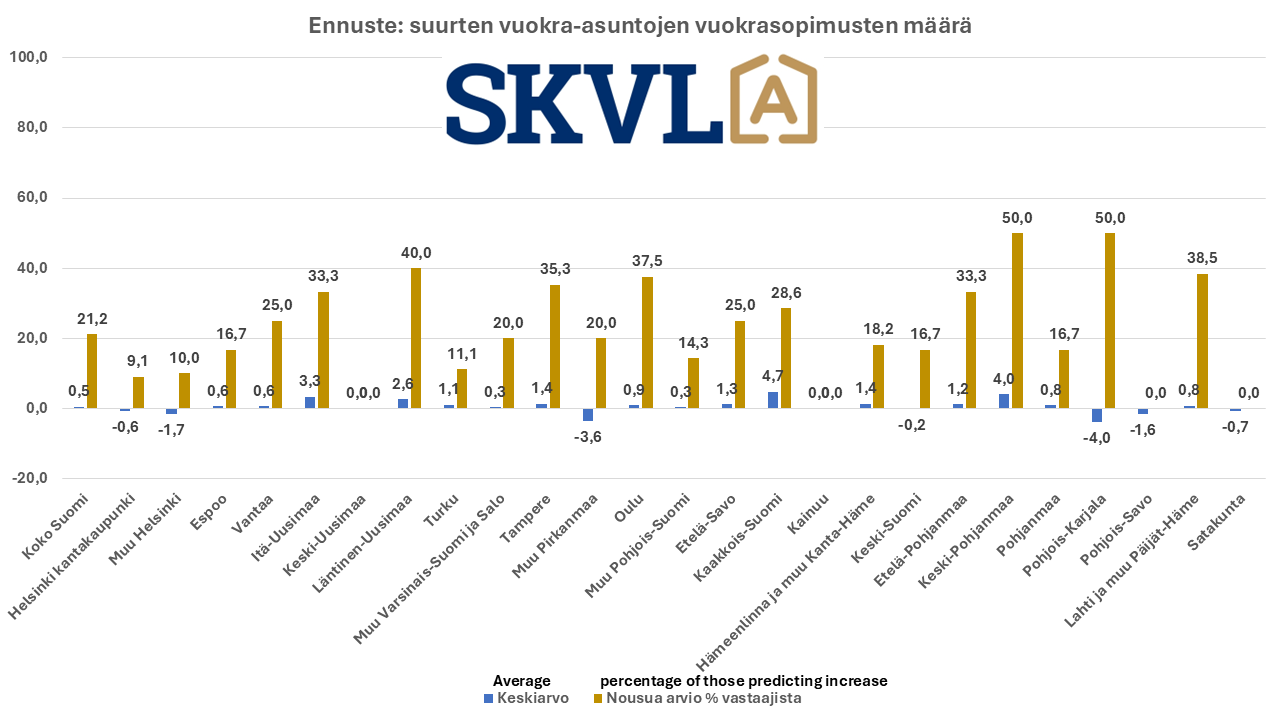

Rental housing market

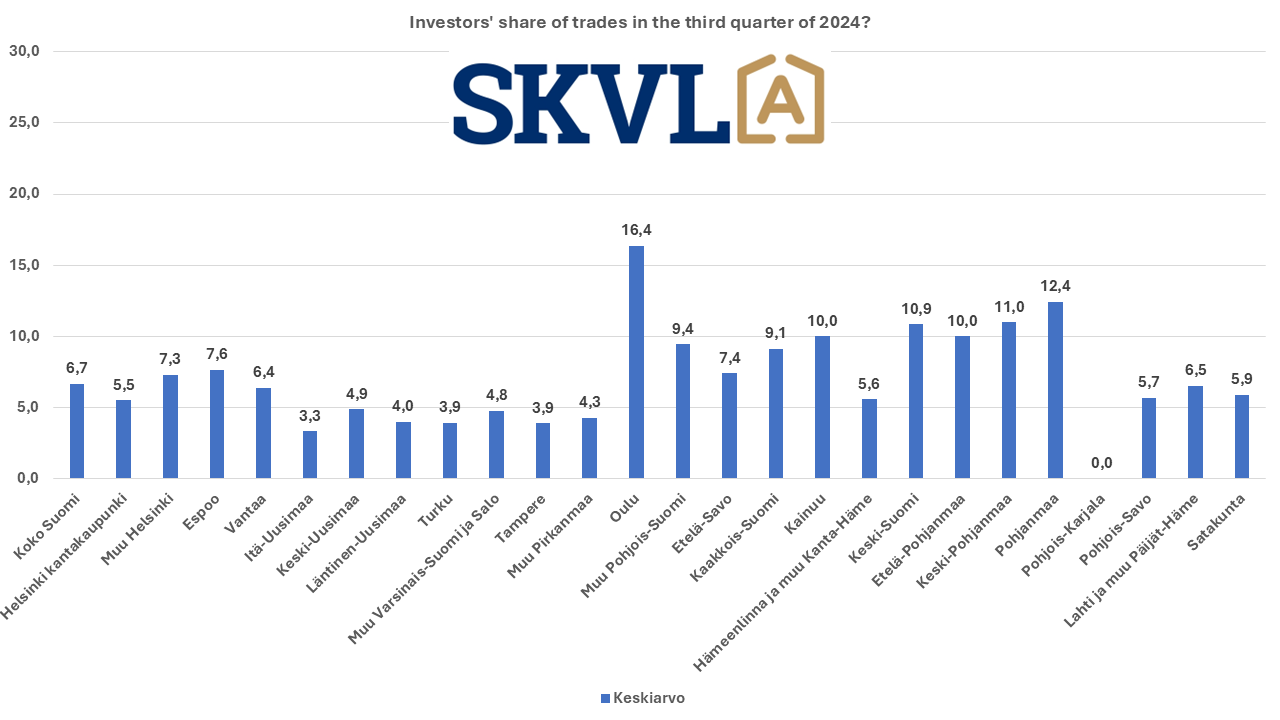

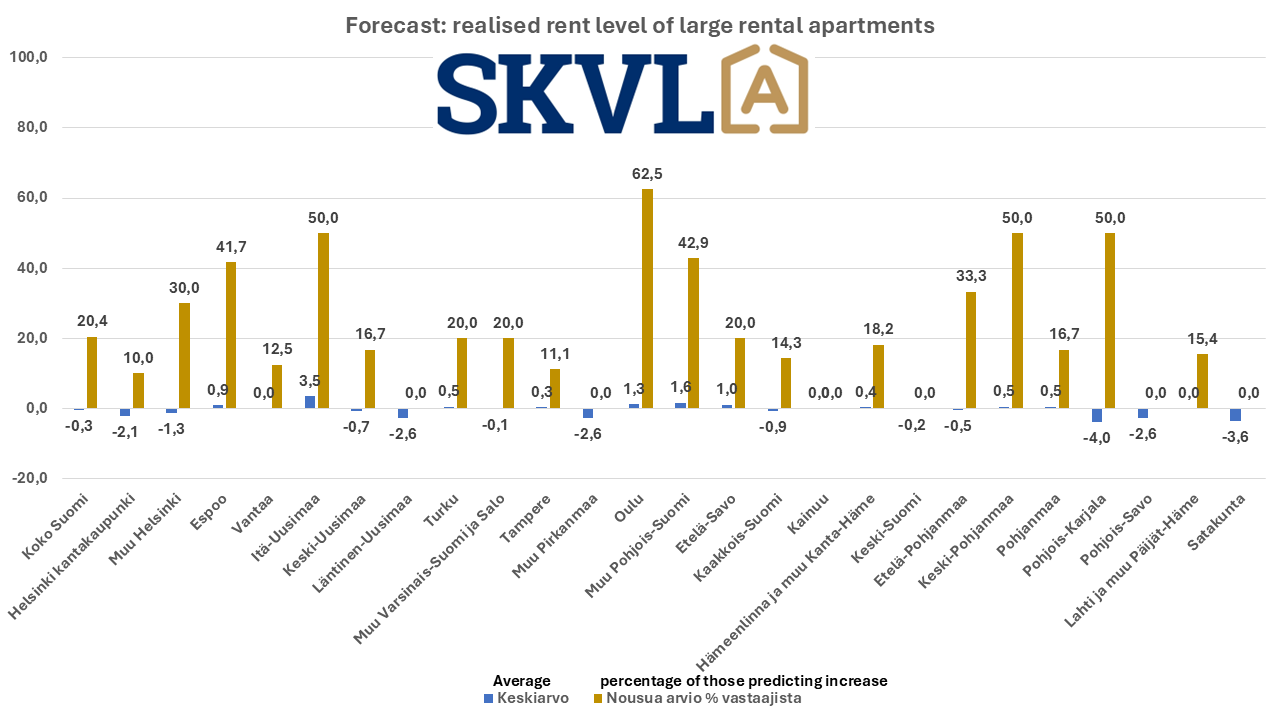

Investors are on the move, but not quite as much as in the previous quarter. About 7% of trades were made by investors. Further north in Finland, the share of investors is higher. In market conditions, it is typical for larger foreign investors to buy larger bundles of apartments in Finland. Retail investors have bought some apartments for their children since the housing allowance changed this year.

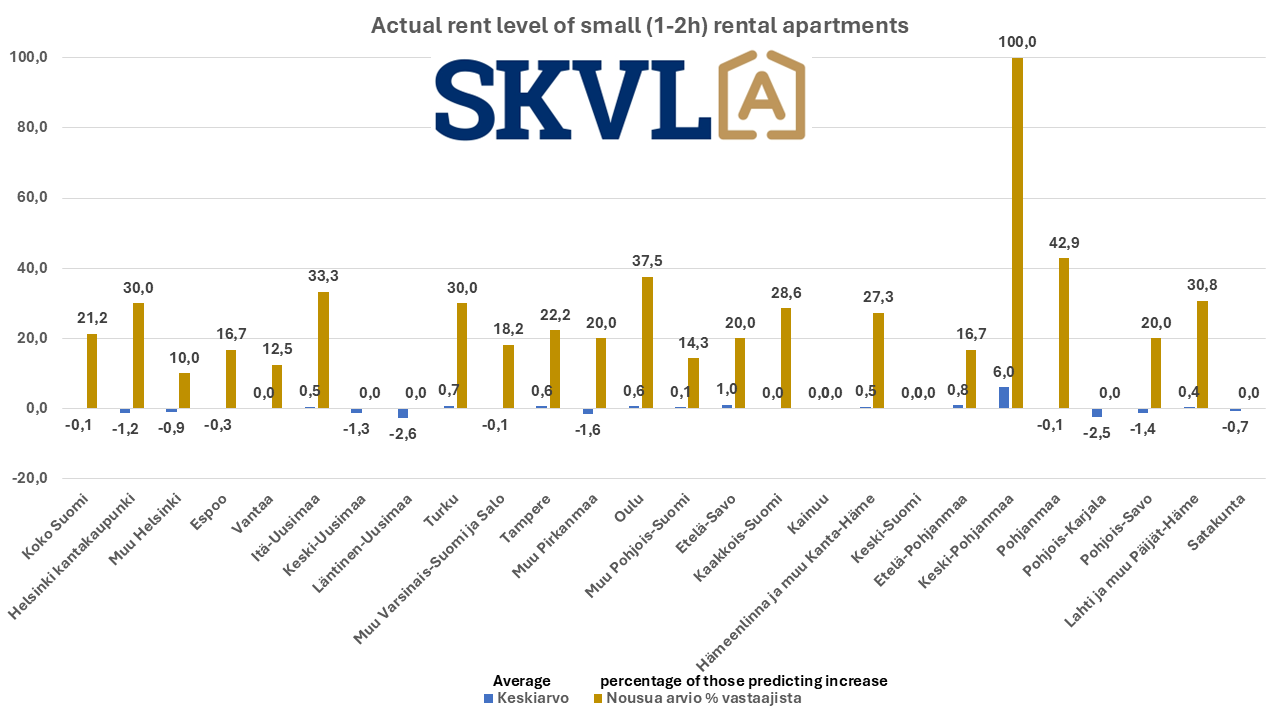

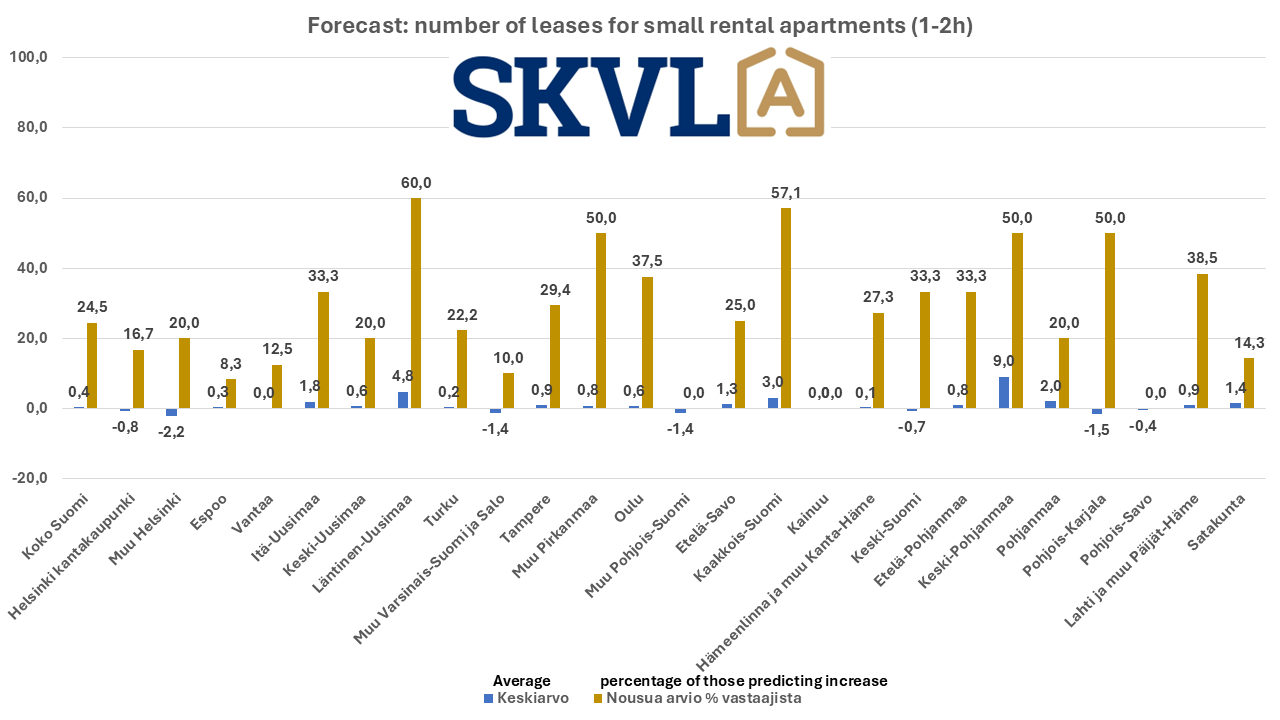

The demand for rental apartments remains unchanged and the seasons are autumn and the beginning of the year as study places become clear. As well as other seasonal workplace areas, such as holiday resorts in Lapland, are examples.

The supply of rental housing will remain high and in practice prevent significant changes in the rent levels of new leases. In particular, cuts in housing allowance have affected the level of rents.

Regional comments SKVL housing market forecast 4/2024

Helsinki

The housing market situation in Helsinki and its surrounding areas seems to vary greatly between different districts and apartment types. In the inner city, especially in old houses such as Art Nouveau buildings, interest is still strong, especially in high-value properties and attic apartments. Family apartments in the high price category have attracted buyers, and in many cases even several offers have been observed. This can be seen, for example, in the activity of projects worth more than EUR 1.2 million. However, there are not many investors in sight in the smaller housing market for the time being.

On the other hand, trade in Helsinki and its peripheral areas is slow in many places. For example, in the areas of Kallio, Eastern Helsinki and Northern and Northeastern Helsinki, sales are not doing as hoped, and outside the inner city, such as in Töölö, trade has almost stopped. In many cases, deals are caught for small sums and there is so much supply on the market that buyers have difficulty making decisions.

Espoo and Vantaa

In Espoo, private presentations seem to work best, but general presentations are expected to pick up during the autumn. In Espoo and the Helsinki Metropolitan Area more broadly, sales of two-room apartments in particular are very quiet, even though the number of viewers at presentations has increased. The market situation in Vantaa is also twofold: some areas, such as Tikkurila, have done reasonably well, while weaker areas have not. However, trade in Vantaa is slowly recovering, even though prices have fallen and some sellers have to sell at a loss.

Rental market, Helsinki Metropolitan Area

The rental market suffers from oversupply, which has caused competition among landlords. This is typical for the entire Helsinki metropolitan area, where there are many apartments available for rent on the market.

The situation can be interpreted as heading towards a “new normal”, but there are still many uncertainties in the market, such as tightened lending conditions for banks, interest rate movements and general economic uncertainty.

Eastern Uusimaa

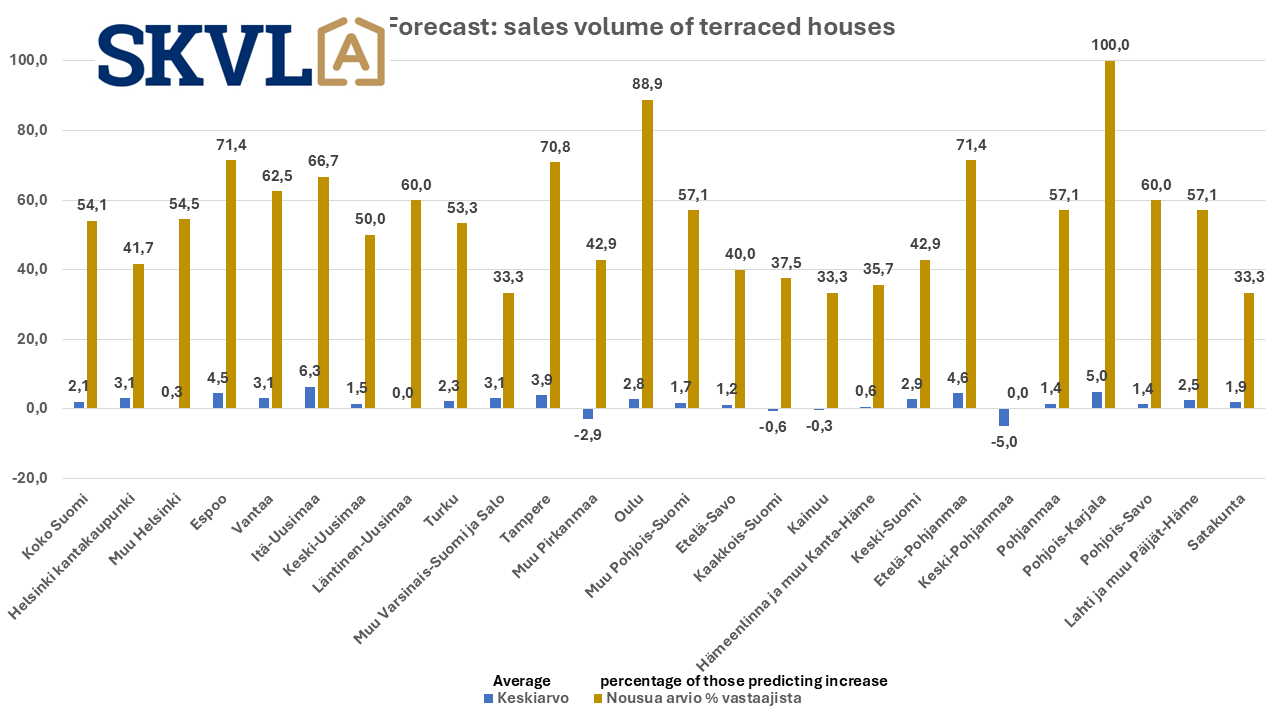

In the housing market of Eastern Uusimaa, certain areas are still in demand, but especially suburbs built in the 1970s offer affordable single-family and apartment building projects. Terraced houses are slightly more popular. In Porvoo, deals have been created since the summer. There is not much new hard money production in the area, which balances the market. Sales in large blocks of flats are slow, because even though buyers are on the move, few decisions are made. Investors are expected to enter the market at the end of the year, but so far they have not yet been seen.

Central and Northern Uusimaa

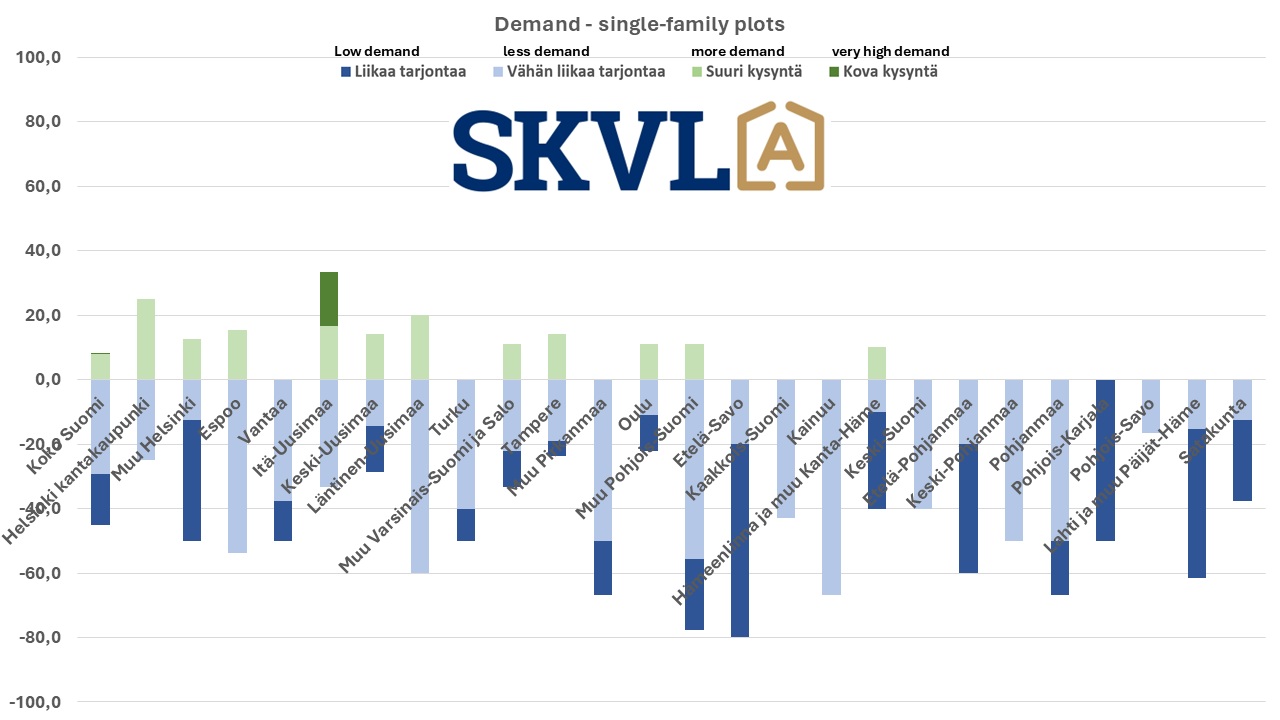

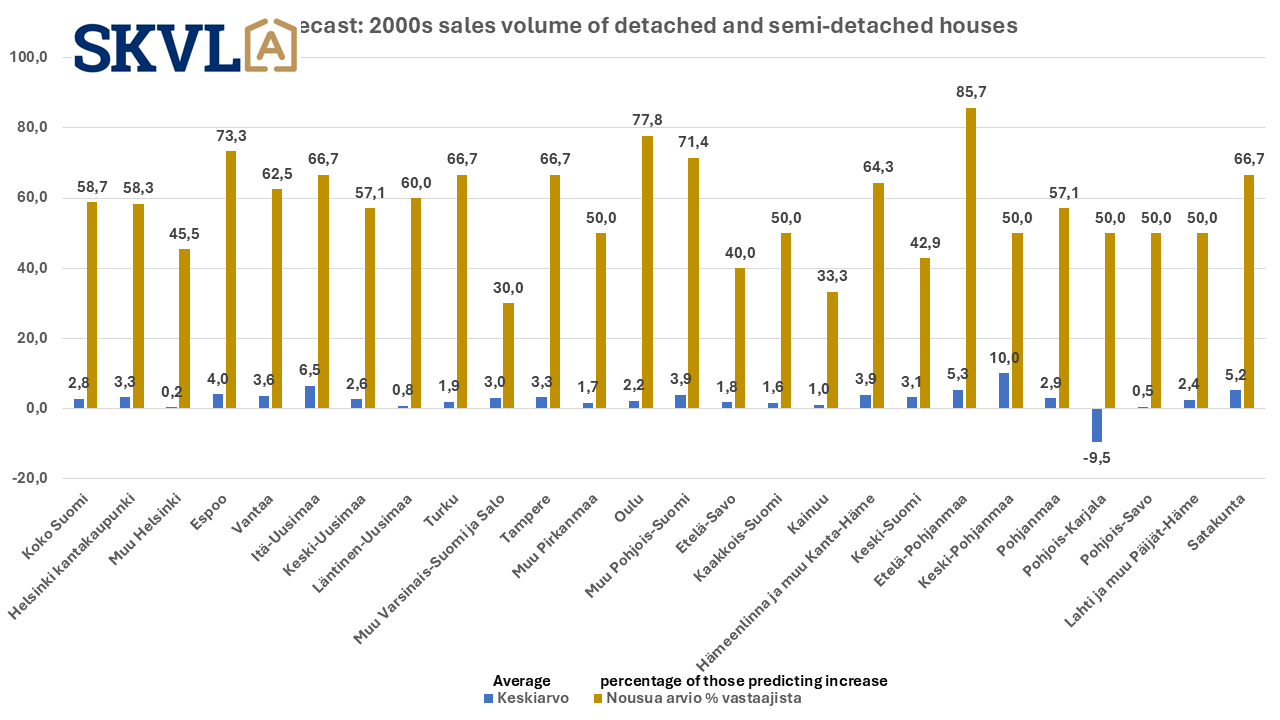

The housing market is lively in certain areas, such as the Vihti/Nummela region, where trade is very active. Sellers’ expectations are high. Buyers have some choice, and homes in poor condition or on rented plots have been less in demand. In Jokela, there is demand especially for reasonably priced detached houses, the demand for plots is recovering, and purchase decisions are still generally considered for a long time. An exceptionally large number of transactions where the buyer does not take a loan.

There is currently no demand in Mäntsälä, although there is a lot to sell.

July was hectic, but August and September have been calmer, and buyers thought about their decisions for a long time. Reasonably priced detached houses and semi-detached houses under 5 years old move well at the right price.

Western Uusimaa

In Kirkkonummi, the market has picked up as a result of the data center project, even though warm weather has slowed down trade. In Hanko, the busiest summer season is over, but the search for second homes is still ongoing. Many sellers have understood the new lower price level if the object has been for sale for a long time.

Turku and surrounding areas

In Turku and its neighbouring municipalities, terraced, semi-detached and semi-detached houses in good condition are selling well, but the demand for apartments in blocks of flats is weaker. There are many first-time homebuyers on the move. New ship orders from Mayer Shipyard will increase demand for more affordable housing.

Teleworking opportunities have increased demand for rural centres and well-maintained single-family houses in their vicinity, and a distance of about half an hour from the city is suitable for many. However, there is a shortage of new houses in rural areas.

The supply of small rental apartments is still oversupplyed, and cuts in housing allowances affect the level of rents. Rents are not rising. The market is expected to stabilise only in the longer term.

Tampere and Tampere Region

In Tampere and Pirkanmaa, housing sales are going relatively well, especially family apartments, such as terraced house three-room apartments and square meters, are in high demand. Small apartments will also sell if sellers are willing to bargain on price. However, the sale of old large terraced houses and suburban flats is more challenging. Purchasing decisions are slow and there is a lot of supply in different segments. The strict conditions imposed by banks, especially the lack of temporary financing, are a major obstacle to trade, especially for new properties.

On the positive side, Tampere and its surrounding municipalities (+-20 minutes drive from the city centre) attract buyers. Areas such as Kaleva (apartment buildings) and Koivistonkylä (larger family apartments) are considered popular, as is Lempäälä and its surroundings, especially Sääksjärvi, Kulju and the vicinity of Ideapark. In the fabric sector, trade has picked up slightly, but the situation has not yet fully normalised.

Rest of Pirkanmaa: Ylöjärvi near Tampere is an attractive area, and a new large grocery store has increased interest in the area.

Oulu

Activity in the Oulu housing market has increased and more people attend presentations. There has been enough supply throughout the year and the number of buyers has also increased. Competition for apartments and houses has started again. However, the process is often slow, as many buyers make conditional offers because their own homes do not sell as quickly as before. The operations of larger banks further slow down processes, which causes frustration for other parties involved in the housing transaction.

Demand has picked up especially since July for both smaller and larger apartments in housing companies. Some owners of rented apartments are willing to lower prices, which has promoted sales. The prices of the most affordable apartments have even risen slightly, but depending on the region, the actual prices are below the peak levels of 2021.

Rest of North Finland

The housing market in Northern Finland is showing signs of recovery, especially in the Tornio and Rovaniemi areas. Trading in the Tornio market has picked up due to lower interest rates, and customers are now making faster decisions, even though there was demand in the summer without clear decisions.

In Rovaniemi, the market has recovered significantly, and in August it even approached record levels in second-hand housing sales. September looks set to return to long-term normal levels or even better. However, there is a shortage of apartments for sale in the Rovaniemi market, and the rental market also suffers from a lack of supply. Although second-hand housing sales have picked up, the market for new properties is still challenging, but it is hoped that it will also start to recover in the near future.

South Savonia

The likely deployment of Finland’s NATO Headquarters in Mikkeli will be a significant boost to the region. Larger banks make it difficult to do business and it is really challenging for other parties to the transaction. There would be a little more trade and much faster if customers received service.

Southeast Finland

There are many properties for sale on the housing market in Southeast Finland, but there are few spectators, even if the prices are at market level. In the suburbs, prices are low and there are too many rental apartments available, which has led to a decrease in rents. There are no tenants for apartments in poor condition.

In Lappeenranta, the market situation has improved considerably compared to last year. Thanks to the student season, sales of small apartments have been active in July-September, but demand evens out at the end of the student season. However, falling interest rates and the reversal of inflation may increase demand for own-use housing towards the end of the year. The new housing market is still suffering from oversupply, and price differentials between regions are widening, leading to polarisation of the housing market according to micro-locations.

Banks’ slow performance and reduced customer service are a major barrier to trade, and buyers are frustrated with banks’ demands, such as high equity requirements and low collateral value. This delays processes and can prevent you from getting your dream home.

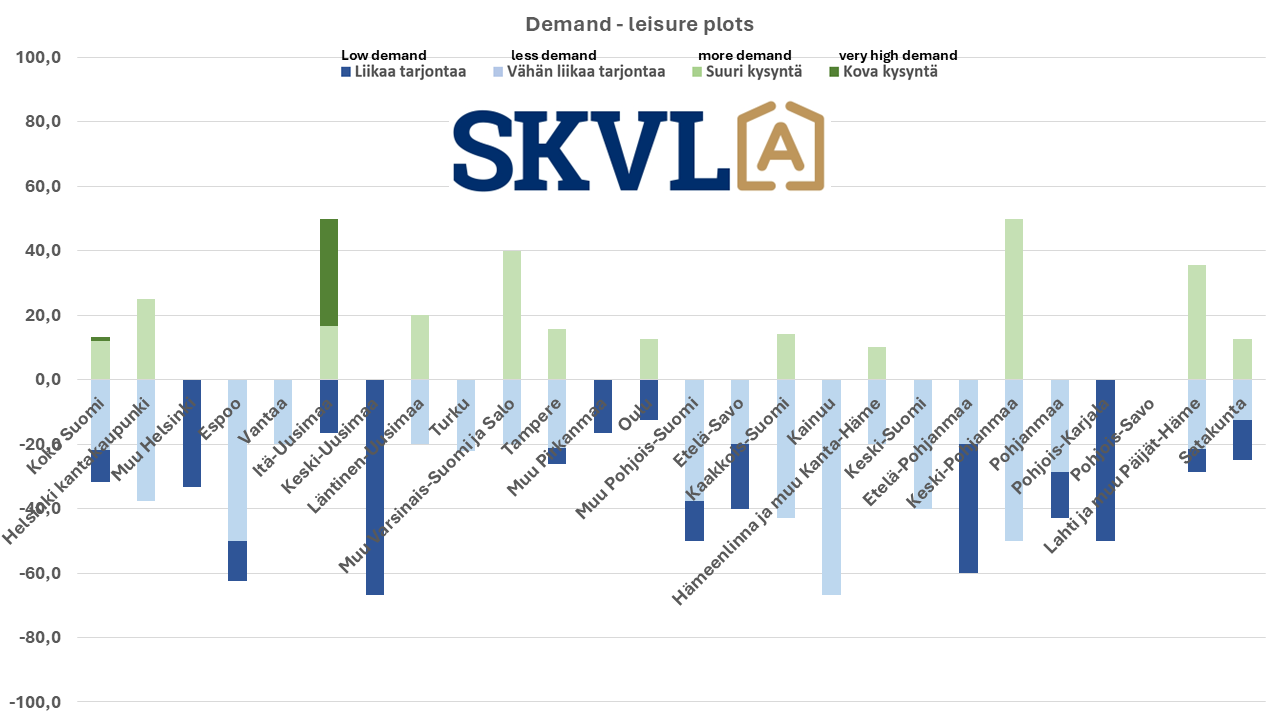

Hämeenlinna and other Kanta-Häme

The housing market in Kanta-Häme is currently challenging. Lammi, Tuulos, Hauho and Hämeenkoski suffer from an oversupply of cottages in dry land, and delays in loan-based offers due to banks have made it more difficult to sell detached houses. Loppi in Kanta-Häme in particular has a problem with the inequality of collateral values compared to Uusimaa. It is easier to get a loan for destinations in Uusimaa, but it is more difficult to get a loan for destinations located in Loppi, even though the distance to the Helsinki metropolitan area is less than an hour. This discourages potential buyers from moving to the countryside, although prices for single-family houses in Loppi have even risen in recent years.

In Hämeenlinna , the market is particularly difficult, and trading is slow. There is an oversupply of small flats and a shortage of new single-family houses.

Trade in Riihimäki is moderate, but there is a shortage of single-family houses especially from the 2000s.

In Forssa , trade has almost come to a halt due to migration loss, layoffs and bankruptcies. Banks now require condition checks on almost all sites, which slows down and makes it more difficult to obtain loans.

Banks are generally a major problem throughout the region due to long processing times, collateral values often at zero and reduced customer service. This has led to potential deals not being executed.

Central Finland

The housing markets in Central Finland, especially in Jyväskylä and Muurame, have started to recover with the autumn. As second-hand housing sales have picked up, demand for new properties has also picked up, although purchasing decisions are being considered longer than usual. At the moment, there is the greatest interest in completed and soon-to-be-completed sites, even though they no longer have the opportunity to influence material choices.

The demand for single-family house plots has increased and many spring builders have become more active.

The supply of detached and semi-detached houses was large in the summer, especially in single-family houses in the 2000s. Since August, trade volumes have increased, partly due to lower interest rates, the unwinding of sale-based offers as a chain, and the narrowing of supply in the autumn. The demand for spacious terraced houses has remained good throughout the summer, but the prices of newer apartments are too high for many. There have been few housing investors on the move and they will only buy if prices are affordable.

Items that are put up for sale sell quickly if they are in good condition. Banks require loan-based offers and check the documents of the object, which can slow down trading. The reluctance of banks to finance older houses, even after renovations have been carried out, often discourages the sale of older houses. Palokka remains a favourite area for families.

South Ostrobothnia

In South Ostrobothnia, housing sales are still volatile. Trade in the area is good and several deals have been made in September, but demand has not fully returned to normal levels. In many municipalities with migration loss, the collateral values of real estate are poor, which makes it difficult for buyers to obtain financing. In Seinäjoki, the most expensive apartments in the city centre do not move, and prices have been reduced by up to tens of thousands of euros. By contrast, single-family houses, terraced houses and semi-detached houses from the 2000s move better in areas outside the city centre.

Trade in Seinäjoki is still slow, although there is some momentum. Offers are often small and some sellers, such as heirs, sell when they get tired of waiting. Differences in price perceptions, even between EUR 5,000 and EUR 20,000, have prevented many deals. Banks’ financing decisions take a long time and collateral requirements are strict, which drives buyers even to high-interest payday loan-type solutions. This makes trade more difficult, especially in rural areas. Cash buyers are especially valuable because trades are completed quickly and effortlessly.

Central Ostrobothnia

In Central Ostrobothnia, especially in Kokkola, the market situation is not as good as expected, even though a lot of construction is being done in the area and new jobs are being created. However, the rental market is lively thanks to workers coming to the industrial area who rent apartments locally. Industrial investments in Kokkola and projects in the Kaustinen region have brought more activity and new entrepreneurs to the housing market, especially in rental activities.

Ostrobothnia

In Vaasa, the influx of students has increased the sale of small apartments, especially in the city centre and in the Palosaari area, where there is a shortage of rental apartments.

North Karelia

The housing market in North Karelia, especially in the Kitee area (Kitee, Kesälahti, Tohmajärvi, Rääkkylä), has faced challenges in obtaining financing. Many buyers who have already had loan decisions ready have experienced banks withdrawing from financing for no apparent reason, such as in one case in a well-maintained detached house in Kitee. However, low-priced properties are still sold in the area, but financing problems are hampering trade.

Northern Savonia

North Savo, especially Siilinjärvi, has seen a slight recovery in the housing market. The demand for properties in the 2000s has improved and sales times have shortened. However, for properties in the price range of more than 300,000 euros, demand decreases considerably, and in older houses from the 1960s and 70s, sales times have become even longer. It is difficult to get a loan for these objects because their collateral value is low. However, there is demand for forest plots and plots with private shores near the centres, but sales of summer cottages have slowed down from last year.

In Kuopio, the demand for apartments in blocks of flats has improved clearly after a slower spring and the market has returned to a normal level. Investors have started to appear in the market again.

Lahti and the rest of Päijät-Häme

The housing markets in Lahti and Päijät-Häme are lively, but banks’ operations have posed unprecedented challenges this summer. Transactions using a digital home purchase system have been repeatedly delayed due to bank processing. Many banks have often claimed that buyers have not taken care of the necessary paperwork, when in reality the documents have been in order.

These banking errors and delays have a significant impact on trading and brokers have had to insist on getting things done on time. In order to streamline trade, it is hoped that improvements will be made to banks’ operations and quality control, so that schedules are better kept and transactions are more reliable.

There is a shortage on the market of plots and cottages opening to the evening sun, which are in constant demand. Those buyers who have sufficient wealth have a clear interest in these objects. The market is doing reasonably well, but the challenges are large fluctuations in pricing.

Satakunta

A major problem in the housing market in Satakunta has been falling prices, which sellers have not fully accepted, and the slowdown of bank lending, especially in peripheral villages and renovation sites, slows down trade. There is a lot to sell, even though prices have already fallen. However, trade has picked up somewhat.

Migration to large growth centres has increased the number of properties coming up for sale, and estates in particular have become more active as sellers.